The Dow Jones Industrial Average is often dismissed by professional traders and investors. It is either too old, too narrow or too top heavy to be important, or so the story goes. Sure it is only 30 stocks and all are very large cap. But it also packs a dividend yield of over 2.65% as of yesterday’s close. What do bonds yield again? Can it be cool to own something as old as Yoda?

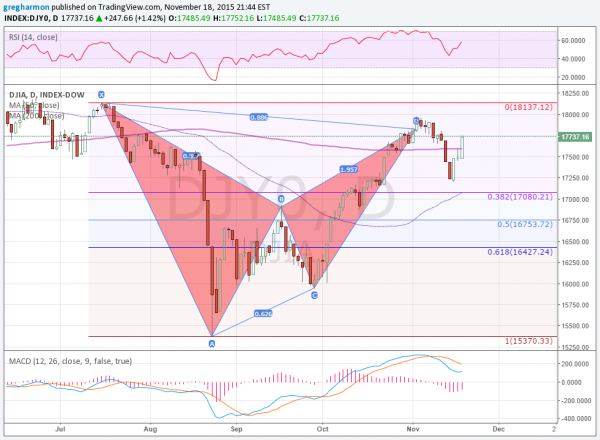

For those of you that are not happy with fat dividends, there is another reason to consider owning the Dow. It is going up. Take a look at the chart below. Clearly it had a good run from the September low to the peak in early November. But that pullback now seems to be over. Here is the evidence.

Friday last week things looked dire. The Dow was heading lower and closed the week with a bearish Marubozu candle. This is a signal for more downside. But following the crisis in France and an overnight meltdown Sunday, the Dow rebounded. And with vigor for such an old guy. With a bullish engulfing candle it signaled a possible reversal higher Monday.

The shooting star Tuesday made many think of a reversal back lower. But the actual result, a move higher, is a good reminder that stars are just indecision points and can move in either direction. The follow through higher Wednesday took the Dow back over the 200 day SMA.

It also showed that the move lower in the bearish Bat harmonic after attaining the PRZ stalled short of the 38.2% retracement. This is a sign of strength. Now moving higher it has support from the rising and bullish RSI and the MACD turning higher. The Measured Move higher would take it to 19200 or more. What are you waiting for? Listen to Yoda.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.