We came across the following bullet points from a Seeking Alpha article titled- The Fed is not Juicing the Stock Market.

- It makes for a great headline, but the Fed is not the cause of this rally.

- Every dollar the Fed has pumped into the economy is spoken for, and it is not in equities.

- The truth is a lot more boring and scary than the conspiracy theory.

After explaining how the Fed is not culpable for rising stock prices, the author ends the article with the following challenge:

“So please, I invite anyone to explain to me, like I was a 5-year-old, what exactly is the mechanism that explains “the Fed is juicing the market,” when we know exactly where all the Fed’s money is, and we know that it isn’t in the market.”

We are always up for a challenge.

The following article describes four ways in which the Fed juices the stock market.

Draining the Asset Pool

The Fed conducts monetary policy by governing the Fed Funds Rate. To do this, they buy and sell Treasury securities via open market operations. When the Fed wants to lower rates, they buy Treasury debt. In doing so, they reduce the supply of investible debt, making remaining debt more expensive (lower yield). They most often buy or sell short term Treasury Bills to affect the short term Fed Funds rate. Open market operations also add or drain the banking system’s liquidity to help further hit their target.

More recently, with Fed Funds at zero percent, they have conducted QE or large-scale asset purchases. These operations help manipulate rates across the maturity curve and not just Fed Funds. QE, as with traditional open market operations, reduces supply, boosts prices, and lowers yields.

With knowledge of the Fed’s modus operandi, let’s go swimming.

Think of the asset markets as a big swimming pool. The kiddie pool is for risk-averse investors, and the deep end is home for the riskiest of investors. While the depth of the water varies extensively, the water level is the same throughout the pool.

Imagine the Fed comes to our pool with a giant bucket and removes gallons of water from the shallow end. What happens to the water level for the entire pool? It falls, and consequently, there is less water to swim in. The effect is more obvious in the shallow end as the depth was lower to begin with. Regardless of appearances, the water level in the deep end falls by the same amount.

Some of our risk-averse shallow end swimmers will now take a step or two towards the deep end. They may move from Treasury Bills to short term corporate bonds or mortgages. As investors take on more risk, they start crowding out other investors and pushing everyone toward the deep end.

Less water means less supply of investible assets. The basic laws of supply and demand clearly state that less supply and the same demand result in higher prices.

Leverage

One of the Fed’s recent accomplishments during this economic crisis is fostering easy financial conditions. Such an environment allows companies to borrow and reduce the possibility of default. Another benefit is it encourages investors to use more leverage as borrowing is easier to attain and cheaper.

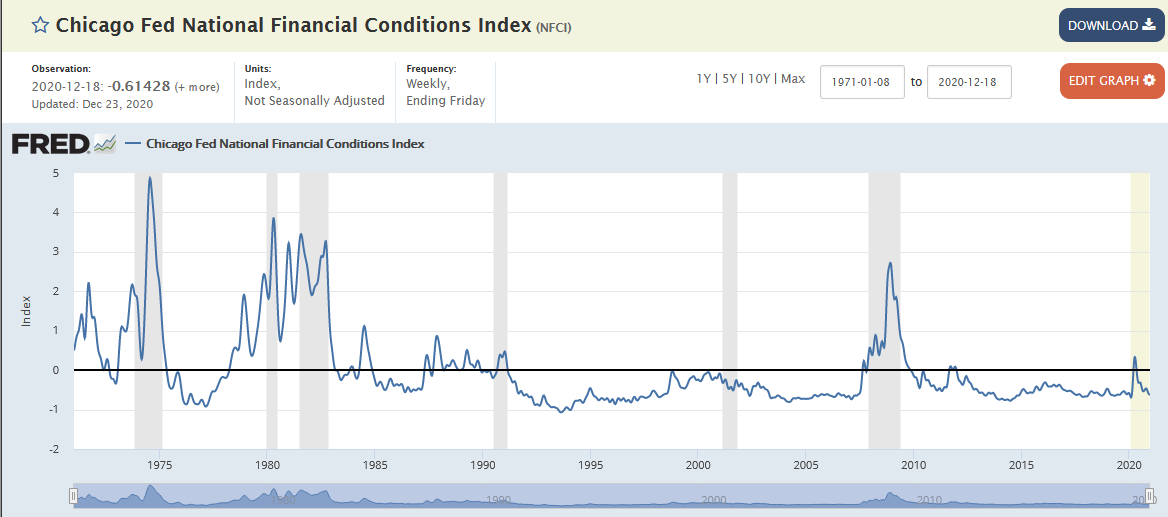

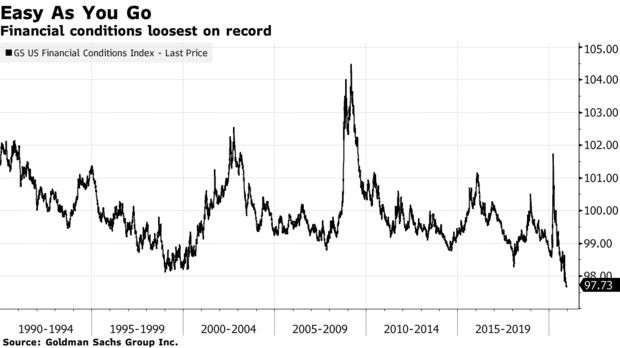

The two graphs below show borrowing conditions have rarely been easier. Typically a recession has the exact opposite effect on lending conditions.

“U.S. financial conditions are the easiest they’ve been in more than a quarter century as stock markets scale new heights on hopes of an end to the Covid-19 pandemic, according to an index compiled by Goldman Sachs Group.” – Bloomberg 12/14/2020

More leverage allows speculators and traders to amass larger holdings than would otherwise be possible. Much of this leverage comes from the repo markets. Repurchase transactions, or repo, is a loan collateralized with an asset. For example, an investor buys a security, pledges it as collateral, and uses the borrowed funds to buy more assets. The investor holds more assets with the same original investment.

The Fed has been actively providing funds to the repo markets resulting in more liquidity and lower borrowing rates since the fall of 2019. At its peak in March, the Fed supplied over $400 billion in repo funding to the market. This source of funds allowed for the increased demand for assets, and as you would expect, this includes stocks.

Fed Put

Investors are like Pavlov’s dogs. Increasingly they associate Fed actions with more stimulus, easier financial conditions, and higher asset prices. The Fed has responded by becoming more verbally accommodative via talking up policy options when markets hit rough patches.

Fed actions or even words of encouragement become buying opportunities. As such, prices do not decline as much as they might have, and volatility is muted as a result. Muted volatility encourages more investment and speculation as risks, measured using common financial math, such as standard deviation, are perceived to be lower.

More return with less perceived risk encourages more risk-taking, ergo more interest in stocks.

Fed Supports Passive Investing

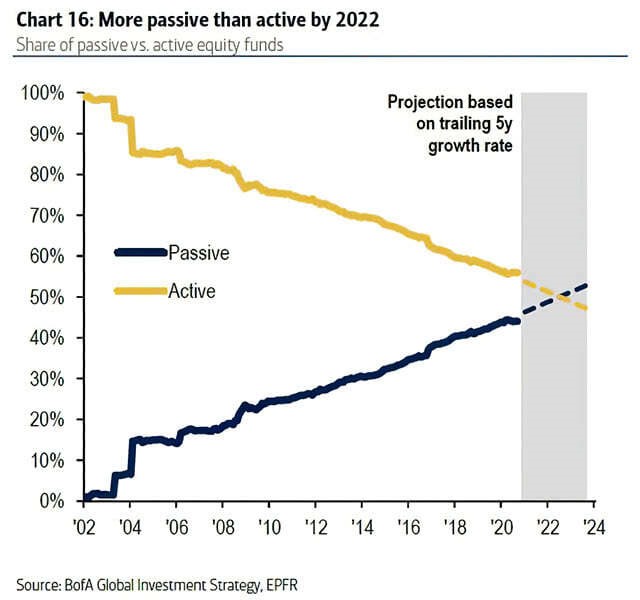

Reduced volatility and eye-popping returns are increasingly leading investors to focus on momentum and passive strategies. Active investors, forecasting economic and earnings trends, and assessing valuations get left behind in momentum-driven markets. As these investors lose assets or switch to more passive strategies, passive strategies by default play a more prominent role in asset pricing.

For more, please read our article: The Market’s Invisible Guardrails Are Missing.

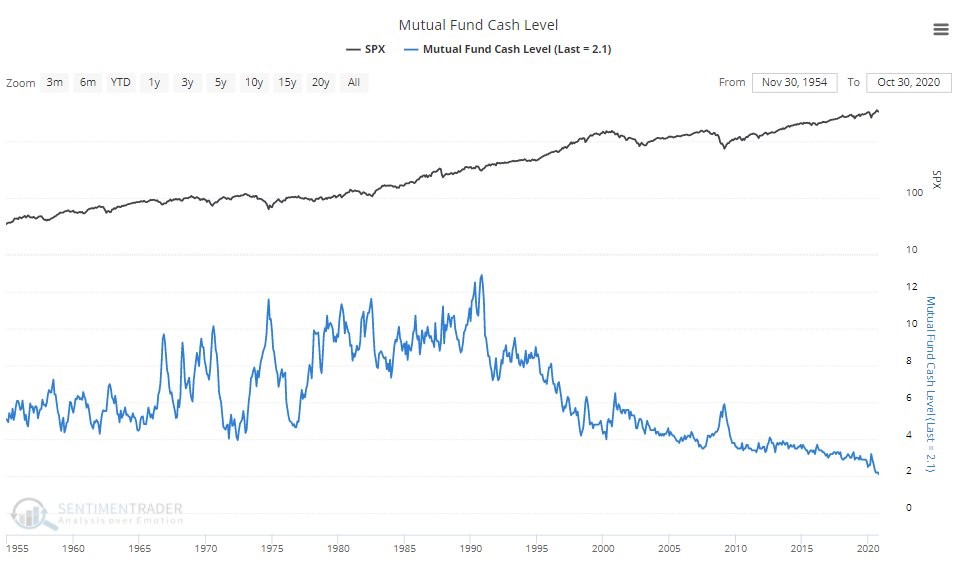

Active investors tend to hold cash to take advantage of opportunities that may occur in the future. Further, at times like today, when valuations are historically extreme, active investors take profits and may not find suitable replacements, also increasing their cash balances.

Passive investors are typically fully invested. Cash, after all, is a performance drag in upward trending markets. They do not sell because of high valuations but switch from one index to another based on momentum.

Due to the steady gravitation from active to passive strategies over the last decade, system-wide cash balances are reduced, and there is more demand to buy assets. As shown below, courtesy SentimentTrader, equity mutual fund cash balances are 70-year lows.

Summary

Our summary is short and sweet, so even a five-year-old can understand.

The Fed juices stocks!