Going Long Into the Weekend?

Stocks had an uneventful day on Friday, with the S&P 500 rising by about 20 bps to finish at 3,380. I’m modestly surprised we didn’t see stocks move lower in the afternoon, given the long holiday weekend. Regardless the trends are unchanged, and the S&P 500 is heading to 3,400 with its sight on much higher numbers. Just don’t tell the market, the Fed’s balance sheet hasn’t expanded since the beginning of January.

It’s A Bubble?

The bears always have an excuse for why the market’s rally won’t last.

Overvalued?

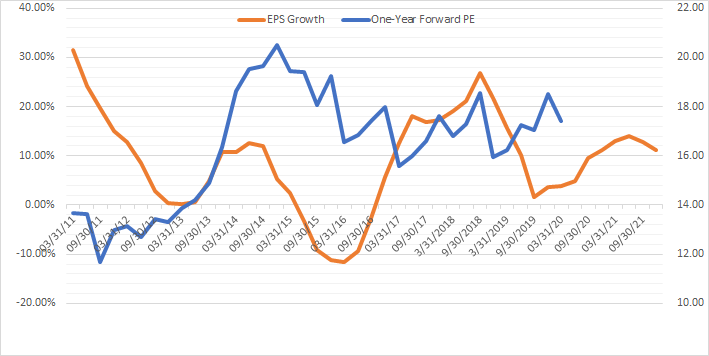

I don’t see or understand the bear’s calls for an overvalued market. Everyone is quick to point out that in 2019 we rose on pure multiple expansion, but they seem to forget to mention that in 2018, we had some 22% earnings growth and a whole lot of multiple contractions.

So perhaps it wasn’t that we rose in 2019 purely on multiple expansion, but were merely reverting to the mean from extraordinarily oversold and unwarranted conditions based on a fairytale calling for a 2019 “recession.” That fairytale resulted in the one-year forward PE ratio falling from 18.5 at the end of the third quarter to less than 16 by the end of the fourth quarter, and returning to 18.5 by the end of 2019.

It Must Be The Fed?

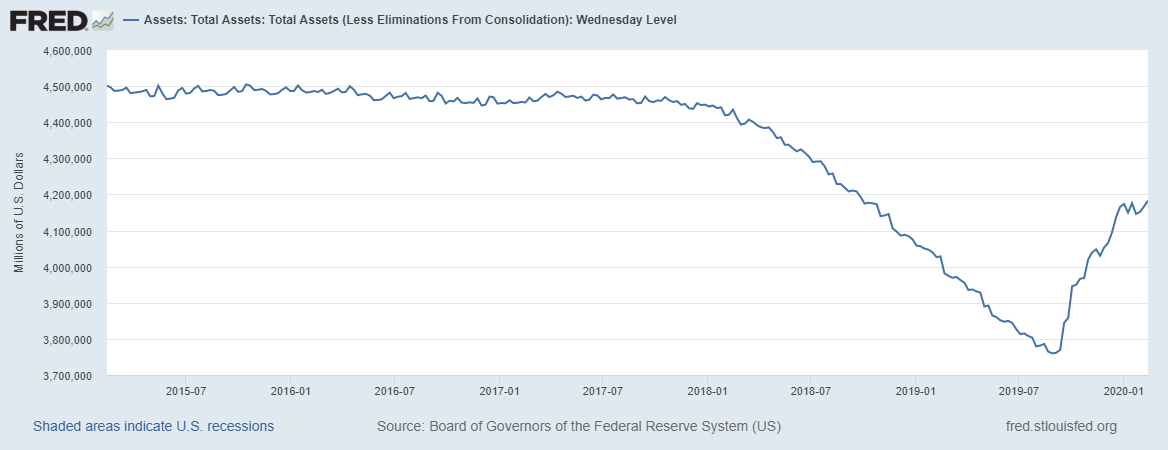

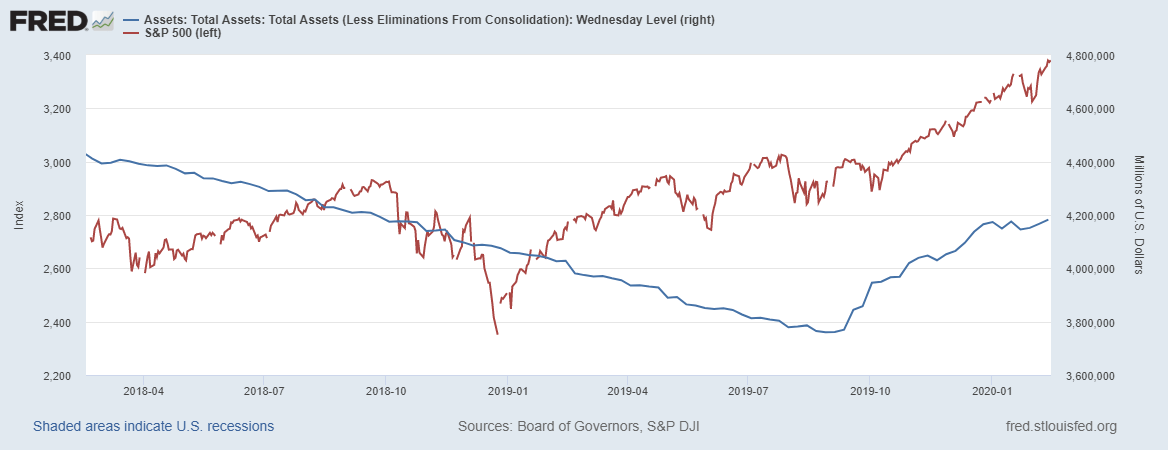

What also seems interesting, is that stocks are still cheaper today than they were in much of 2014 and 2015, when rates were significantly higher than present levels. Maybe I just don’t get it. I know, I know, it’s the Fed pumping, lifting the entire $30 trillion market cap of the S&P 500, with there balance sheet expansion, that has stopped, oh by the way, or at the very least paused.

But yet the market has continued to rally on. I mean you can see pretty clearly, the market had no problem rallying through much of 2018 or off the December 2018 lows, despite the Fed contining to drain liquidity through September 2019, or do those rallies not count?

What Now Bears?

It has also managed to rally by the tune of about another 5%, since the beginning of the year, despite the balance sheet expansion being in a “pause mode”.

So what do you think?

Seems pretty obvious to me. But that’s ok bears, stay negative and keep putting down the market’s rally, it only means it has much further to rise.