Oktoberfest has wound down in Germany and you can tell by the crowds in the picture above the tension in the air surrounding whether or not Deutsche Bank AG (DE:DBKGn) NA O.N. (NYSE:DB) will survive. Sounds like a lede from financial press story doesn’t it? The world is gonna end but everywhere you look people are happy and having fun. Well the divide is not quite that extreme in Germany but it may be close.

Deutsche Bank stock is in the dumper and at lows below the financial crisis low. That is the bad news. Reports of their meeting liquidity tests, and rumors Wednesday of a Government bailout are supporting the stock. But what about the broader German market? The chart below tells the story with prices.

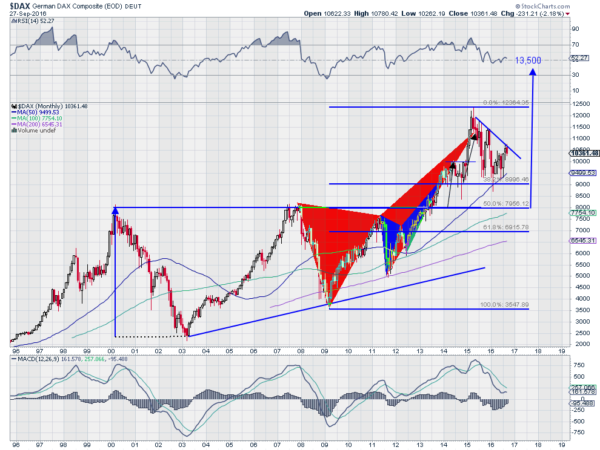

There is is a lot to talk about in this chart. Long term price action shows a break of an ascending triangle in 2013 and continuation higher. The target out of that triangle, 13,500 on the German DAX Composite, is still not met. The trouble comes from the price action since 2008. The two triangles show the completion of a Deep Crab harmonic pattern in 2015. Where the US markets consolidated the entire year the German market started a pullback upon reaching the Potential Reversal Zone (PRZ) of that pattern.

At the stat of 2016 it had retraced 38.2% of the pattern, the target for the reversal, and touched its 50 month moving average. It had not touched that SMA since 2012. A healthy pullback. But the rise off of that is pullback has met resistance as it reached the falling trend line in August.

That brings it to day. In the last hours of trading for September, the DAX sits at the falling trend line. Where will it go from there? Momentum is mixed. The RSI has been pulling back but remains at the mid line. This is in bullish territory. It is moving sideways now so perhaps the worst is over. The MACD has also stopped falling and is moving sideways. It is in positive territory, also a mildly bullish signal.

These both support the short term trend higher in 2016 to continue. And so do the rising moving averages, all below the DAX. The picture looks like the easier path is to the upside. What would change this is a break and close below 9000 on a monthly basis. Good luck to Deutsche Bank in their troubles, but the DAX seems fine but unexciting for the long term holder.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.