Black clouds are forming over the U.S economy as consumer confidence suffers its biggest blow in over four years. The release of the latest CB Consumer Confidence figures underscore the fragility of the purported economic recovery, as the key index fell from 100 to 90.9. The property market was also not immune from the rout as New Home Sales fell from 546k to 482k m/m.

The decline in consumer sentiment has arrived at a point when the U.S Federal Reserve is considering a tighter monetary policy. Subsequently, many are starting to question whether the U.S economy is, in fact, starting to slow along with the current global growth expectations.

It has been suggested by some analysts that the slump in consumer confidence is indicative of the global equity turmoil. However, consumers form their economic expectations over a period of time and it therefore typically lags current events.

Consumer sentiment actually mirrors much of what has been seen in July’s Retail Sales figures which came in significantly below forecasts at -0.3%. It is clear, that for whatever reason, consumers are paring back on their retail spending whilst also altering their overall expectations.

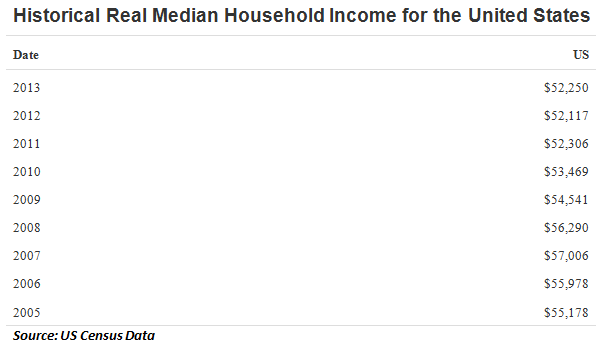

This decline in spending is also in-line with the current trend in US Real Incomes which have fallen in contrast to nominal incomes. According to the last US Census figures, the US Real Median Household Income was $52,250, which is a 3 year change of -2.28%. Despite significant nominal increases, real incomes have continued to come under pressure despite the strengthening labour force data.

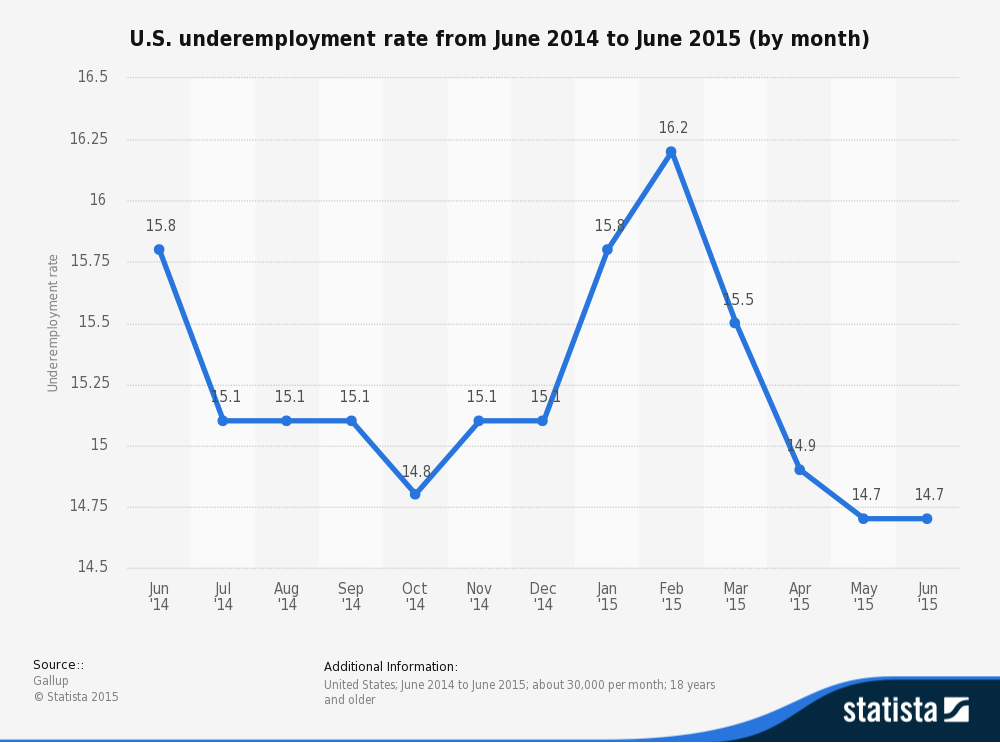

The reason for this is that much of the employment growth that has been seen has been of a part-time service nature. Subsequently, these types of jobs lead to underemployment and do nothing to provide for any buoyancy in household income. Despite the current U.S unemployment rate recently declining to 5.3% the real figures to consider are indeed the under-employment rate.

The U.S under-employment rate was compiled to June 2015, by a formal Gallup survey of a randomized selection of workers. The result was illuminating in that it showed over 14.7% of workers surveyed as desiring more work. The result, although not absolute, likely fuels the case for a significant component of the increase in employment being based around part time work.

Ultimately, in a service driven economy, consumer confidence and expectations feed into a critical part of domestic demand. Any slow-down in domestic demand, driven by lack of growth in real incomes and a transition to more flexible part time working arrangements, is likely to damage retail spending significantly.

Subsequently, there will be no sustained inflation, or strong economic recovery within the U.S, without a robust labour market to ultimately back it up.