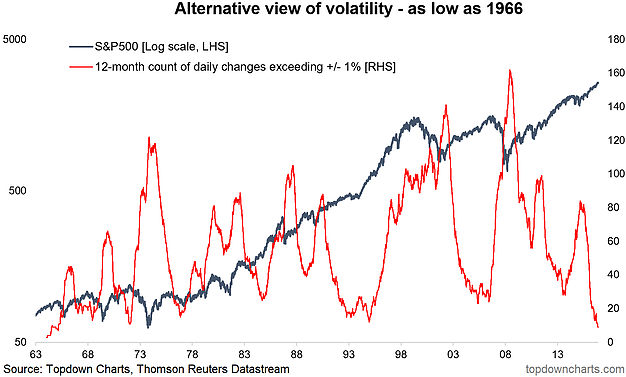

Regular readers and followers on social media will be familiar with this chart, but what will probably be surprising is how this alternative gauge of stock market volatility has made the plunge to the lowest level seen since 1966. The crunch-down in S&P 500 volatility is extraordinary, albeit it is a familiar sign as this metric often trends down as a new bull market gets underway – certainly at least in the initial phase.

Just like our analysis on yield curves and the bond market, it is perhaps just another sign of the stage of the market and business cycles. That is, it is a sign of a maturing cycle. Of course the next question is (and should be) when does the cycle turn? The simplest answer is that you will know when it happens.

Rather than being a throwaway line, this refers to the fact that instead of making wild predictions and forecasts, people like us prefer to study the data, the indicators, and let the facts tell us what's happening and what to do. In this respect we are watching precisely this indicator and many others like it, because the easiest way to tell when a market and business cycle is turning, is to simply pay attention.

This alternative view of volatility tracks the rolling annual sum of daily price changes exceeding +/- 1% – in other words, over the last 252 trading days there were only 9 days where price changed by 1% or more.

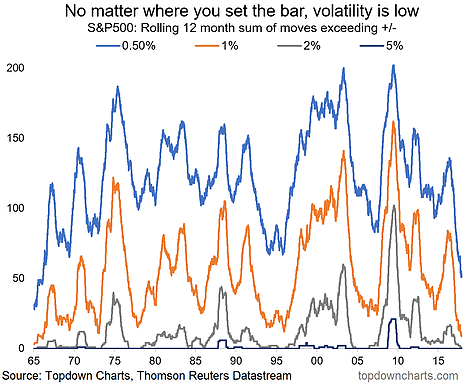

Looking at the tapestry of volatility, whether you set the bar at 1% or 0.5%, it's clear we are in extraordinary times, and the trends are echoed in traditional implied volatility (and implied correlations by the way).