The Federal Open Markets Committee (FOMC) is due to meet later on today for a two day meeting on the state of the economy and to set monetary policy. They are widely expected to raise interest rates in September, but does the data really support a rate rise? Is there another reason the Fed wants to raise rates?

A rate rise at the meeting today would be a major shock and send the US dollar soaring. The likelihood of this is just 2% according to the market. The Fed themselves have not hinted at a July rate rise at all, instead some members have said the chance of a September lift off for rates is slightly better than 50/50.

So what will the Fed say at this meeting and will they hint towards a rate rise in September? In previous statements, Fed chair Janet Yellen has said she wants to see further improvement in the labour market before she raises rates. The labour market has improved over the last three months, with unemployment claims hitting a record low of 255k last week. The unemployment rate has improved to 5.3% which is the lowest since May 2008. It is still off the low of 4.4% hit in April 2007, but it will certainly be a focal point for Yellen.

Inflation is another metric the Fed will look at before they raise interest rates. Unfortunately for the Fed, if they took inflation alone, they would not be raising interest rates this year. Inflation is lower now than it was in 2012. Core CPI for June came in at just 1.8% year on year with headline CPI the real disappointment at just 0.1% y/y. Energy commodities have taken another dive over the course of July, so we are likely to see that headline figure plunge into negatives. Interest rates are used as a tool to control inflation, and most central banks would be cutting when inflation is in the negatives. This indicator certainly does not support a rate rise.

Looking at other indicators and the picture does not become any clearer for the Fed. Retail sales have been mixed with a dive from 1.0% in May to -0.3% in June. Real GDP growth fell to -0.2% (annualised) in Q1 2015 which is disappointing at best. Consumer sentiment and Durable goods orders have shown improvement over the course of 2015, but they merely balance out the poor data.

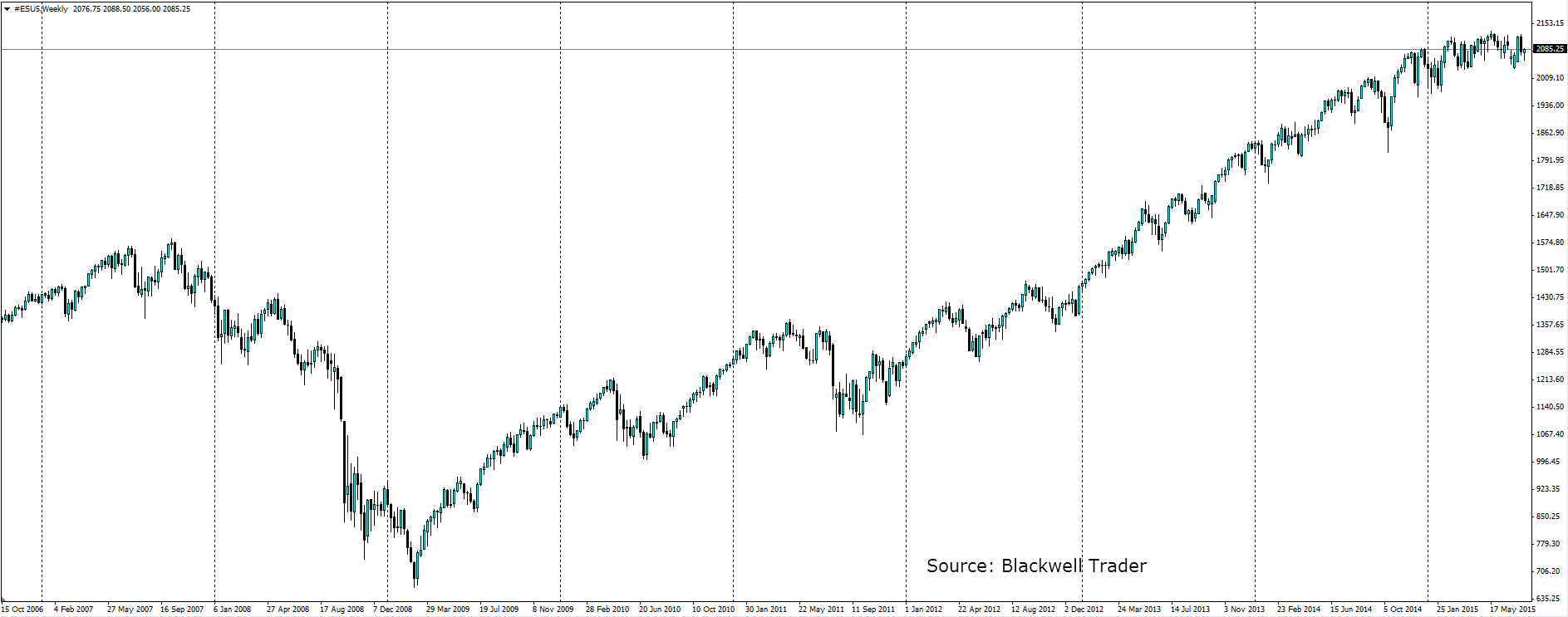

I believe the real reason the Fed are keen to hike rates is to deflate the equity bubble. The S&P 500 is hitting all-time highs on a regular basis and has had only minor corrections since the rally began. Since the depths of the crash in 2009, the S&P is up 180%. Currently it is 40% higher than the peak in 2007, again without any substantial pullbacks. The easy money the Fed has been pumping into the markets, in the form of QE and near zero interest rates has led to the bubble in equities. It is getting to the point where they have to deflate it now, because if they do not and it deflates thanks to a recession, they will not have any room to cut interest rates.

The data is a little mixed and is not significantly better than it was in 2011-2012, apart from the labour market. The Fed has an issue on their hands that needs to be addressed and that is the equity bubble. Raising rates in September will begin to deflate the bubble and give the Fed wiggle room if the economy turned pear-shaped and required a round of interest rate cuts to stabilise it.