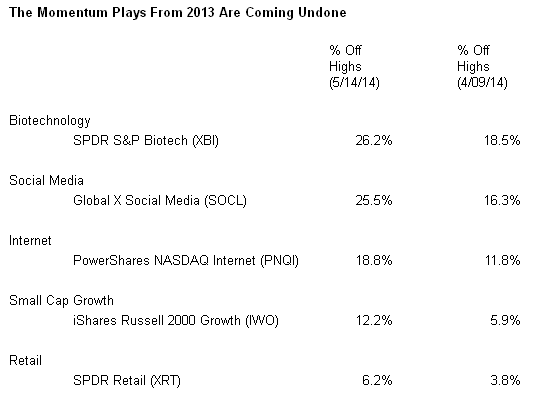

Back on April 9, I talked about a “Great Rotation” away from momentum plays (e.g., biotech, Internet, small-cap growth, etc.). Where did the smart money go? Demand had been picking up for the least popular asset classes from 2013, including long-dated treasuries, select emerging markets as well as commodities.

Five trading weeks have passed since I began discussing the likelihood of a major shift. Did enough investors buy the dips in former high-flyers to push their prices back up? Conversely, did rotation participants bolster the prices of previously maligned assets or were the moves temporary in nature?

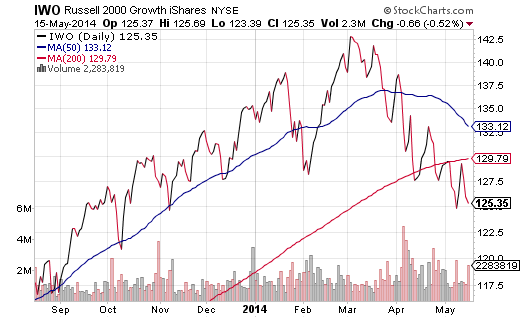

The answer to the first question is straightforward: High-flyers continue to deteriorate. For instance, biotech and social media stocks had been experiencing a significant correction up until April 9. Today, though, the sub-segments register bear market percentage declines. Similarly, small-cap growth companies represented by iShares Russell 2000 Growth (ARCA:IWO) had been dealing with a modest pullback. Right now, however, IWO sits in correction mode more than 10% off its peak; the current price also resides below a long-term 200-day trendline.

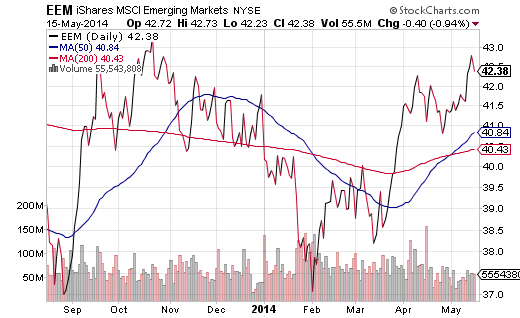

The answer to the second question requires a bit more explanation. Precious metal and commodity proxies SPDR Gold Trust (ARCA:GLD) and Greenhaven Continuous Commodity (NYSE:GCC) have dipped slightly since April 9. In contrast, long-dated U.S. Treasuries in Vanguard Extended Duration EDV have positively flourished. Meanwhile, emerging market equities via funds like Wisdom Tree India (NYSE:EPI) and iShares MSCI Emerging Markets (ARCA:EEM) have moved higher over the last five trading weeks. In fact, EEM resides above key moving averages and offers positive returns year-to-date.

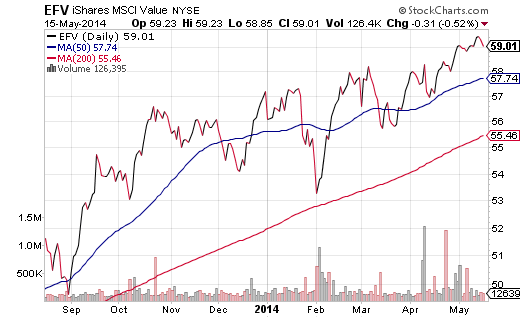

It is not too late to take advantage of the changing tides. Reduce U.S. small company exposure. Increase foreign market exposure. And do not be afraid to own long Treasury bond ETFs, particularly muni bond ETFs, as long as the chosen asset is above a long-term 200-day moving average.

If foreign stocks scare you, look at funds where low P/Es and modest price volatility still fit your risk profile. Funds that have worked well for my clients in 2014 include iShares MSCI EAFE Value (NYSE:EFV) and iShares United Kingdom (ARCA:EWU). Whereas the S&P 500 is up roughly 1.1% year-to-date and the NASDAQ Composite is down -2.6 in 2014, EFV and EWU have gained 3.2% and 4.2% respectively.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.