We’re in the midst of a new equity rally. The markets are at new highs...

In the first quarter, the S&P 500 reported revenue growth of 7.6%. This was the highest level since the fourth quarter of 2011.

On top of this, it marked the third consecutive quarter the index reported year-over-year revenue growth. And this hadn’t happened since the second through fourth quarters of 2014.

And unlike last time, this rally has nothing to do with politics. It’s because of fundamentals.

I say this because the sector leading the charge higher was the one forecast to be the most disrupted by the new administration... technology.

In 2015 and 2016, the S&P 500 was mired in an earnings recession. The collapsing price of crude - and the weight the energy sector has in the index - pulled down average corporate earnings. That hid the fact that many other sectors were still growing.

This is especially true in regard to technology.

The sector continues to report growth that outpaces that of the S&P. And it’s a reflection of the new digital economy.

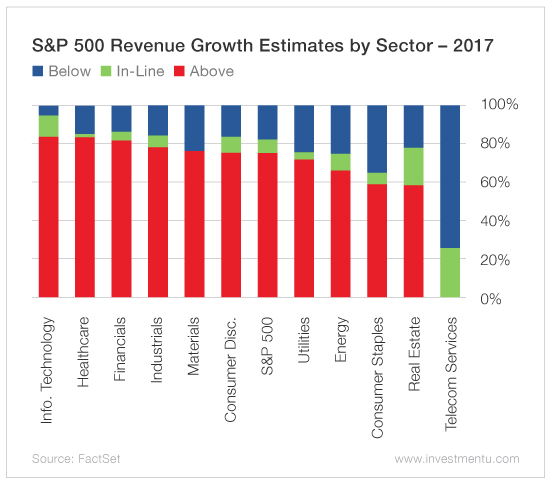

In the first quarter, 76% of tech companies beat Wall Street revenue expectations. Only industrials had more revenue beats. And 84% of all tech companies topped earnings expectations - leading all S&P sectors.

So it should be no surprise that when we look at the top movers in the S&P this year, the list is dominated by tech stocks...

- Lam Research (Nasdaq: NASDAQ:LRCX), up 56%

- Autodesk (Nasdaq: NASDAQ:ADSK), up 50%

- Skyworks Solutions (Nasdaq: SWKS), up 48.7%

- Qrovo (Nasdaq: QRVO), up 48%

- Intuitive Surgical (NASDAQ:ISRG) (Nasdaq: IRSG), up 46.6%.

And then we have Activision Blizzard (Nasdaq: NASDAQ:ATVI), which is up more than 65%.

Even the FANGs - Facebook (Nasdaq: NASDAQ:FB), Amazon (Nasdaq: NASDAQ:AMZN), Netflix (Nasdaq: NASDAQ:NFLX) and Alphabet (NASDAQ:GOOGL) (Nasdaq: GOOG) - are up more than 27% each in 2017. They’re once again outpacing the S&P 500 and the Nasdaq.

These are the pillars of the new economy - the digital world that’s enveloped us all.

Plus, Alphabet and Amazon are helping to bring artificial intelligence out of the pages of science fiction and into the real world.

If we look at the Russell 2000 - the small cap index - the technology gains are even more pronounced... Applied Optoelectronics (Nasdaq: AAOI) is up 212%, and the telecom bidding war over Straight Path Communications (NYSE: STRP) drove those shares up more than 434%!

Again, these are year-to-date share price gains.

There is still no sector that offers as much upside and as much exciting innovation as technology.

We have augmented reality and virtual reality (AR/VR) entering the marketplace. Last year, consumers spent $41 billion on mobile games. And Pokémon Go stole headlines as it brought AR into the mainstream consciousness.

We all know about autonomous vehicles... These are already in use in the mining industry, led by Komatsu Ltd (OTC:KMTUY) and Caterpillar (NYSE: NYSE:CAT).

There’s the growing web of the Internet of Things... commercial space industries... and the rise of the robots.

The tech sector is fueling this rally. And it’s helping all the other sectors become more efficient. The pundits said that Trump would be bad news for tech... But, as so often is the case, they’ve been proven wrong. And it’s the tech sector driving markets to new all-time highs... because you can’t ignore exceptional growth.