I did not know what to write, but I knew I have to write. Yesterday in the account of December Governing Council meeting they noted that they are going to change their forward guidance. This signal was taken as “hawkish”, market reacted immediately and both EUR/USD and yield went up. EUR/USD rose from 1.1940 to 1.2050, more than 100 bsp, perhaps setting a new “base” level. Under “base” level I mean if the currency last couple of days moved around 1.1984, this is the 200 day exponential moving average, now this level also increased and might be something around 1.2030. In the bond market 2y-5y curve steepened while 5y-10y curve flattered. There is something in this 5 year tenor that I have been watching after ECB announced the change in asset purchasing program. When there is an upward shift in the curve 5Y can move more than other tenors whether this shift is related to some news about inflation expectations or changes in the market that should drive short-term yields upward. This is the reason why I mentioned in my “EUR papers: buy or sell in January” article it makes sense to keep duration at 5 taking long position in shorter and longer papers instead of buying 5 year papers.

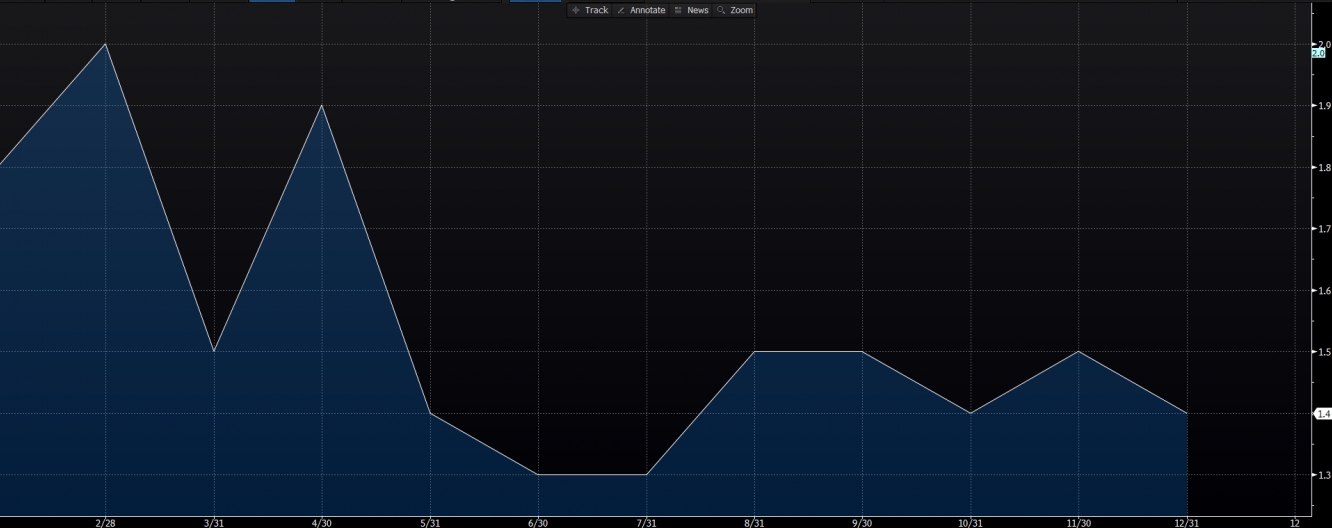

Chief economist Peter Praet noted that new decision is relevant to the quantitative easing guidance rather than rate guidance. Well does that make difference when both are connected? They say economy is performing well, but that is something we have been talking about for half a year or even may be more although the key aspect that should be taken into consideration in my opinion is inflation. The well performing economy still not translated into inflation. In the chart below we see that last year inflation fell from 2% to 1.4%.

Source: Bloomberg

And they noted “At the same time, while the significant absorption of economic slack was expected to ultimately generate the price pressures needed for inflation to move towards the Governing Council’s aim, this convergence was still subject to uncertainties surrounding, for example, the interpretation of the recent unexpected decline in measures of underlying inflation, the measurement of economic slack and the formation of inflation expectations after a prolonged period of low inflation. Importantly, convergence remained contingent on continued support provided by the full range of the ECB’s monetary policy measures currently in place”. So all the positive performance was due to the stimulus provided by the central bank and what does change in forward guidance mean? I think it mean no more after September 2018.

But what if they will not reach 2% target after the end of QE program? What are the odds of such an end? I think they are quite high taking into account that it will be difficult to get some inflation from the currency side. Will they hike rates? I think they will, but not immediately. Even after minutes we had yesterday I do not expect rate hike earlier that 2019. In my opinion market overreacted yesterday in the bond market. Looks like they only support well performing economy, ignoring the inflation, but if they are doing so why did not reacted same way during the last half a year? Perhaps because now we have one more player in the game. And the name of it is rate hike.

Economic Calendar

· China Trade Balance

· China Exports

· China Imports

· French CPI

· US CPI

· US Core CPI

· US Retail Sales

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI