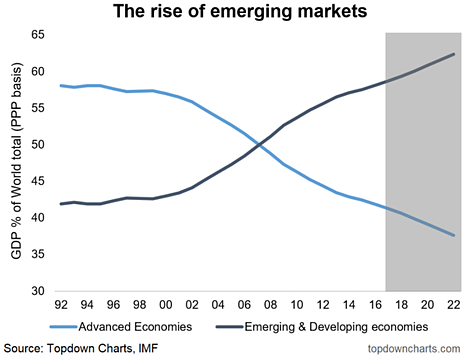

If it feels like there's a power struggle underway between developed markets and emerging economies, it's probably in part because the economic balance of power has already undergone a big change in the past 30 years. The chart in this article helps put some of the key geopolitical and macroeconomic trends of today in context.

The chart appeared as part of a study on emerging market equity valuations in a recent edition of the Weekly Macro Themes, which also focused heavily on relative valuations (EM vs DM).

The chart shows the percentage share of world GDP for developed vs emerging economies.

The data comes from the IMF (their World Economic Outlook data set), and is measured on a PPP adjusted basis. The shaded portion is IMF projections.

As I was saying, in 2008 something happened... a combination of the financial crisis and a series of baked-in structural trends conspired to flip the balance of economic power, where emerging economies now account (comfortably at that) for the dominant share of world GDP. And if IMF projections are anything to go by this trend will only become more accentuated in the coming years.

It is perhaps then little wonder that tensions between America (the dominant DM power) and the major EM powers (Russia and China) are slowly but surely escalating. The transition from a unipolar to a multipolar regime is being facilitated and driven by the transition in economic make up of the world economy.

I often say that economics drive politics, and in this case it couldn't be truer.

Aside from perhaps greater geopolitical risks and tensions, the other impact will be felt on the macroeconomic cycle. It's interesting to note that the potential or trend GDP growth rate for many emerging economies is materially higher than for most of developed economies, so the changing composition of the global economy could actually see on-net higher global GDP growth.

Yet at the same time these economies also experience greater volatility and are still developing in terms of governance, so it may well be that although global GDP growth rises, it may also become more volatile.

So whether its heightened geopolitical tension, higher GDP growth, or higher volatility of global growth, the transition from a global economy dominated by developed economies to one dominated by emerging economies is an important trend to be mindful of.