Business as usual under new manager

The European Investment Trust (LON:EUTP) aims to provide long-term growth in capital from a diversified portfolio of European ex-UK equities. There has recently been a change in lead fund manager; however, Craig Armour follows the tried and tested Edinburgh Partners investment process, which aims to select stocks based on a five-year P/E multiple (Y5 P/E). Evidence suggests the best performing stocks have a Y5 P/E of less than 11x; EUT’s portfolio currently has an average Y5 P/E of c 9x. Although the primary focus is on capital growth rather than income, ordinary dividends have been maintained or increased since 2009; the current dividend yield (including a special dividend) of 2.1% is above the peer group average.

Investment strategy: Seeking long-term value

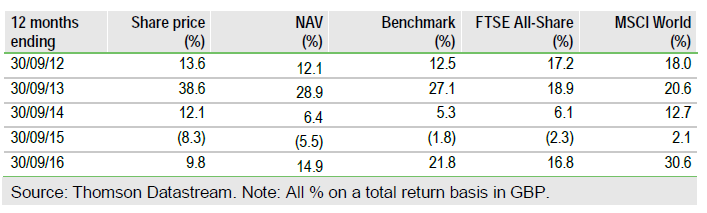

Manager Craig Armour applies Edinburgh Partners’ disciplined investment process, selecting stocks using detailed fundamental analysis to determine five-year earnings estimates. The process is based on analysis that indicates stock prices are correlated with inflation-adjusted five-year earnings performance, although over shorter time periods stock price moves are more random. The resulting portfolio typically comprises 35-50 holdings and over the last 20 years the average Y5 P/E of the portfolio has ranged between 7x and 11x. EUT measures its performance against the FTSE All World Europe ex-UK index; its sector and geographic exposure may vary considerably versus the benchmark.

To read the entire report Please click on the pdf File Below