Three developments drove the dollar last week. The eurozone bond market sell-off exhausted itself with the help of softer than expected German industrial orders and an outright decline in industrial output. The US jobs data bolstered arguments that what now looks like a contraction in Q1 is not a representative of the state of the economy. The unexpected Tory victory in the UK lifted sterling to its best level since the end of February.

The potential double bottom in the euro in the $1.0450-$1.0500 remains intact. It projects toward $1.1600-$1.1650. We had thought that the May 1 high, near $1.13, was a reasonable approximation. The euro rose by another cent this week at its best, but the upside momentum eased. The euro closed above its 100-day moving average for the first time in a year over the course of two consecutive sessions (May 6-7), but failed to do so on a weekly basis. The euro's technical condition has not changed very much. The RSI has turned down after peaking at mid-week, but the MACDs have yet to turn. Initial support is seen in the $1.1160 area, but until the $1.1050 area goes, it is hard now to say the downtrend has resumed.

The technical condition of the dollar-yen pair has not changed either. The greenback was confined to a JPY119.00-JPY120.50 range. Volatility continues to get sucked out of the market. The benchmark three-month implied volatility is slipping through 8.4%. It has not been below 8% since the BOJ's surprise. In the November-January period, it has pushed through the 12% level briefly.

It is difficult to get enthusiastic about the yen. The higher US interest rates and even the strong gain in the US equity market failed to lift the dollar much against the yen. The dollar has yet to close above the downtrend line we identified off the March 10 high (~JPY122), the April 13 high (~JPY12085) and the May 1 high (~JPY120.30). The trend line comes near JPY119.90 on May 11, falling to JPY119.70 by the end of the week.

The stunning UK Conservative victory lifted sterling by around three cents to nearly $1.5525. This is near the year's peaks ($1.5590 in January and $1.5550 in February). It also corresponds to the top of the Bollinger® Band. The RSI and MACDs remain constructive. The $1.5570 area also corresponds to the a 38.2% retracement of sterling's decline from last July's peak near $1.7200. The 50% retracement is found near $1.5880.

The 200-day moving average is closer at $1.5635. Going forward, we suspect sterling will be less about UK politics and more about the dollar's general tone. We would expect sterling to fare better against the euro than the dollar. Look for the euro to test the seven-year low seen in March near GBP0.7000.

The Australian dollar has benefited from a shift in interest rate expectations. If the RBA is going to ease again, it won't be until much later this year. New Zealand appears to be moving in the opposite direction. This divergence can see the Australian dollar gain against the kiwi after approaching parity earlier. Against the dollar, the technical indicators are mixed. It seems to be in a one-cent range on either side of $0.7900. A breakout to the downside could see $0.7600. Besides causing the central bank some displeasure, a move above $0.8000 would target $0.8200.

The US dollar also appears to be consolidating in a range against the Canadian dollar. The Canadian dollar did not rally as much as one might have expected given that it created nearly 47k new full-time positions in March, which would be roughly the equivalent of the US adding 470k jobs. It grew a little less than half of that. The dollar's range is approximately CAD1.20 to CAD1.22. The technical condition is similar to the Australian dollar. The next significant move seems to be for a stronger US dollar, but it is not clear that an important low is in place.

June light sweet crude oil futures peak in the middle of last week near $62.60. It subsequently backed off to make new lows for the week before the weekend, near $58.15. The 20-day moving average is just below $57.90, and the contracts have not closed below that average since the very end of March. Additional support is seen in the $55.5-6 area. Technical indicators suggest the advance is getting stretched but has not necessarily peaked. On the upside, there is a band of resistance in the $65-$66 zone. Potential may extend toward $70 from a technical perspective.

US 10-Year Treasury yields rose sharply in the first part of the week as the European rout continued. However, selling exhausted itself when the 10-Year bund yield approached 80 bp and the comparable yield was 2.30%. From there the US 10-year yield fell almost 20 bp. The market extended the move even after the employment data which saw the unemployment rate tick down to a new cyclical low of 5.4%. The 2.10% yield may draw some selling interest, but the more important issue is whether the move above 2.0% will be sustained.

The 10-year bund appears to have posted a hammer candlestick pattern on May 7. The yield peaked just shy of 78 bp and fell to 52.5 bp before it settled a little below 55 bp for the week. That is still an 18 bp increase over the five sessions (compared with two basis points for the US). The contours of the pullback in yields will determine whether the rate adjustment is over. There are three yield levels to watch. A break of 50 bp points to a deeper correction that may be between 9 and 17 bp.

The S&P 500 rally before the weekend managed to turn the week's performance from a small decline to a small advance. For the first time this year, it posted three successive closes below the 20-day moving average. The pre-weekend rally pushed the index to near 2120, where the market turned cautious. Yellen warned that the valuations were elevated, but the near-term technical outlook looks constructive. The earnings season is just about over and it appears that corporate income growth eked out a small gain compared to a 5.8% decline forecast at the start of the earnings season.

If the dollar's strength in Q1 was a headwind, then it has lessened so far in Q2, where it has fallen against all the major currencies. It has fallen against most emerging market currencies as well, with the notable exception of the Turkish lira, Indian rupee, Thai baht andIndonesian rupiah. The Chinese yuan is off 0.15% so far this quarter.

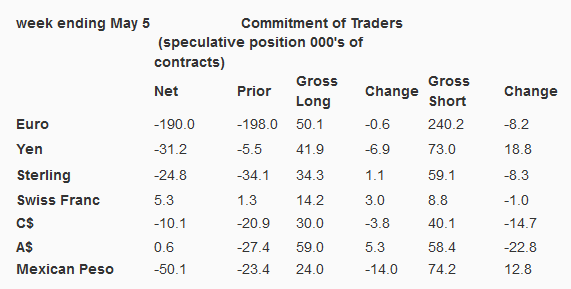

Observations from the speculative positioning in the futures market:

1. There were several significant (more than 10k contacts) adjustment of speculative positioning the CFTC reporting week ending May 5. First, the gross short yen position jumped by 18.8k contracts to 73k. In percentage terms, it was the largest rise in two years. Second, the gross short Canadian dollar position was chopped by 14.7k contracts, leaving 40.1k. In percentage terms, it was the largest in three years. Third, 22.8k gross short Australian dollar contracts were covered. In percentage terms, this was also the largest reduction in three years. The short covering plus a small increase in gross longs (5.3k) was sufficient to swing the net speculative position to the long side for the since last September. In mid-March, the net short position was almost 77k contracts.

2. Both gross long and gross short Mexican peso positions were adjusted by more than 10k contracts. The gross longs were cut by a third (14k contracts) to 24k. This was the largest cut of longs in percentage terms in three years. The gross short position grew 12.8k contracts to 74.2K.

3. Gross short positions were mostly reduced, with the yen and peso the exceptions. Gross long position adjustments, outside of the peso, were modest. Gross longs were reduced in four of the seven currency futures positions we track.

4. The net short 10-year Treasury futures almost doubled to 183k contracts (from 98.6k). The gross longs were cut by 54.1k contracts to 309.5k. The gross short position rose 30.4k to 492.6k contracts.

5. The net long light crude oil futures positioned edged higher by 10.9k contracts to 530.8k. This mostly reflected the 9.1k contract increase in the gross long position. The gross short position slipped 1.8k contracts to 205.1k.