It’s been a fairly soggy end to the Asia trading week, with a triple-threat of negative news flow hitting a market that was showing signs that the bulls may be exerting better dominance into year-end.

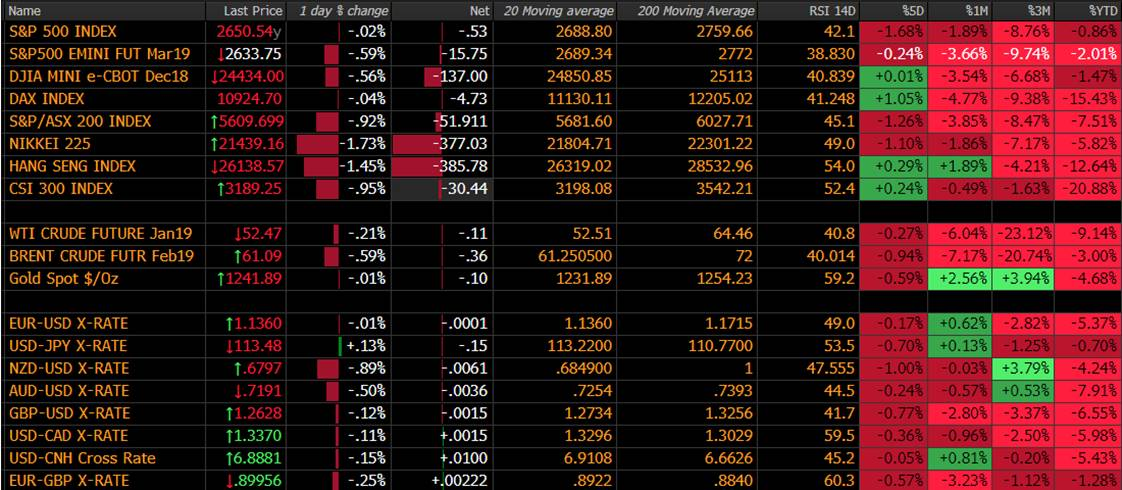

Firstly, an NBC article that Donald Trump was present with Michael Cohen (Trump’s lawyer at the time) and David Pecker (National Enquirer Publisher) during the hush money payments has been one clear consideration. We can also add a poor outlook from large Japanese manufacturers (in the Q4 TANKAN report), as well as weak Chinese data hitting equities hardest. Certainly, Japan has fared the worst, taking S&P 500 and DAX futures down 0.6% and 0.7% respectively, and we should see a weaker open for European equities in the hours ahead.

The GBP has found sellers, and the interesting aspect from a technical perceptive is the test and subsequent failure to reclaim the August lows at 1.2670, and GBP/USD is threatening to head back to 1.2600. It feels as though GBP/USD feels like it will chop around through to the new year, and with this morning’s EU Summit providing no real inspiration and detailing what everyone had expected anyhow. That being, that the EU is giving Theresa May absolutely nothing, and at best an assurance that they will come to an ‘aspirational’ end-date for the backstop. The market cares little for any assurance unless they are legally binding, and that just isn’t happening.

So, until the timeline around the backstop has legal standing, we know this deal will not pass, and the idea that the EU has created a situation whereby the UK face either a hard Brexit or pull Article 50 and remain in the EU, perhaps after a second referendum looks compelling. The other option is we see a softer stance and May pushing for a Norway model and joining the EFTA and EEA – this would require a huge change of heart of May though and retains free movement of people.

As we discuss in the video, a key focus next week falls on China’s Central Economic Work Conference, which is expected to play out from Wednesday through to Friday. Local media detail the key thematic of the conference aims to address stabilising the currency, easing credit and looser fiscal policy. I am sure we will hear some very selective commentary, and it will be aimed at addressing all the concerns the market has, so it’s hard to see this being negative to any great degree. However, there are ongoing concerns around the Chinese economy in 2019, and this meeting could address many of those aspects.

The markets core focus though falls on the December FOMC meeting (Thursday at 06:00aedt), followed by Fed Chair Powell’s Q&A session 30 minutes after. I detail a few factors to focus on in the video, including whether we see a tweak in their forward guidance and a change in the Dots plots projection. One also expects Powell to be probed on the neutral rate, and where this likely resides given the recent tightening of financial conditions. I can’t see this meet being wholly USD positive, despite my firm belief that they will hike at this meeting, but, when we consider the current subdued market pricing on rate hikes for 2019, it’s tough to make a case that there are substantial downside risks for the USD. If we look at the options market the implied move over the week is 79-points for USDJPY and 105-points in EURUSD. Hardly a market positioned for fireworks.

I also address the key European data, which gets extra credence given last night’s ECB meeting, where Draghi detailed the momentum in the data has been to the downside. That won't shock, but if EU data doesn’t improve soon, then economists will thoroughly question whether the notion that the soft patch is transitory is correct and we could be looking at something more sinister and protracted.

Clearly, EUR shorts will cover should the data show better signs of improvement, as this will validate the bank's glass-half-full approach.