Even though the S&P 500 hit (on an intraday basis) the highest level in the history of the universe today – – – higher than the Internet bubble, higher than the financial crisis – – more overvalued than any time in the history of the financial markets – – my portfolio of entirely short positions is, for the most part, profitable.

How could this be? Well, for one thing, I’ve got a pretty good concentration of energy shorts. I wanted to illustrate just how detached the market in general has become from energy.

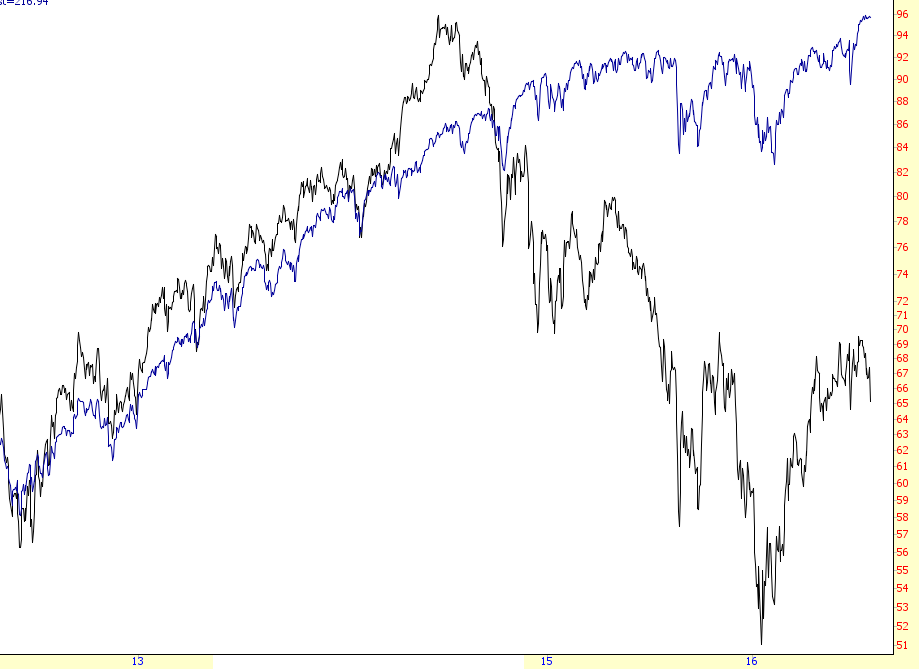

The chart below overlays the SPDR S&P 500 (NYSE:SPY) (in blue) with the Energy Select Sector SPDR (NYSE:XLE) energy fund (in black).

So as you can on the left side, the markets were extremely tightly coupled. Recently, however, if you can stomach looking at the right side of the chart, you’ll see an absolute chasm of difference between the two.

My fervent desire, of course, is for the overall universe of stocks to “catch down” with oil and related companies.