If you caught last Tuesday’s tweet (@deMeadvillePro, Gold then 2042) you saw where this was going: “Santa clearly is contemplating a new all-time Gold high by Christmas. ‘Twould be 2075 spot a/o 2089 FebFuts. (On verra)”

And so for Gold, as the expression goes, “Santa came early this year.” In settling the week yesterday (Friday) at 2092, February Gold (the current “front month”) en route traded to as high as 2096, +7 points above the prior “front month” 2089 All-Time High that had been in place since 07 August 2020. Spot Gold, too, exceeded its prior All-Time High of 2074 in trading as high as 2076. Finally! ‘Tis a beautiful thing.

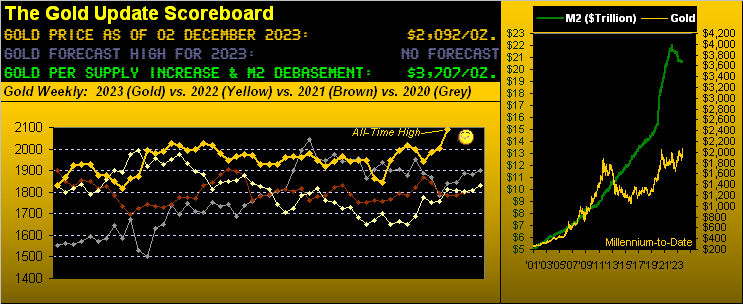

‘Course, you astute readers of The Gold Update fully realize that this year we did not forecast a specific high price, (which for you WestPalmBeachers down there is why the above Gold Scoreboard has stated “No Forecast” throughout 2023). Nonetheless, early in the year we expressed our anticipation of Gold by year-end at least achieving a new All-Time High: “Whoomp! (There It Is)” –[Tag Team, ’93]

To wit, as herein penned back on New Year’s Day: “how do we forecast a high for 2023? Linearly we don’t as for uncharted territory above Gold’s All-Time High (2089 of 07 August 2020) that’s for the Fibonacci-obsessed.”

True, we from time-to-time dabble in “fib retracement” for establishing trading targets. However, we avoid the Sybilistic art of future “fib extension”: for us ’tis too Timothy Leary, to whom President Nixon in ’70 purportedly referred as “the most dangerous man in America”, (only to then to nix the Gold standard a year later). That from the “Now Look Who’s Talkin’ Dept.” but we digress.

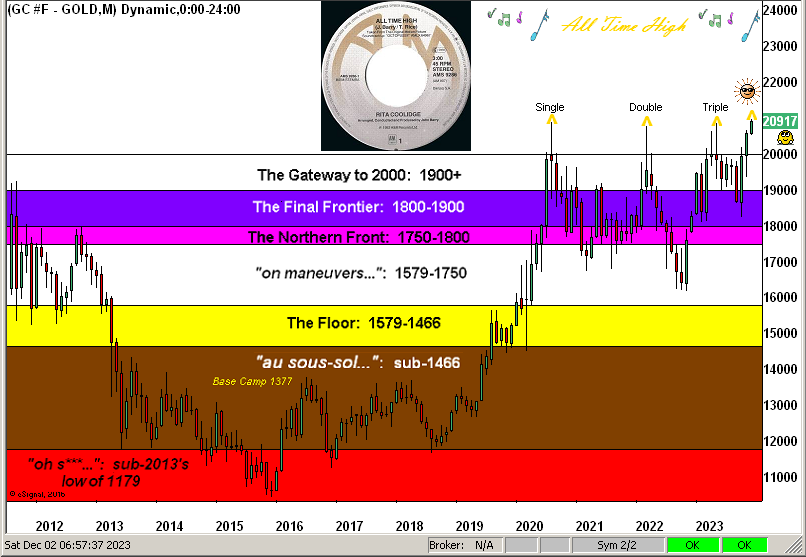

Given Gold’s fresh All-Time High is finally in hand, let’s take a realistic crack at “How high from here?” for the yellow metal. After all, new highs in major financial markets tend to draw in the “mo-mo” crowd, albeit for Gold, its notorious triple top across the past three years ain’t drawn squat. And let’s be honest: Gold’s new high at present is marginal at best.

“But it’s only been one day, mmb”

‘It wouldn’t be a landmark missive without our beloved Squire. Still, such marginal high can cue the Gold Shorts, which from the “Party Pooper Dept.” may swiftly remind us that following the aforementioned 2089 high came the 2079 high on 08 March 2022 and then the 2085 high this past 04 May. Thus in the Shorts’ words, “There’s nothing to see here” in their anticipation of it again all going wrong for Gold.

Yet as we’ve oft quipped of late, “triple tops are meant to be broken”. And marginally or otherwise, that just happened. Moreover as herein penned one week ago regarding December’s monthly net changes: “the last six [have been]: +2.6%, +4.5%, +3.4%, +6.4%, +2.9% and +3.8% from 2017 through 2022 respectively” That is an average net December change of +3.9%, which from November’s 2056 futures settle would bring 2136 by New Year.

But wait, there’s optimistically more. Century-to-date Gold has recorded 5,767 trading days, 252 of which have elicited All-Time Highs. Now obviously it doesn’t “feel” like Gold averages a new high every 23 trading days: indeed therein the standard deviation is 155 days, the longest stint between All-Time Highs being 2,237 days from 06 September 2011 to 27 July 2020 (whew!) even as the U.S. Money Supply (“M2”) simultaneously increased +90.2% (whoa!)

Nevertheless to our point: for those 252 All-Time High days, the average maximum increase in the price of Gold within the enusing three months is +8.9%; or if you prefer, the median maximum price increase is +7.9%. Either way, “in that vacuum” from the present 2092 level would put Gold in the 2257-2278 range by February’s end, (just in case you’re scoring at home). ‘Course, hardly is “average” reality, but it at least gives us some measure of reasonable upside guidance for Gold through these next three months.

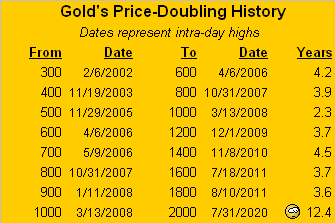

Of greater import however is that Gold’s new high remains peanuts vis-à-vis its currency debasement valuation, depicted in the opening Scoreboard as now 3707, i.e. +77% above here, even accounting for the increase in the supply of Gold itself. Which got us to question: how long does it typically take for the price of Gold to double? Here’s the answer from one price’s “century mark” to the next:

Thus discounting that most recent long 12.4-year stint, Gold from the year 2002 has doubled in value on average every 3.7 years, (inclusive of the above table’s overlapping periods). So achieving that 3707 valuation level in four years time is not unrealistic a wit. Which of course begs another question: will there even be a US Dollar in four years time? Our coy answer: It is oft said “Gold has been money for 5,000 years”; the disintegrating Federal Reserve Note just 109 years. Poof!

But there’s no poofing nor pooh-poohing Gold’s fresh All-Time High. To all those fellow “analysts” just some months ago calling for Gold Shorts down toward 1500-1100, here we are instead at 2092 per the following chart of Gold’s weekly bars and parabolic trends. So do not be that guy:

Neither let us forget Silver. Severely lagging Gold of late, Silver’s weekly parabolic trend only just confirmed flipping from Short to Long per yesterday’s 25.90 settle, (Gold’s Long trend having been in place now through seven weeks). And unlike Gold being at its All-Time High, Silver is -47.9% below her All-Time High of 49.82 established away back on 25 April 2011. Again: do not forget Sister Silver!

Looking ever more forgettable however, is the StateSide Economic Barometer. It’s one-month (21 trading days) plunge from 02 November through yesterday is the most since 27 May 2022, following which the S&P 500 fell -11.8% from 4158 to 3667 in just 13 trading days. That being an exception, as we’ve otherwise acknowledged since COVID, the good news is the S&P no longer follows the Econ Baro, so again “There’s nothing to see here.” See for yourself:

Indeed, of the 49 metrics that have come into the Baro across the past 21 trading days, just 16 improved period-over-period. It thus appears the Fed is well enroute to successfully attaining its slow-growth goal … but given FedChair Powell’s commentary yesterday, they apparently don’t know it (yet).

As for the “we never go down” S&P 500, it has displaced Gold in leading the BEGOS Markets’ percentage changes year-to-date as we go to the standings with 11 months plus one trading day in the books; both the yellow and white metals round out the present podium:

And specific to the S&P 500, we wrote this past week to a fine friend and colleague as follows: “ S&P is ridiculously overbought and horribly overvalued. The set up [for a crash] clearly is there but of course, ‘tis different this time (right?)”

‘Tis ad nauseum for you regular readers, but we’ll keep pounding the table on this:

- The “live” P/E of the S&P per Friday’s close is 42.6x (don’t argue; do the math);

- The average “live” P/E of the top 50 cap-weighted S&P constituents is 52.6x;

- The S&P is now “textbook overbought” through 18 consecutive trading days;

- The S&P’s all-to-risk yield is 1.528%; that of the risk-free US three-month T-Bill is 5.215%;

- The Q3 S&P Earnings Season ranks only 12th of the past 26 for bottom-line improvement;

- The S&P “sans COVID” by 50-year regression would today be about 2900, not 4595.

Got stocks? Scary, really, really scary!

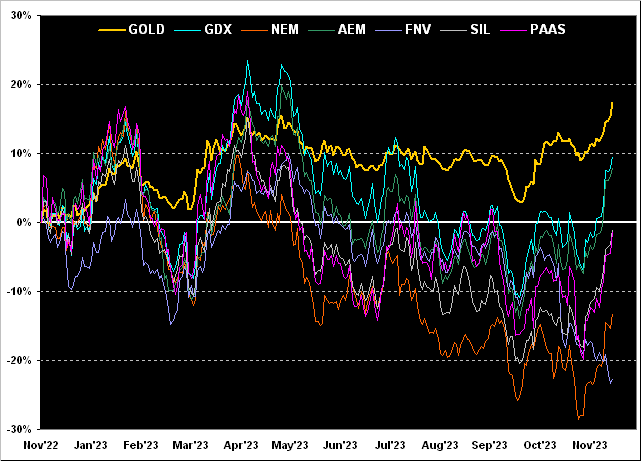

The exception of course is if you’ve precious metals’ stocks, the following graphic suggesting their being well undervalued vis-à-vis Gold itself, even as it too remains debasedly undervalued. Again it being month-end plus a day, here are the year-over-year percentage tracks of those key metals equities from worst-to-first: Franco-Nevada (FNV) -23%, Newmont (NEM) -13%, both Pan American Silver (NYSE:PAAS) and the Global X Silver Miners exchange-traded fund (SIL) -1%, Agnico Eagle Mines (NYSE:AEM) +8%, the VanEck Vectors Gold Miners exchange-traded fund (GDX (NYSE:GDX)) +10%, and Gold itself +17%. And in the perfect Equities/Gold leveraged world, Gold “ought be” the lowest rather than highest line on this graphic:

Got metals stocks? Merry, really, really merry!

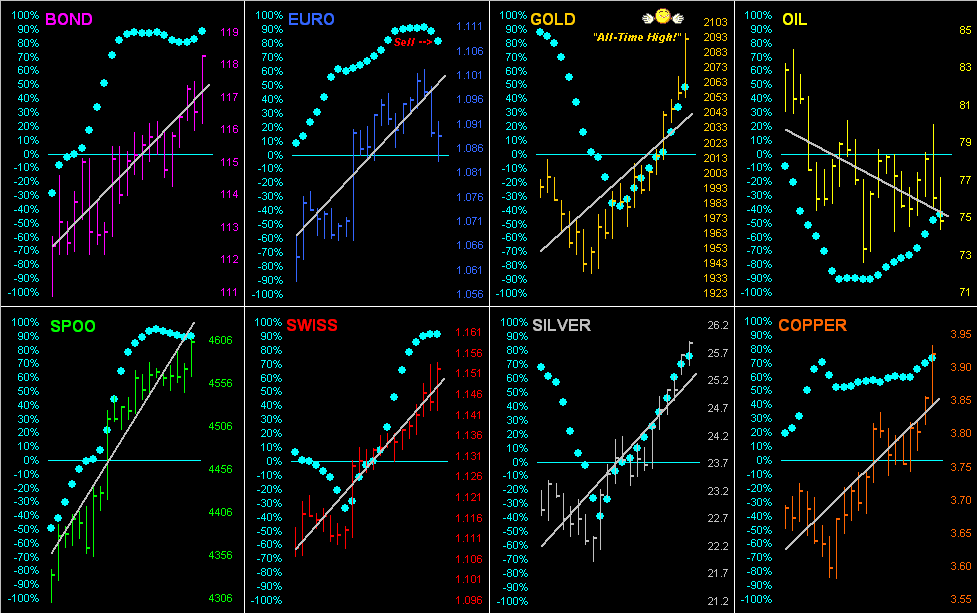

Further, if you’ve been long any of the BEGOS Components across at least the past month — again save for Oil — the rising tide of inflation has been lifting all boats. Here we’ve their respective bars and diagonal trendlines for the past 21 trading days, the consistency of those trends as depicted by the baby blue dots. Note for the Euro the “Baby Blues” suggesting lower levels ahead:

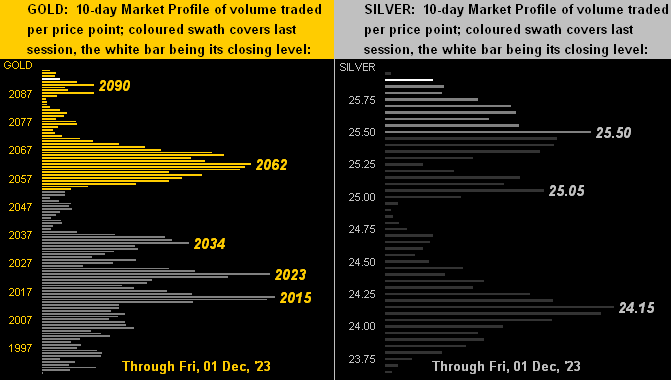

Next we’ve the 10-day Market Profiles for record-high Gold on the left and Silver on the right. The denoted bars are those with the greatest volume-traded support from 17 November through yesterday:

Naturally, it being month-end plus a December day, here is Gold’s Structure by the monthly bars for the past 12 years. And yes, Virginia, just as there is a Santa Claus, so too as noted are triple tops meant to be broken. Et voilà. Thus, in turn, Gold is at an“All Time High” –[Rita Coolidge, ’83]:

To wrap this rather epic edition of The Gold Update, “We have breaking news…”

“Bring it on, mmb”

Thank you, Squire. Direct from the “We’re Completely Gobsmacked Dept.” here ’tis:

Last evening we were all eyes on Gold when at precisely 18:28 GMT price recorded the new All-Time High of 2089.3, surpassing 2089.2 which as you well-know had been in place as the prior high since 07 August 2020. Some three-and-one-half hours later at 22:00 GMT price settled also at an All-Time Closing High of 2091.7.

Curious as to how our FinMedia friends would portray this great event, we went to Bloomy’s home page, obviously expecting it to be the lead story. But it wasn’t there. Worse, it was nowhere to be found their home page! So we instead zoomed over to Dow Jones Newswires’ Marketwatch home page. It must be at the top, right? Wrong! Rather, the lead stories were on “The Dow”, “Bitcoin” and “GameStop”. Where is the Gold story? We enabled a MW home page search for “Gold”: first find was Goldman; second find was again Goldman; third find was “Gold” … buried deep down the page amongst the “click-bait” ads for chumps, with the barest of mention of the new high.

But we really and truly learned something from this: Gold now is of no material media importance whatsoever. Who cares, right? The sad part is: when they finally figure it out (upon everyone morphing from marked-to-market millionaires to marked-to-reality impoverished) it will be too late.

Still, perhaps the late Leary would have gotten it:

“But his was of the Acapulco type, mmb…”

Likely the case there, Squire. As for the real thing, ’tis at an All-Time High and yet it remains unspeakably undervalued. That’s really all you need to know.

Got Gold? Got Silver? Got a wealth-preserved Future!

Cheers!