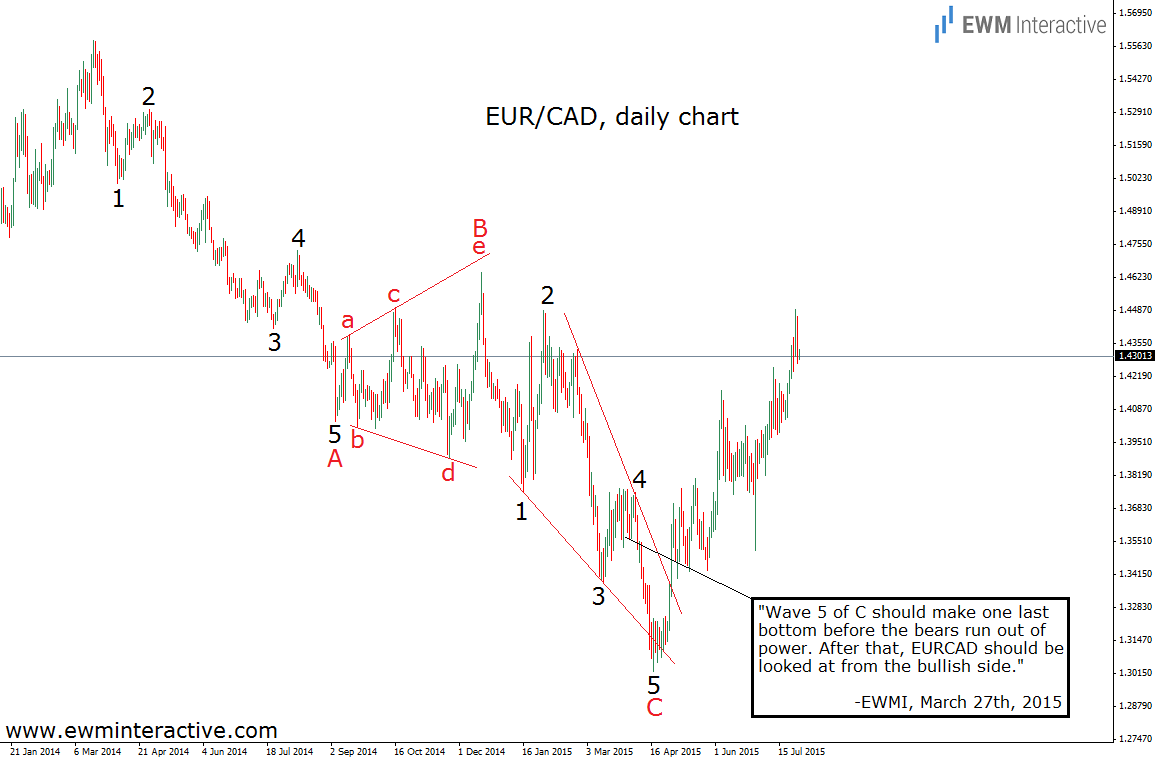

On July 29th we published “EUR/CAD And The Art Of Reversal Prediction” to demonstrate how the Elliott Wave Principle can help you forecast major reversals by looking only at one chart. EUR/CAD was trading slightly above 1.4300 at the time, but due to the fact that the whole decline from 1.56 to 1.3015 is corrective, we were still expecting it to be fully retraced. In other words, “the big picture target of 1.56 is still on the table.” The chart below shows how the situation looked back then.

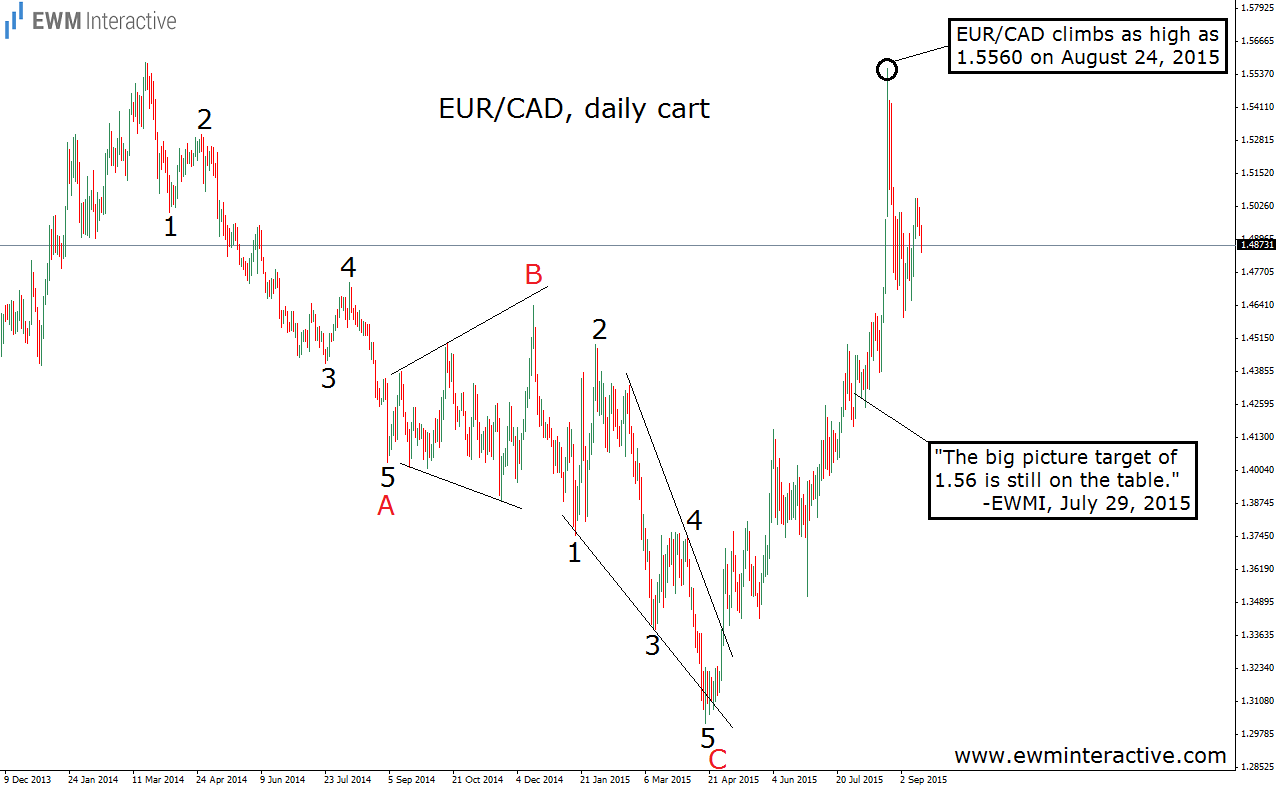

The trend was likely to continue higher, so there was no need to change our mind. Staying bullish was the best decision. And on August 24th, “Black Monday,” it paid off exceptionally well. EUR/CAD climbed as high as 1.5560.

The anticipated move of more than 2500 pips to the upside from 1.3015 to 1.5560 means we could count the forecast successful. However, soon after reaching 1.5560 the pair fell to 1.4595. So let’s take a closer look at this decline.

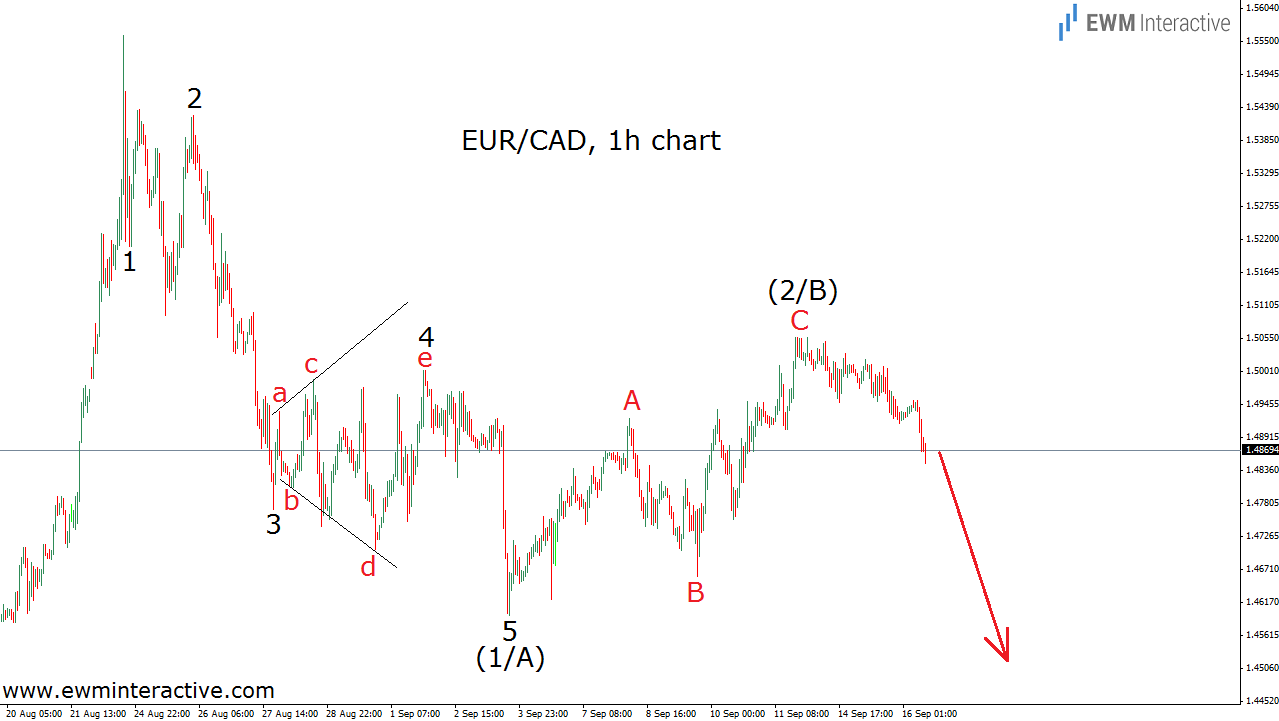

It appears EUR/CAD has formed a nice 5-3 wave cycle. A five-wave impulse to the south, followed by a three-wave recovery to the north, means we should expect more weakness in EUR/CAD. The exchange rate is likely to plunge below the 1.46 mark again.