Highlights

Market Movers: Weekly Technical Outlook

Technical Developments to Watch:

- EUR/USD back testing the bottom of its recent 1.2500-1.2850 range

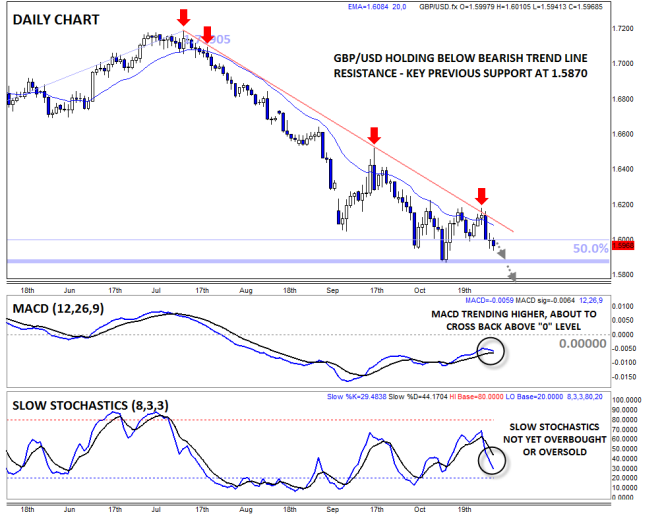

- GBP/USD still below bearish trend line – key support sits at 1.5870

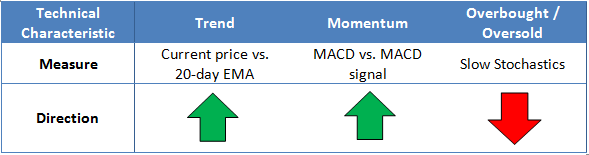

- USD/JPY rockets to 7-year highs, potential for further gains this week

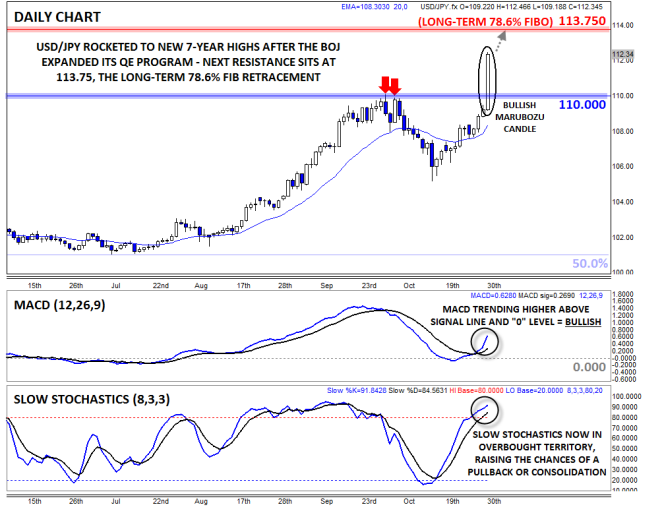

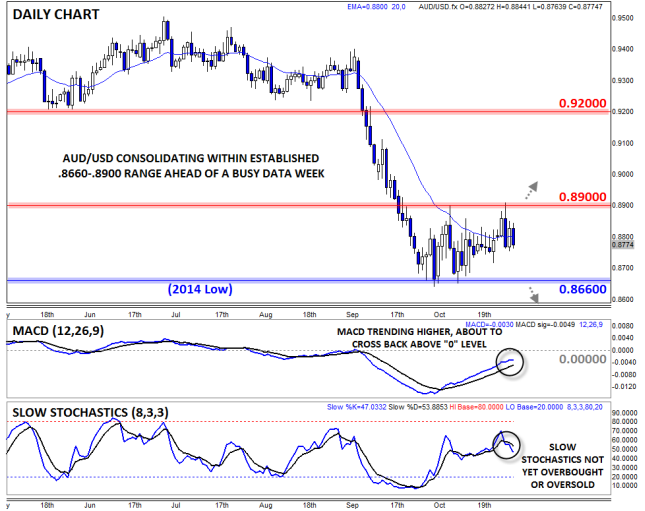

- AUD/USD in play, but rangebound between .8660 and .8900 for now

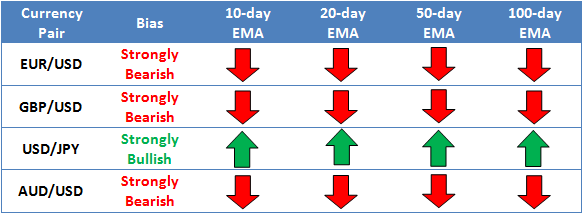

* Bias determined by the relationship between price and various EMAs. The following hierarchy determines bias (numbers represent how many EMAs the price closed the week above): 0 – Strongly Bearish, 1 – Slightly Bearish, 2 – Neutral, 3 – Slightly Bullish, 4 – Strongly Bullish.

** All data and comments in this report as of Friday’s European session close **

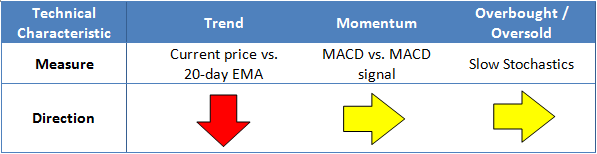

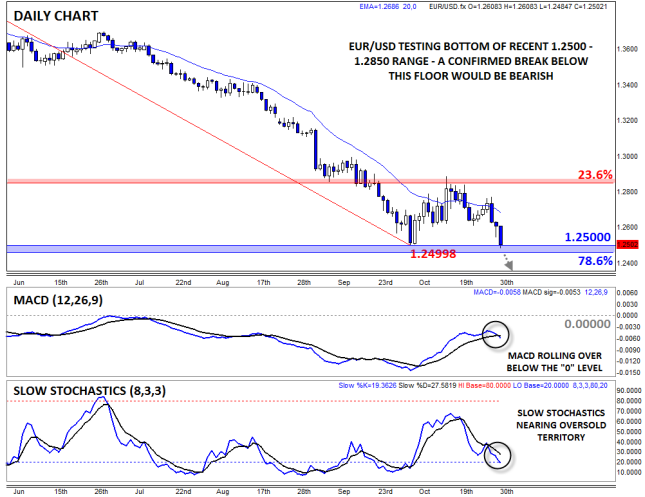

EUR/USD

- EUR/USD inched higher early before turning lower midway through the week

- MACD neutral, Slow Stochastics nearing oversold territory

- Waiting for a break of the recent 1.2500-1.2850 range to signal the next move

EUR/USD inched modestly higher early last week before turning sharply lower after the Fed’s less-dovish-than-anticipated statement on Wednesday. More broadly, the pair remains at the bottom of its recent 6-week range from support at 1.2500 up to resistance at 1.2850. Meanwhile, the MACD has flatlined below the “0” level, while the Slow Stochastics indicator is approaching oversold territory at 20. Overall, a neutral bias is appropriate within the recent 6-week range, but if and when we see a conclusive break below 1.2500 support, a continuation lower is favored.

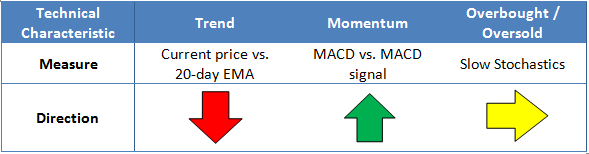

- GBP/USD dropped after testing bearish trend line resistance in the upper 1.6100s

- MACD and Slow Stochastics indicate balanced, two-way trade

- Bias remains bearish below bearish trend line resistance

Like its mainland rival, GBP/USD edged higher early in the week before reversing sharply lower in the wake of Wednesday’s FOMC statement and decision. The pair peeked briefly above the bearish trend line off the July high near 1.7200, but was thoroughly rejected back lower by the bulls. Now, the MACD and Slow Stochastics are signaling generally balanced, two-way trade, but the dominant bearish trend will keep the bias in the pair lower as long as rates remain below last week’s high.

USD/JPY

- USD/JPY rocketed to new 7-year highs above 112.00 last week

- MACD turning higher, but Slow Stochastics now in overbought territory

- Further gains favored as long as rates hold above previous-resistance-turned-support at 110

USD/JPY exploded higher last week, reaching a 7-year high after the BOJ surprisingly expanded its QE program. As we go to press, the pair is trading above 112.00, and the pair has clear skies until at least 1.1300 or 1.1400. Rates also put in a Bullish Marubozu Candle* on the daily chart, signaling strong bullish momentum and a likely continuation higher next week. As you would expect after such a massive move, the MACD is pointing higher and the Slow Stochastics are in overbought territory, raising the potential for a short-term dip or consolidation this week. That said, the longer-term bias is now firmly to the topside as long as rates stay above previous-resistance-turned-support at 110.00.

* A Marubozu candle is formed when prices open very near to one extreme of the candle and close very near the other extreme. Marubozu candles represent strong momentum in a given direction.

AUD/USD

- AUD/USD turned lower after testing 0.8900 resistance last week

- MACD consistently trending higher, now approaching the “0” level

- Break of 6-week range from 0.8660 to 0.8900 should determine next trend

AUD/USD is our currency pair in play due to a number of high-impact economic reports out of Australia and the US this week (see “Data Highlights” below for more). Looking to the chart, the pair tried to break above key previous resistance at 0.8900 midway through last week, but was summarily rejected back lower. Now, the MACD indicator is nearing a cross back above its “0” level, though the Slow Stochastics are solidly neutral at this point. Once again, traders should let price be their guide: a conclusive break above 0.8900 would open the door for a rally toward 0.9000 or 0.9100 next, while a break below the yearly low at 0.8660 would mark a resumption of the recent bearish trend.

Source: FOREX.com

Central Bank Roundup: The Aftermath of Policy Changes at the Fed, BoJ and RBNZ

It was a busy week for central banks around the world, with monetary policy meetings in the US, NZ and Japan. This made for a very interesting end to the week for the FX markets as investors digested the deluge of information coming from policymakers. The lingering impact of these game-changing meetings, and possibility of fireworks in this week’s policy meeting in Europe as well, may continue to influence investor sentiment for some time to come as the market reassesses prior assumptions about the trajectory of monetary policy in these countries.

The Fed sends investors flocking to the USD

In the US, the Fed ended its third round of quantitative easing by tapering asset purchases by their final $15bn and released a somewhat more hawkish statement than the market was expecting. The bank noted that labor market conditions have improved somewhat, with solid job gains and a lower unemployment rate. The underutilization of labor resources is also gradually diminishing according to the Fed.

The market immediately flocked to the US dollar on the back of the Fed’s statement as US Treasury Bond yields rose and stocks fell. Since then the US dollar has gained even more ground against the struggling euro and yen, while the kiwi and aussie have been able to hold their ground on the back of robust investor sentiment and a slightly risk-on tone in the market, which has also helped to ease the impact of some dovish rhetoric from the Reserve Bank of New Zealand (RBNZ).

The question is, has the market overextended the USD rally? The reaction to the Fed’s statement is somewhat more severe than one might expect, given that the actual course of monetary policy in the US remains very data dependent. While the Fed noted that the likelihood of inflation running persistently below 2% has diminished somewhat, we are still yet to see a meaningful pickup in consumer price growth. Some of this can be attributed to lower energy prices, but even once food and energy prices are taken out, inflation remains stagnant around 1.7% y/y. Core CPI was briefly able to hit 2.0% midway through the year, but it has since cooled. This means that the Fed, and the market for that matter, remain on data watch.

The RBNZ enters wait-and-see mode

Shortly after the policy meeting ended at the FOMC, the RBNZ concluded its own monetary policy meeting. The bank completely dropped its tightening bias which came as a mild surprise to the market; thus, NZD was sold off. The bank noted that a period of assessment remains appropriate before considering further policy adjustment, dropping a line from September’s statement that stated further tightening was expected and necessary to keep future average inflation near the 2% target midpoint and ensure that the economic expansion can be sustained.

The RBNZ does not want to risk stalling NZ’s economic recovery and, in any event, the bank’s prior reasons to tighten monetary policy has largely been removed with the cooling of the housing market (the RBNZ’s macro-prudential tools are akin to at least one 25bps rate hike from the perspective of the housing market) and softening commodity prices. At the same time, the RBNZ doesn’t want to risk strengthening the kiwi. A strong exchange rate is a big drag on growth in an export-based country such as New Zealand.

Some banks have now pushed out their expectations for tighter monetary policy in NZ. At this point it seems likely that the RBNZ will not raise the official cash rate until late Q3 2015, at the earliest. Some analysts are suggesting that the bank will not tighten policy until 2016, which may be overly dovish in our opinion. In saying that, a further deterioration of NZ’s inflation outlook may keep the RBNZ on the sidelines for all of next year. Net migration and strong construction growth should prevent the need for looser monetary policy.

The BoJ

The BoJ surprisingly announced that it is expanding its target monetary base for its annual increase in JGB holdings, in what proved to be a very close call (the vote was 5-4 for expanding easing further). The bank now aims to increase its monetary base by 80 trillion yen annually, from 60-70 trillion yen previously, and boost the average maturity of JGB purchases 7-10 years.

While we weren’t expecting the bank to ease policy further this time around, we were expecting further stimulus sooner or later. When BoJ Governor Kuroda began his current QQE program, he said Japan would reach 2% inflation in two years. The two-year deadline ends in around five months and inflation is still only halfway to the BoJ’s target (core inflation is stagnant around 1.0% y/y). There is essentially no chance that the bank will meet this target, even with this new stimulus.

The actions of the BoJ may weigh on the yen for some time, although this will be measured against any possible retracements in USD in the near term. The fact that the Fed is looking to tighten next year and the BoJ is expanding its use of QQE doesn’t bode well for USD/JPY in the long term.

One central bank ends QE, another increases it. This is not a trick, but a treat for the markets. The global equity markets found additional buoyancy on Friday after the Bank of Japan surprised the markets overnight by expanding its monetary easing program to about 80 trillion yen a year, up from Y60tn-Y70tn previously. The BoJ will achieve this mainly by increasing its purchases of longer-term Japanese government bonds. The central bank is clearly worried about the impact of the April sales tax hike, the recent fall back in inflation and lower global oil prices. Indeed, the BoJ governor Haruhiko Kuroda himself thinks that the economy is at “a critical moment,” pointing out “there was a risk that despite having made steady progress, we could face a delay in eradicating the public’s deflation mindset.” That’s why they increased QE. The markets had already been boosted by the Federal Reserve’s promise of keeping interest rates low for an extended period of time. On top of this, the US third-quarter earnings season has been very good so far.

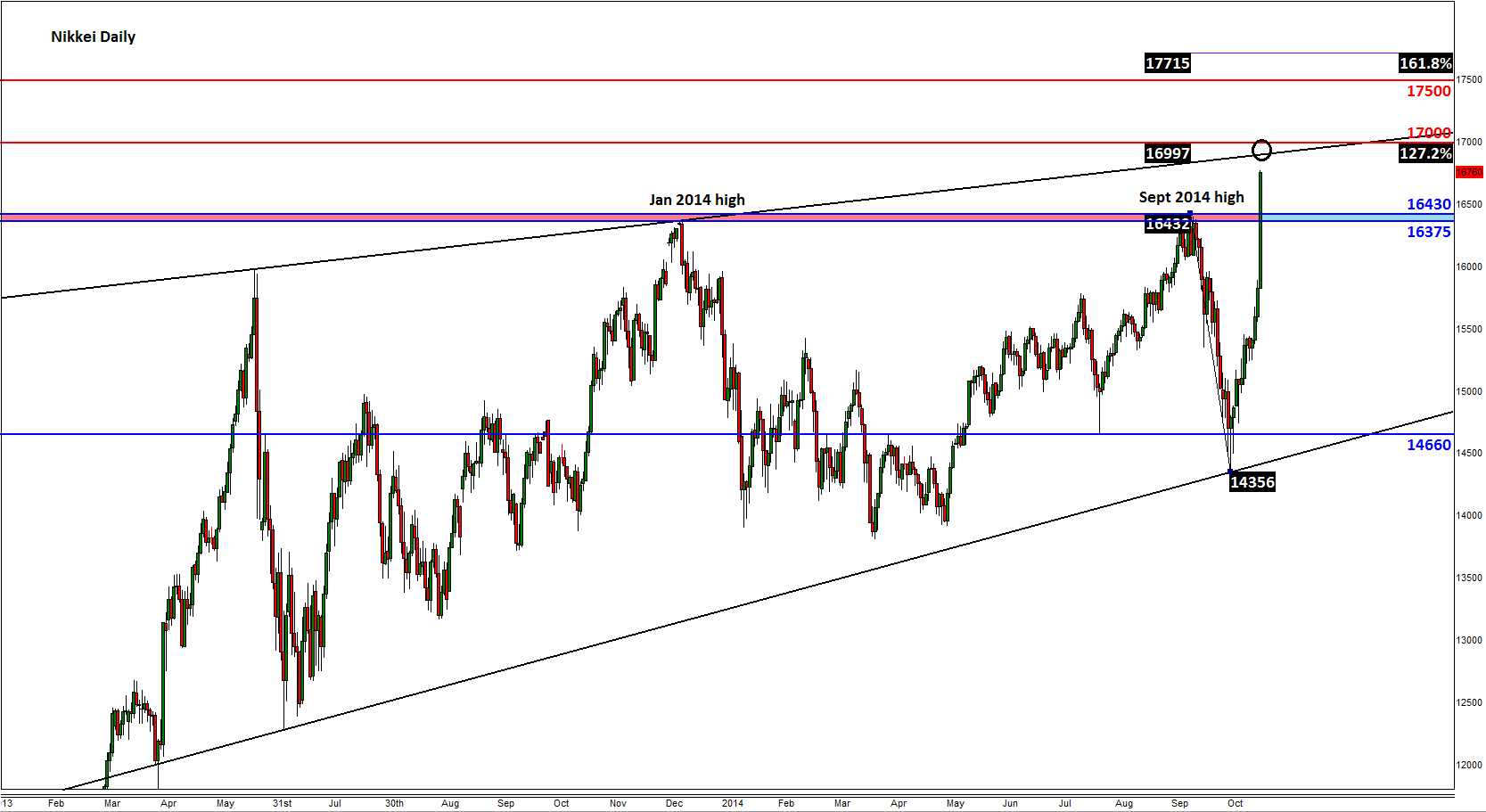

At the close of play on Friday, the Nikkei 225 had already increased 4.8% to 16413. But the index future managed to add more gains during the European and US sessions. At the time of writing it was hovering around 16760, representing a gain in excess of 2% from the official close. If the index future settles around the current levels, then Monday could be another cheerful day for Japanese stocks.

The last time we covered the Nikkei index was at the end of September, when the index had just reached the previous 2014 high around 16375 but was struggling to hold above it. That led us to believe that a correction was imminent, which as it turned out was in fact the case. But like all the other major indices, the Nikkei has since bounced back very strongly and on Friday it decisively took out the area around the previous 2014 highs, namely 16375 to 16430. This area is thus likely to turn into support if and when the index falls back. A potential break below this area would be very bearish. But the path of least resistance is clearly to the upside now, so let’s concentrate on finding potential resistance levels. The first such area is not too far off now: 16900-17000. This is where a resistance trend line meets the 127.2% Fibonacci extension level of the last correction; not only that, 17000 also a psychological level. Beyond there, 17500 could be the next target followed by the 161.8% Fibonacci extension at 17715.

One central bank ends QE, another increases it. This is not a trick, but a treat for the markets. The global equity markets found additional buoyancy on Friday after the Bank of Japan surprised the markets overnight by expanding its monetary easing program to about 80 trillion yen a year, up from Y60tn-Y70tn previously. The BoJ will achieve this mainly by increasing its purchases of longer-term Japanese government bonds. The central bank is clearly worried about the impact of the April sales tax hike, the recent fall back in inflation and lower global oil prices. Indeed, the BoJ governor Haruhiko Kuroda himself thinks that the economy is at “a critical moment,” pointing out “there was a risk that despite having made steady progress, we could face a delay in eradicating the public’s deflation mindset.” That’s why they increased QE. The markets had already been boosted by the Federal Reserve’s promise of keeping interest rates low for an extended period of time. On top of this, the US third-quarter earnings season has been very good so far.

At the close of play on Friday, the Nikkei had already increased 4.8% to 16413. But the index future managed to add more gains during the European and US sessions. At the time of writing it was hovering around 16760, representing a gain in excess of 2% from the official close. If the index future settles around the current levels, then Monday could be another cheerful day for Japanese stocks.

The last time we covered the Nikkei index was at the end of September, when the index had just reached the previous 2014 high around 16375 but was struggling to hold above it. That led us to believe that a correction was imminent, which as it turned out was in fact the case. But like all the other major indices, the Nikkei has since bounced back very strongly and on Friday it decisively took out the area around the previous 2014 highs, namely 16375 to 16430. This area is thus likely to turn into support if and when the index falls back. A potential break below this area would be very bearish. But the path of least resistance is clearly to the upside now, so let’s concentrate on finding potential resistance levels. The first such area is not too far off now: 16900-17000. This is where a resistance trend line meets the 127.2% Fibonacci extension level of the last correction; not only that, 17000 also a psychological level. Beyond there, 17500 could be the next target followed by the 161.8% Fibonacci extension at 17715.

Source: FOREX.com. Please note this product is not available to US clients.

Gold has had a very bad week, hit by a double whammy of a hawkish Federal Reserve policy statement and then a very dovish Bank of Japan move (for details please refer to the stocks equities section). The net effect of the central banks’ decisions has been very bullish for the dollar and also stocks. With these two assets both rallying, investors have found it difficult to justify holding the safe haven gold, an asset which not only costs money to store but pays no interest or dividends. What’s more, we have also had mostly positive US macroeconomic data, including the first estimate of third-quarter GDP, which showed the world’s largest economy grew by an above-forecast annualized rate of 3.5% in the third quarter. This has lent additional buoyancy to the dollar, causing more pain for buck-denominated assets.

As a result of the above-mentioned fundamental factors, gold has broken below the key support area of $1180/5. This breakdown has therefore given rise to follow-up technical selling. Unless gold stages an unlikely sharp reversal here and close Friday’s session back above $1180/5, the chances are we will see some significant losses in the near future. If the metal continues to hold below the $1180/5 area then most of the exiting longs will be forced to abandon their positions which would undoubtedly increase the selling pressure even further. Others might even be thinking the unthinkable: “if you can’t beat them, join them” and act by reversing their bullish positions. The yellow metal has already reached the 127.2% Fibonacci extension level of the last rally that started at the beginning of this month, at $1163. The 161.8% extension of the same move is at $1138/9. In between these levels is the psychological $1150 mark which could also be a target. Meanwhile the 127.2% extension of a separate move, the short-lived rally from the 2013 low comes is at the psychological $1111.1 level.

Global Data Highlights

Monday, November 3, 2014

1:00 GMT Chinese HSBC Final PMIs (October)

The market has been somewhat concerned about a Chinese economic decline ever since the Asian giant started growing exponentially a couple of decades ago. Now the market is concerned that the newfound growth in other regions like the US will take away from the Chinese monopoly on the situation, but that hasn’t yet materialized either. If a slowdown were to take shape, it would likely start in the HSBC Manufacturing and Services PMI surveys. The Flash Manufacturing data came perilously close to the growth/contraction boundary line of 50, but remained above it at 50.4. If it were to fall below, the market may not be too kind to risk currencies like the AUD and NZD to start the week. Manufacturing data will be released at 1:00 GMT on this day, with Services to follow on Tuesday at 1:45 GMT.

8:00 GMT Eurozone Final PMI’s (October)

This week will be chock full of PMI releases, and no one has the market cornered on these releases like the Eurozone. Spain, Italy, France, Germany, and every other Eurozone nation will be releasing Final Manufacturing and Services PMI’s today and on Wednesday at various times that will likely have varying degrees of impact. Strange thing about these releases is that they may not matter much because we already know that the European Central Bank is embarking on a 1 trillion euro Quantitative Easing program that started in mid-October and will really kick in sometime in Q4. Drops in these figures further below 50 though could exacerbate a EUR devaluation and hammer home the point that the ECB had no other choice but to foray in the world of QE.

9:30 GMT UK Final PMI’s (October)

Much like the Chinese and Eurozone PMI releases, these will be spread out through the week with Manufacturing, Construction, and Services PMI’s being dropped at the same time on Monday, Tuesday, and Wednesday respectively. Unlike the ECB though, the Bank of England has no interest in introducing a QE program to boost growth because they haven’t been struggling like the Eurozone. Each of these releases is comfortably above 50 according to the Flash results and, if anything, can be viewed as a confirmation that the UK isn’t feeling the effects of the EZ slowdown. Consequently, the new QE program from the ECB could help to boost activity in the UK’s all-important financial sector as London is the undisputed heavyweight champion of the world in global trading volume with nearly 40% of foreign currency transactions going through The City.

Tuesday, November 4, 2014

0:30 GMT Australian Retail Sales (September)

As attention-getting news headlines happen around the world including the Federal Reserve axing QE, the Reserve Bank of New Zealand shifting to neutral, the Bank of Japan adding to QQE, the ECB introducing QE, and the People’s Bank of China injecting liquidity to their largest banks, Australia has stayed in the shadows. In essence, the AUD has been shoved around more due to outside influences than anything else that is coming out of Australia. This is just the type of release that could spur some activity though as last month’s 0.1% result fell below expectations, and a bounce back could be in the cards. Expectations are centering on 0.3% this time around, but if pent up demand from August spilled in to September, the AUD could regain some of the losses it took in September.

3:30 GMT Reserve Bank of Australia Interest Rate Decision and Rate Statement

Not much has changed on the Aussie front since the last meeting on October 7th, so RBA Governor Glenn Stevens may not have much to add. Most of the economic indicators have met expectations or slid slightly, but not enough to warrant any new major decisions from the central bank. However, the element of surprise can be a central bank’s best friend as we recently witnessed from the BoJ, so don’t rule out a mention that inflation has been falling worldwide along with the historically high value of the AUD which could be viewed as dovish and slap the AUD lower.

21:45 GMT New Zealand Employment Change and Unemployment Rate (Q3)

This past week the RBNZ acknowledged the fact that “growth in the NZ economy has been faster than trend over 2014, reducing unemployment, and adding to demands on productive capacity.” By that statement alone one could surmise that employment continued to progress along nicely as they likely had most of the data they needed to accurately predict what this quarterly release will tell us. Expectations are for unemployment to fall to 5.5% from 5.6% and for Employment Change to accelerate to 0.6% from 0.4%. If this figure fails to achieve these expectations, doubt may be cast upon the RBNZ as they didn’t warn about a deteriorating situation in the economy which could weigh on the NZD.

Wednesday, November 5, 2014

2:30 GMT Bank of Japan Governor Haruhiko Kuroda Speech

The BoJ caught the market off guard this past week as they added to their Quantitative and Qualitative Easing program to an annual target of 80 trillion yen. They also cut forecasts for inflation and growth, which has sent JPY currency pairs skyrocketing to end the week. The decision was far from unanimous as the BoJ voted 5-4 to institute these measures, so Kuroda’s speech may give some insight in to the dynamics of the split in votes. Since Kuroda voted for the acceleration in QQE, he may be eager to explain why they did this now instead of earlier or later and if he hints that this may not be the last one, the JPY pairs may have higher yet to go.

13:15 GMT US ADP Employment Change (October)

This is one of the most watched employment indicators heading in to the widely followed Non-Farm Payroll report on Friday. Consensus is calling for another 200+ result, which would be the fifth in a row and cement the overall feeling that the US economy is finally on the right track and won’t need any more QE from the Fed. In fact, improvement in employment was one of the reasons the Fed felt it was justified to taper away QE, and this report could go a long way toward making that point more clear if it performs. However, if it fails to summit 200k mountain, doubts could come creeping back VERY quickly.

15:00 GMT ISM Non-Manufacturing PMI (October)

Much like the ADP release before it, this report is used as a barometer for NFP later in the week. The Unemployment Subcomponent is widely referenced due to the US economy’s reliance on the service sector for employment. If it is strong, watch for a further rally and renewed confidence that the US economy is destined for great things in the coming months and years.

Thursday, November 6, 2014

0:30 GMT Australian Employment Change and Unemployment Rate (October)

Last month offered a bit of a disappointment for Australian Employment as it fell 29.7k, but belief in that official figure is mixed to say the least. Australia has had some issues in reporting their employment figures of late as they have had to refigure their seasonal factors. Due to this issue, the market may be wary of placing too much significance on what the final figure shows and may have a delayed reaction as confirmation becomes available after the fact, as Chris Tedder explained in a piece earlier this month. Regardless, expectations are calling for a bounce back to good and a 10.3k increase.

12:00 GMT Bank of England Monetary Policy Decision

The BoE has done a magnificent job of making investors hit the snooze button on release of their decisions as there hasn’t been much to glean from them. There has been speculation that the BoE would be the first of the major central banks to increase interest rates, but that belief has been tabled as the Fed appears to be pulling away in that race. The BoE may allow that belief to continue, particularly if they deliver another non-headline worthy type of decision once again.

12:45 GMT European Central Bank Interest Rate Decision, Statement, and Press Conference

In recent months the ECB has cut rates to negative, instituted Targeted Long Term Refinancing Operations, introduced QE, and essentially done everything it can to talk down the EUR. Is there anything else they can do? Well, the ECB’s QE program is scheduled to spend about 1 trillion euros, which pales in comparison to the Fed’s myriad iterations of QE that totaled about $4 trillion. Unfortunately for the ECB, half measures (or quarter measures in this case) may not be enough for the market to respect, so the only recompense for the ECB to pursue would be adding on to QE even more. That may be an uphill climb though as German officials have consistently been standing in the way of that path. Therefore, don’t expect anything new to come out of this meeting other than ECB President Mario Draghi calling for European leaders to get their financial houses in order to help the ECB do its job more efficiently.

Friday, November 7, 2014

13:30 GMT Canadian Net Change in Employment and Unemployment Rate (October)

Canadian employment data has become somewhat of a joke in these pages the last few months as it has followed the trend of alternating positive and negative figures, but it continued to follow that path last month as a spectacular 74.1k jobs was added. That makes 10 straight months of flip-flopping, and we’re quickly approaching our one-year anniversary! This time around, consensus is calling for only a 0.4k rise which makes sense considering the overwhelmingly positive month previous means that less hiring would be happening the next month. However, if our tried and true pattern holds, the consensus may not be bad enough as a negative number could rear its ugly head.

8:30 GMT US Non-Farm Payroll and Unemployment Rate (October)

The perfect end to an exciting week that has a lot of influential reports, but only one ring…errrr report…rules them all. The world will be watching to see if the Fed was justified in tapering away the last bit of QE3 while simultaneously proclaiming that “a range of labor market indicators suggests that underutilization of labor resources is gradually diminishing.” Of course, one report doesn’t paint the entire picture of an economy, but if you were to look up the definition of “knee-jerk reaction” on Google, a photo of NFP would be listed first on the image page. Consensus is calling for around 230k-235k, but that may change as the pre-NFP employment reports get released. Also, watch for revisions to previous months which might bring the release from September up over the 200k threshold which would be significant in the total of 200k+ result string that started in April. If that revision takes place (and we get another 200k+ result), that would make it 8 straight 200k+ numbers, a streak that hasn’t been achieved since the mid-1990’s.