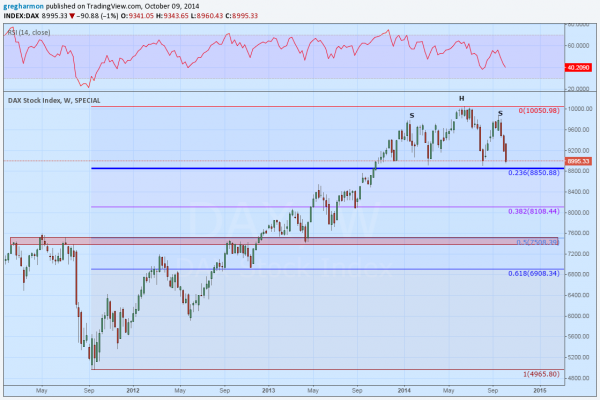

The German DAX has a lot of short-term badness piling up against it. The chart below shows the daily price action since the major low in September 2011. The run up to 10050 and subsequent consolidation above 9000 now seems at risk as it sits at a critical level. This is happening just above the 23.6% retracement of that move higher at 8850 and the tails of the prior lows have nearly touch that level. As I write it is cracking the barrier. The third time here, it is now making a bearish Head and Shoulders Top. If it breaks down below the neckline it would target a move to at least 7750. The RSI, a momentum indicator, is also right at an important level at 40. A move below that turns it bearish. 7750 is not that far from the break out range that drove it higher. Perhaps a retest? Not if Angela can help it.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.