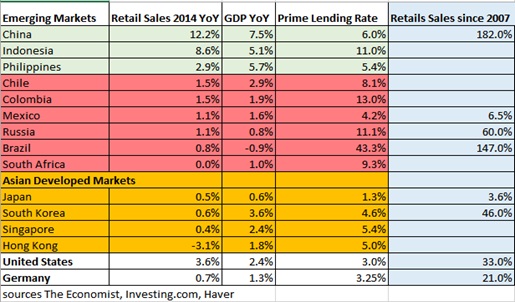

The world economy has reached a stage of very slow growth: Apart from the now more consumption-driven China, retail sales and spending rises very slowly in Europe and in the previously so strongly expanding Emerging Markets (EM). As usual the dollar is the winner of this phase.

Let’s have a closer look the reasons of the stronger dollar on the supply side:

There are some slight and often overestimated effects from the U.S. shale industry. But Fed’s year-long dollar bashing has achieved a nice effect: With the weaker dollar, American labor is relatively cheap on a global scale – or better it was until the dollar appreciated. On the other side American companies benefited from the dollar’s reserve currency status and had less problems obtaining credit. Still, many companies preferred to invest and to create labor abroad and to globalize their supply chains. While in the U.S. those were mostly the bigger companies in the S&P 500, in Germany or Switzerland even medium enterprises followed that strategy. Logically the S&P 500 clearly outperformed smaller U.S. companies; the small business confidence is far under the values seen before 2008.

Reasons on the demand side are

1) With higher inflation caused by the breakdown of their currencies in June 2013, EM central banks responded with higher interest rates. People in many EM, in particular in the “fragile five”, decided to save and not to spend. Europeans are still driven by austerity and the desire to save for the coming retirement age instead of relying on perceived “near-bankrupt governments and social systems”. This depressed spending and investments in these countries and consequently oil and commodity prices.

2) The dollar is inversely related to oil prices: Due to lower fuel taxes and higher distances, gasoline takes a significantly higher part in the US consumption basket than in the European one. Lower gas prices, however, help to spend on things that are no so essential like for example the typical American car that consumes more fuel than European ones.

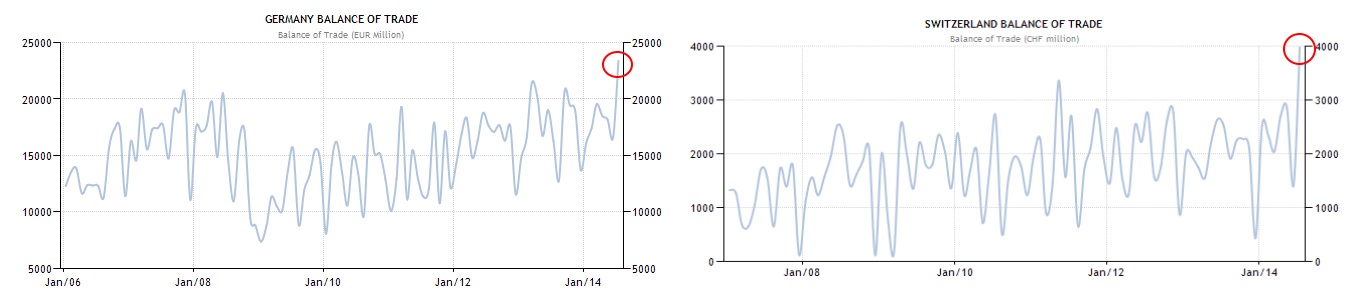

Lower oil prices and Draghi’s “Euro-Abenomics” policy, namely the artificial talk-down of its currency when deflation was at sight, has finally triggered a period of a stronger dollar. The first effect of a weaker euro and higher prices for imported goods is that the ones that are ought to spend, namely Germans, are not doing so. Instead Germans and the closely related Swiss obtained record high trade surpluses, mostly caused by lower Brent Oil prices, machinery exports to the US and non-euro countries and the reluctance to invest and to spend locally.

The Chinese, however, also decided to keep a strong trade surplus. Therefore they invested less than previously in capital goods and slowed the imports of machines from Germany. The Ukraine crisis additionally depressed German sentiment.

Given the weak interconnectedness of the American economy – for example only 5% of exports go into EM – the status quo of global austerity could lead to a new period of American irrational exuberance like during previous global austerity phases, e.g. in 1999 when the euro introduction and the 1998 Asia crisis required strong austerity.

The irrational exuberance is already visible in economic indicators like the manufacturing ISM: it might be driven by the American car industry and lower gasoline prices. In Q2/2014 firms were ready to reduce unemployment further and to pay a total wage increase of 7.5% annualized in Q1 and 5.8% in Q2. Apart from the high-income earners and stock owners, the irrational exuberance has not arrived yet at the “normal American” and the small businesses mentioned above. Effectively Americans have increased their savings rate from 0.4% in 2007 to 5.7% recently and are still trying to pay down debt. The median wealth of Americans is one of the lowest of OECD countries. If they spent it could rapidly translate into higher U.S. current account deficits and new inflows into EM and stronger spending there.

Hence the irrational exuberance – visible in extremely stretched and rising CFTC positions against the euro – is an indicator of global weakness but not of American strength. It is only an imagination of investors and FX traders, that try to imitate history, namely the 1999/2000 phase. The problem with that thinking is that a technology idol like the “New Economy” is missing. Moreover, this time the Fed will not follow with strong interest rate hikes. Inflation and the recent 2% nominal increase in U.S. wages are mostly driven by asset price inflation, e.g. the 2.9% increase in rents. Instead the stronger dollar, weak global demand and the desire of ordinary Americans to pay down debt will reduce inflation considerably.

As already visible in the latest jobs report – the reality is different than the ISM suggests. S&P 500 companies may use the stronger dollar to invest and create jobs abroad. The ECB, however, might obtain her wishes. The weak euro and higher imported inflation in Germany may effectively lead to higher German wage demands – after Buba president Weidmann raised the 3% wage hike cause. Recently strikes stopped both German air and train traffic and indicated labor shortages in Germany. Due to wage downwards stickiness, France and Italy were not able to re-adjust their 20% relative wage increase since 1999 compared to Germany, which resulted in higher unemployment. The ECB’s calculus is obvious: The weak euro will make European labor cheaper and do the necessary adjustments: Higher German wages and spending and the reduction of unemployment in the rest of Europe.

Attention however, that any sign of higher German wages and inflation might quickly translate into a collapse of the CFTC speculators’ position and a rapid rise of the euro exchange rate. We continue to bet on low global inflation and are therefore bullish on Southern Europe, in particular on Italy (iShares MSCI Italy Capped Fund (ARCA:EWI)) and Greece (Global X FTSE Greece 20 (NYSE:GREK)) where current accounts and LTRO-induced profits of banks continue rising. Improvements of the European stock markets will be able to overlay the euro weakness. Moreover we bet on euro-denominated debt like Eurobonds issued by Emerging Markets