The US dollar sold off in response to the Fed's lack of action, but it rebounded to close firmly before the weekend. For the past week as a whole, it was mixed. The Australian and New Zealand dollars were the strongest of the majors, advancing 1.3%-1.4% against the greenback. They extended those gains on Friday, even though the dollar was firmer against most of the other majors.

The euro was the weakest of the majors, losing about 0.35% against the dollar. The pre-weekend loss of about 1.4% offset the earlier gains and a little bit more. The Swedish krona and Norwegian krone, like the euro, were higher for the week before Friday, when they gave it all back. They finished last week down about half as much as the euro. Officials at the Swedish Riksbank suggested inflation may have bottomed, but they do not want to see the krona appreciated. Norway's central bank is likely to cut rates in the week ahead to respond to slowing growth.

Before the weekend, the euro traded on both sides of Thursday's range. It closed near its lows, but did not close below Thursday's low, which would have been a stronger reversal pattern. The euro's high of $1.1460 was just shy of the 61.8% retracement of the euro’s decline from the Chinese-induced spike on August 24 (~$1.1715) to the September 3 low (~$1.1087). A break of the $1.1230 area now would confirm that the euro's advance since September 3 is over.

With the Fed on hold, attention may shift back to the ECB and the flexibility of its current asset purchase program. The euro has appreciated about 4% on a trade-weighted basis since the middle of July and the price of Brent is about 20% lower over the same period. Neither is particularly helpful from the ECB's perspective.

The dollar approached the lower end of its recent range against the yen before the weekend, but recovered smartly, even though strength in bonds and weakness in equities often hold it back. The yen gained about 0.5% on the week. The dollar's five-day average crossed above the 20-day average for the first time in a month. In order to lift the dollar's technical tone, however, it needs to move back above the band of resistance seen between JPY120.80 and JPY121.35. While JPY119.00 held before the week, support in the JPY118.60-JPY118.80 area is more important.

Sterling gained about 0.7% last week, but the poor price action before the weekend warns of downside risks. It appears to have traced out a shooting star candlestick pattern by rallying strongly initially, reaching it best level since August 26 (~$1.5650), and then sold off to close below the open and near its lows. Sterling's high met the 61.8% retracement objective of the decline from the year's high set on June 18 (~$1.5930) to the September 4 low (~$1.5165). Initial support is seen near $1.5470, but a breach of the $1.5400-$1.5415 area would be more significant from a technical perspective. Although wage pressures appear to be somewhat greater in the UK than the US, and there may be another hawkish dissent at the October 8 MPC meeting, it is hard to envisage the BOE lifting rates before the Fed.

The Australian dollar surpassed our $0.7200 target last week, reaching a high of $0.7280. However, the failure to close above it on two attempts warns the upside momentum may be fading. Confirmation requires a close below the five-day moving average, which the Aussie has not done for two weeks. Its recovery over the past few weeks dovetailed with the recovery in copper prices, which turned back down before the weekend. On the upside, a move above $0.7300 would signal a move into the $0.7380-$0.7400 area.

The US dollar posted an outside up day against the Canadian dollar before the weekend. Initially the greenback fell to a little below CAD1.3015, its lowest level since August 13. It then recovered, trading through the previous day's high (~CAD1.3205) and closed on its highs. The drop in oil prices offset the smaller US premium over Canada on two-year money. Moreover, with the Fed on hold for longer, some speculation is beginning to build that the Bank of Canada may cut interest rates again. A move above CAD1.3240 would signal a return to the upper end of the trading range found in the CAD1.3300-CAD1.3350 area.

In explaining the decline in oil prices, most analysis has put more weight on supply than demand. However, one of the consequences of the Fed's apparent dovishness was to raise concerns over demand. The front-month November light crude oil futures contract finished the week essentially unchanged, but on a weak note. It has held above the five-day average this month. A break of it (~$44.30) could signal losses toward $43.20-$43.50. A break of that area warns of losses toward $42. Technically, a move above the $47.50-$47.70 area is needed to lift outlook.

The US 10-Year yield fell 18 bp from the mid-week high of 2.30%. At 2.13% at the close before the weekend, it was about 5.5 bp lower on the week. It may be difficult for the yield to break below the 2.05%-2.10% without some new spur.

The S&P 500 lost 0.15% last week. That is after the 3.3% (~67 points) drop from the post-Fed high to the pre-weekend low. The technical tone is poor. The price action suggests that the correction off the August 24 low is complete. The S&P 500 has held above the 20-day moving average, which is found near 1952 now. That is just below the trend line drawn off the August 24 and September 4 lows. A loss of 1925 warns of the risk of a return to late-August lows near 1867.

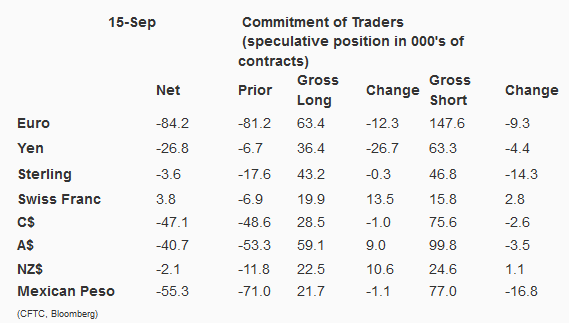

Observations from the speculative positioning in the futures market:

1. There were six significant (10k+ contracts) gross speculative positions in the Commitment of Traders reporting week ending September 15. The speculators cut their gross long euro holdings by 12.3k contracts (~16%) to 63.4k contracts. They slashed their gross long yen position by 26.7k contracts (~42%) to 36.4k contracts.

2. Speculators boosted their gross long Swiss franc position by 13.5k, giving them 19.9k contracts (and enough to swing the net position to the long side for the first time since late July. It was the largest percentage term jump in the gross longs in a little more than two years. Speculators also nearly doubled their gross long New Zealand dollar position. It rose by 10.6k contracts to 22.5k.

3. Speculators covered 14.3k short sterling contracts, leaving 46.8k. They also covered 16.8k short Mexican peso contracts. They retained 77k gross short contracts.

4. Adding the New Zealand dollar futures to our currency matrix, we tracked 16 gross speculative positions. In the past week all but five were reducing exposures. It appears the specs are trying to pick a bottom to the Aussie and Kiwi. Speculators were lightening up on long euro and yen exposure into the rally. Speculators began covering short sterling positions as the nine-day losing streak ended on September 4, though they were not inclined to bottom fish (extend gross longs).

5. The speculative net short 10-year Treasury futures position grew for the third consecutive week, rising to 39.5k contracts from 23.9k. This is despite the covering of 12.k gross short contracts (to 419.6k). The bulls were more aggressive, liquidating 27.7k contracts (to 380.1k).

6. Similarly in the oil futures, speculators reduced their exposures. The longs were shaved by 4.3k contracts (to 485.8k) and the shorts were slimmed by 12.3k contracts (to 246.4k). This resulted in an 8k increase in the net long position to 239.4k contracts.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.