Market movers today

Following ECB President Mario Draghi's hint at future easing yesterday, it is today the Fed's turn to turn more dovish. At the FOMC meeting tonight we look for the Fed to open the door for a rate cut in July and a total of 75bp cuts in H2, see FOMC Preview - Cutting like it is the 90s , (11 June 2019). Lower inflation expectations, trade war uncertainty and signs of a manufacturing recession point to the need for a lower Fed funds rate. Comparing the current Fed funds rate with measures of the neutral rate also suggests that monetary policy is not too tight. The Fed meeting will include new projections (dot plot).

On the data front we get UK inflation data where consensus looks for a further decline in the core inflation rate to 1.7% y/y in May from 1.8% y/y in April. Core inflation has been trending lower since the peak at 2.7% in early 2018.

In Scandi focus turns to Swedish key figures on economic and consumer confidence as well as unemployment. Sweden's NIER also publishes new forecasts.

Selected market news

It was a fairly volatile trading session in global bond and stock markets. US treasuries initially rallied from the opening following Draghi's dovish comments signalling further ECB easing, but erased most of the gains later in the day, as news broke from both U.S. and China administrations that Trump and Xi will meet once again at the upcoming G-20 meeting in Japan next week regarding the ongoing trade war. Thus, 10Y US treasuries ended the day 3.5bp lower covering an 8bp intraday range. US curves flattened 2s10s to 20bp as the short end was held close to unchanged. A total of 63bp worth of cuts is currently priced by the end of this year.

Equities, on the other hand, merely extended gains from earlier in the day following the renewed trade talk optimism. S&P ended the day 0.97% per cent higher, while in Asia Hong Kong shares (Hang Seng) is currently up 2.4%.

Oil prices rose 2% (brent crude up USD 1.3 per bbl.) as OPEC and its allies are nearing on a date for its next meeting regarding oil production cuts (Vienna July 1-2). This ends a one-month dispute regarding time and place for the upcoming meeting and finally some good news for oil, which has seen prices drop USD 10 per bbl. since late May. The oil price is set to remain highly volatile on the back of the current conflict in the Gulf of Oman and volatility indices have surged to the highest level in five months.

Japanese 10y bond yields fell 2bp to -15bp ahead of the BoJ tomorrow and are thus currently trading close to the lower bound of the target range of -20bp. The Yen initially slid on the trade optimism, but quickly erased the deficit. We currently target a stronger JPY (see FX Strategy - USD/JPY Accept defeat: 105 is easily within range ).

Finally, Swedish house prices (Valuegard HOX Index) rose 0.7% m/m and 1.8% y/y.

Scandi

Valueguard home prices (May) just released, show that prices continue to recover slightly. Flats were up 0.6% mom and single-family homes rose 0.7%. Later this morning we get June NIER business and consumer confidence data. Last month consumer confidence dropped to a six-year low, manufacturing confidence is moderating too, but is still at decent levels.

Fixed income markets

On the back of Draghi's speech yesterday, we have changed our call for the ECB outlook. We now expect the ECB to cut rates by 20bp, introduce a tiering system, present an extended forward guidance, and restart QE in a combined package. We expect the ECB to open for further easing at the July meeting and announcement in September, alongside new staff projections. We acknowledge a risk of an earlier announcement should market and economic sentiment suffer further.

We expect that the struggle to avoid negative yields will intensify. It points to even flatter curves 10s30s. Periphery in general will benefit directly from a new QE programme.

Hence, we do not expect the usual textbook curve steepening. Curve steepening views could alternatively be expressed by paying in e.g. 5y5y EUR inflation swap (more negative real rates) though it already jumped some 9bp last night. In respect of 10Y Bund yields we target a new drop to -0.45%. For more see New ECB call.

The busy central week continues today with the important June FOMC meeting. We expect the Fed to open the door for rate cuts. We expect cuts in July, September and December. Even though the US market is clearly priced for rate cuts, the 'official' confirmation tonight should push US treasury yields a new leg lower.

Denmark will tap the DGB 11/29 and the DGB 11/39 today. For more see Auction preview. We have closed our long position where we bought 10Y DGBs versus 10Y Bunds.

However, we have not become negative on Danish government bonds, we are just taking a “wait-and-see” stance with the potential supply of 1% 30Y callables in the coming month – which could be even higher now – as well as possible upward revision of the supply of DGBs in 2019 as the public finances so far have not been as good as expected.

FX markets

EUR/USD dropped yesterday as ECB finally acknowledged the market’s call for monetary easing. We see a case for the euphoria calming down again as the market recalls how it was left disappointed when ECB last announced rate cuts and QE in December 2015 and March 2016, i.e. we are not bound for a bigger move lower in EUR/USD after ECB’s dovish shift. Rather we see a case for EUR/USD to rebound today on a dovish Fed signalling it is ready to cut rates from July. In the end, we look for the Fed to ease more aggressively than the ECB and push EUR/USD higher. We forecast 1.15 in 3M (NYSE:MMM).

With ECB rate cuts on the table it is time to consider how Danmarks Nationalbank (DN) would respond and how EUR/DKK would react. We see a case for DN to deliver only a 10bp rate cut if the ECB cuts by 20bp in September. That in turn would push FX forwards higher and EUR/DKK spot lower. See more in Flash Comment Denmark.

We are now one day from the Norges Bank (NB) meeting. With both the ECB and the FOMC likely to ease policy in the coming months the big question is whether NB is able to stand alone as the sole G10 central bank hiking rates? In short, we think yes. Norway is much less of a traditional open economy than e.g. Sweden and last week’s Regional Network Survey indicated accelerating (!) mainland growth prospects across most sectors despite much weaker global growth prospects. The reason? Rebounding global petroleum industries, a weak currency, substantial rise in oil investments and large infrastructure investments. As a result NB will have to balance A) a slowly overheating economy set to operate at above-trend potential in the coming 6-12M against B) elevated international risk factors. We think emphasis once again will be on the former and we expect both a NB 25bp rate hike tomorrow and a firm maintenance of the central bank’s tightening bias. This is in stark contrast to rates markets that price tomorrow’s hike as the last in the cycle.

A dovish Draghi sent EURUSD lower and initially weighed on EURSEK. However, the market seems to realize that further ECB easing will make it more difficult for the Riksbank to move ahead, limiting the downside in EURSEK for now. We are not at all surprised to find EUR/SEK going bid at the end of the day. Come autumn Swedish fundamentals, in particular inflation, will add headwind for the Riksbank and the krona. Today a speech by über-dove Per Jansson (12:00) and NIER data will set the stage.

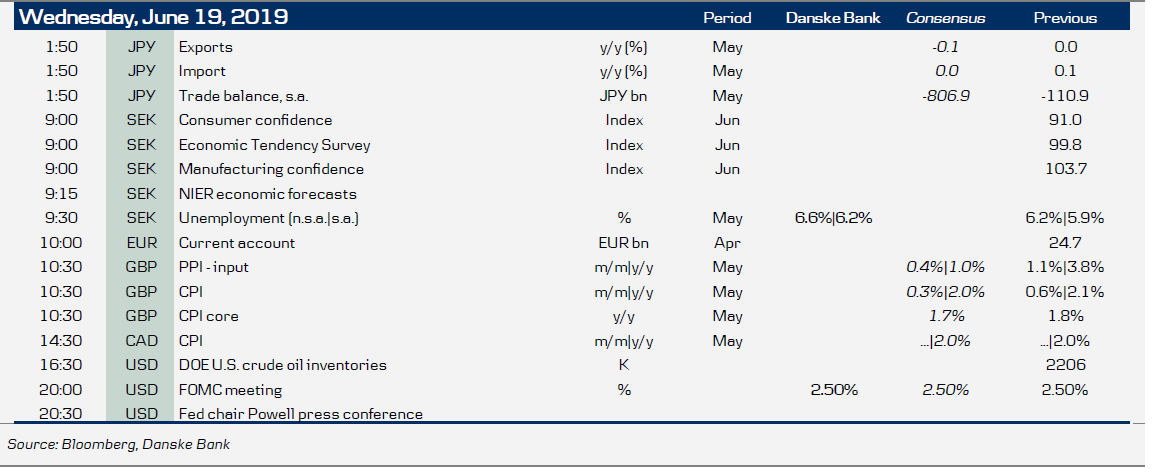

Key figures and events