The Fed tried to return positive sentiment to the markets by suppressing expectations of an imminent policy tightening.

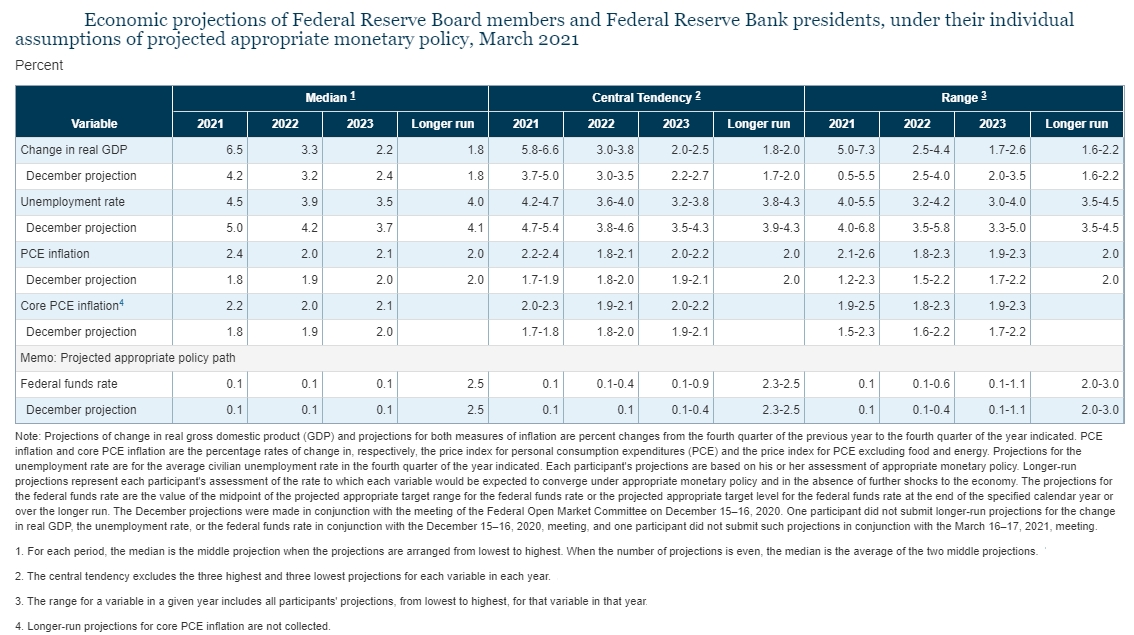

Thanks to the announced economic stimulus, the FOMC has drastically raised this year's GDP growth estimate to 6.5% from 4.2% and forecast that the economy will grow above the trend pace of 1.8% in the next two years. The unemployment rate is expected to fall to 4.5% by the end of 2021, returning to the lows of the last half-century. The market reaction has been moderately positive. Medium-term bond yields fell, reflecting the falling odds of a rate hike next year.

The market reaction has been moderately positive. Medium-term bond yields fell, reflecting the falling odds of a rate hike next year.

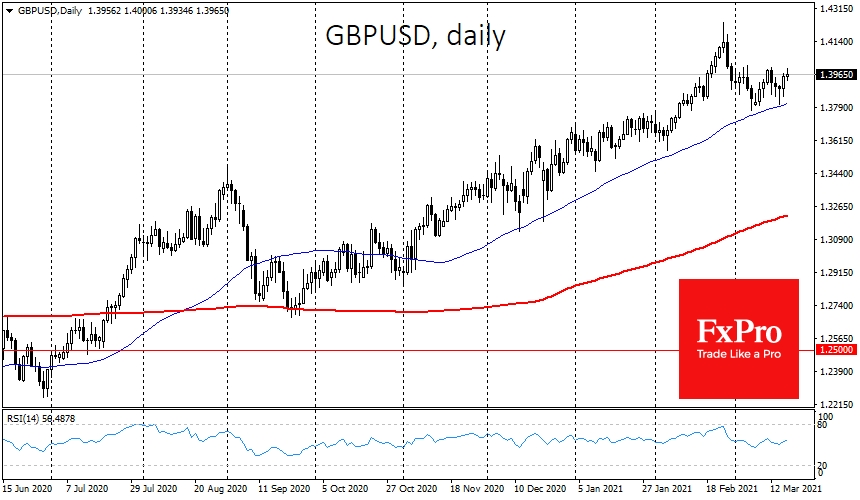

The US dollar lost 0.7% to the euro and 0.9% to the pound after the Fed decision and the subsequent chairman press conference. EUR/USD is back on track with 1.2000, and GBP/USD is testing 1.4000 - psychologically important round levels.

A weaker dollar has helped gold gain ground and climbs to $1750, which has been in an upward trend since the beginning of last week. However, the upward dynamic in gold is cautious.

The Fed is trying to look beyond the inflation target of 2%, presented as a consequence of the change in strategy. However, experienced traders know that the same approach has been around since 2008 and is widely used by other global central banks.

While the dollar has turned to decline against the major currencies, there are some warning signs to look out for.

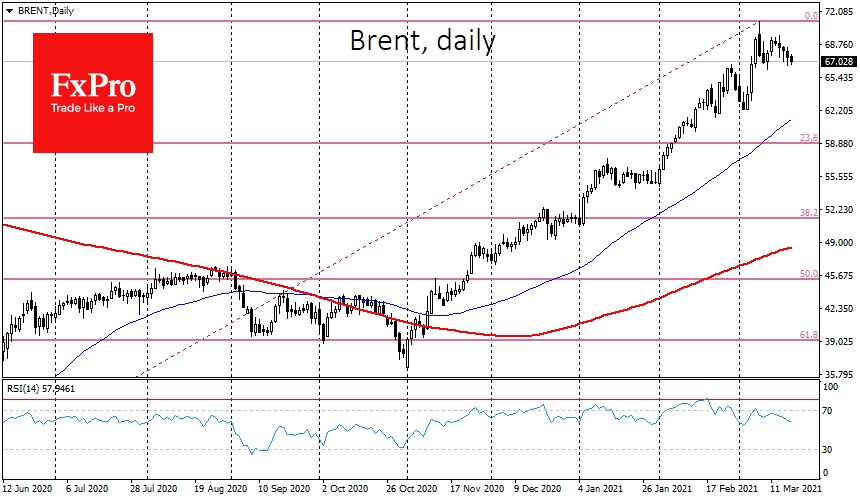

Oil, which had previously brushed off the markets' pessimism, is now ignoring their optimism, sliding for the fifth trading session in a row amid rising US stockpiles. This reinforces the notion that it has become vulnerable to negative news and misses the positive factors.

Also worth bearing in mind is the reverse correlation between technology stocks' performance and long-term bond yields. Yields on 10-year treasuries have risen to 1.7%, new 14-month highs, which promises to constrain near-term growth stocks mainly in the NASDAQ Index vs more robust growth of companies in the Dow Jones Index.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Fed's Optimism Is Not Beneficial To All

Published 03/18/2021, 06:47 AM

The Fed's Optimism Is Not Beneficial To All

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.