Market Drivers & Fundamentals

- Fed delivers a well-telegraphed 25bp hike but lowers rate increase expectations for 2019-2021 via the dots diagram by an average of 25bp.

- The Fed continues to highlight that “some gradual increases” in rates may be required, which implies not closing the doors to more hikes, even if the pace slower from here on out.

- US equities, with lower Put premiums priced ahead of the FOMC in expectations of a more dovish Fed, take another plunge as the outcome does not provide an immediate circuit breaker.

- The Fed lowers its 2018/2019 GDP forecast, leaves inflation unchanged. Reasserts its stance that the Central Bank will be as data-dependent as it gets given uncertainty in 2019.

- The UK inflation came flat at 2.3% ahead of today’s BoE, which is expected to be a non-event, until the Brexit impasse can be addressed next year.

- The Canadian inflation data undershot consensus. Even if marginally, enough to rule out the possibilities of any BoC rate hike in January.

- The BoJ leaves its policy rate unchanged as widely expected by the market.

- The NZ GDP for Q3 disappointed by coming way below expectations at 0.3% vs 0.6% expected, causing banks such as ANZ to revert back to calls of rate cuts by the RBNZ in Q3 2019.

- The Australian jobs report came higher than expected, almost doubling estimates, but behind the headline number the full-time/part-time split and jobless rate cast a shadow.

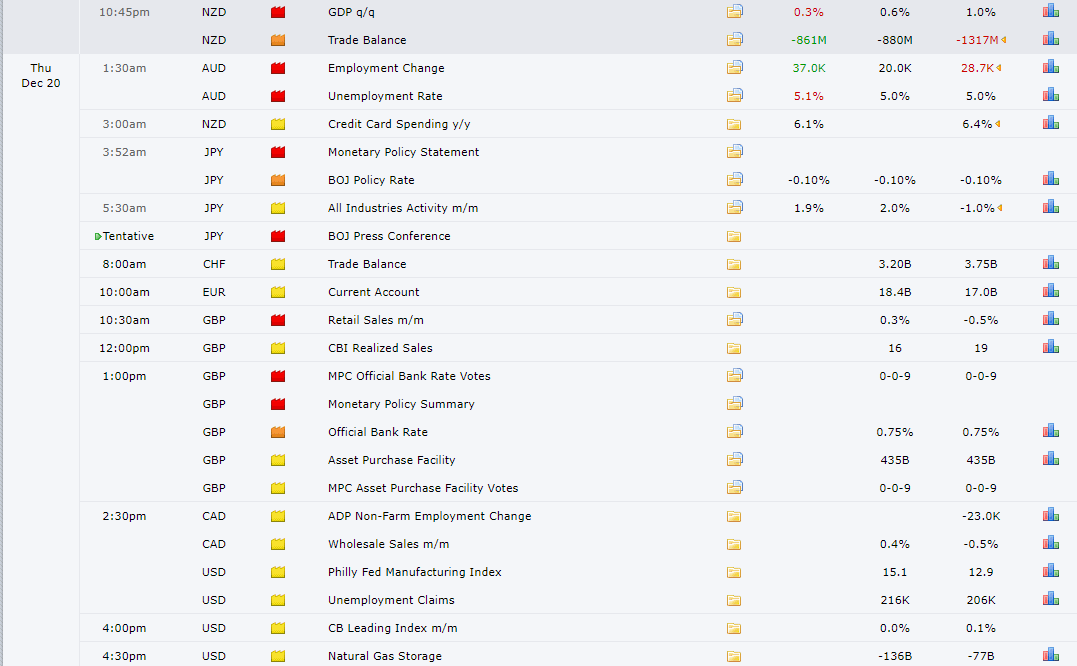

Events Ahead

The Bank of England (BoE) is in no rush to make any changes in policy and it is set to keep the Bank Rate unchanged. Besides, the meeting is not attracting a whole lot of attention as it’s an interim one not followed by an Inflation Report, therefore we should not expect any new developments of interest. The BoE is in a wait-and-see, but not precisely on data-dependency as the ECB or the FED, but rather they’ve been taken partly hostage until Brexit clears up.

Risk Model

Risk continues to be punished severely after the risk-weighted index lost another 3% on the aftermath of the less dovish rate hike by the Federal Reserve. The combination of a trounced S&P 500, along with the hammering of US bond yields to a new cycle low of 2.78% was the perfect risk-off storm.

Access the chart via Tradingview

By looking at the anatomy of Wed’s sell-off in the S&P 500, we saw renewed sell-side commitment on increasing volume, way above the 20-day MA. The price action also screams more trouble ahead, with the selling only finding a temporary base on the touch of the 2,500 major psychological number. The free-fall in the junk bond market (iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG)) shows no end in sight, while a hefty VIX above 25.00 is very troublesome. To make matters even worse, the US yield curve dropped mercilessly, with the 10y-2y at 0.11bp, while the Fed’s fav measure 10y-3m is at 0.43bp

The outlook for the 10-yr US bond has also worsened, even if one must be extremely vigilant as the yield, currently at 2.78%, just landed into what signifies a major support area. The violent move, with an increase in volume heading into the level, does suggest that the downside pressure may persist. Meanwhile, the US Dollar continues to be boxed in within a rising wedge on the daily. Until the pattern finds a resolution either way, movements in equities and yields will be far more important to determine the state of affairs when it comes to the risk profile.

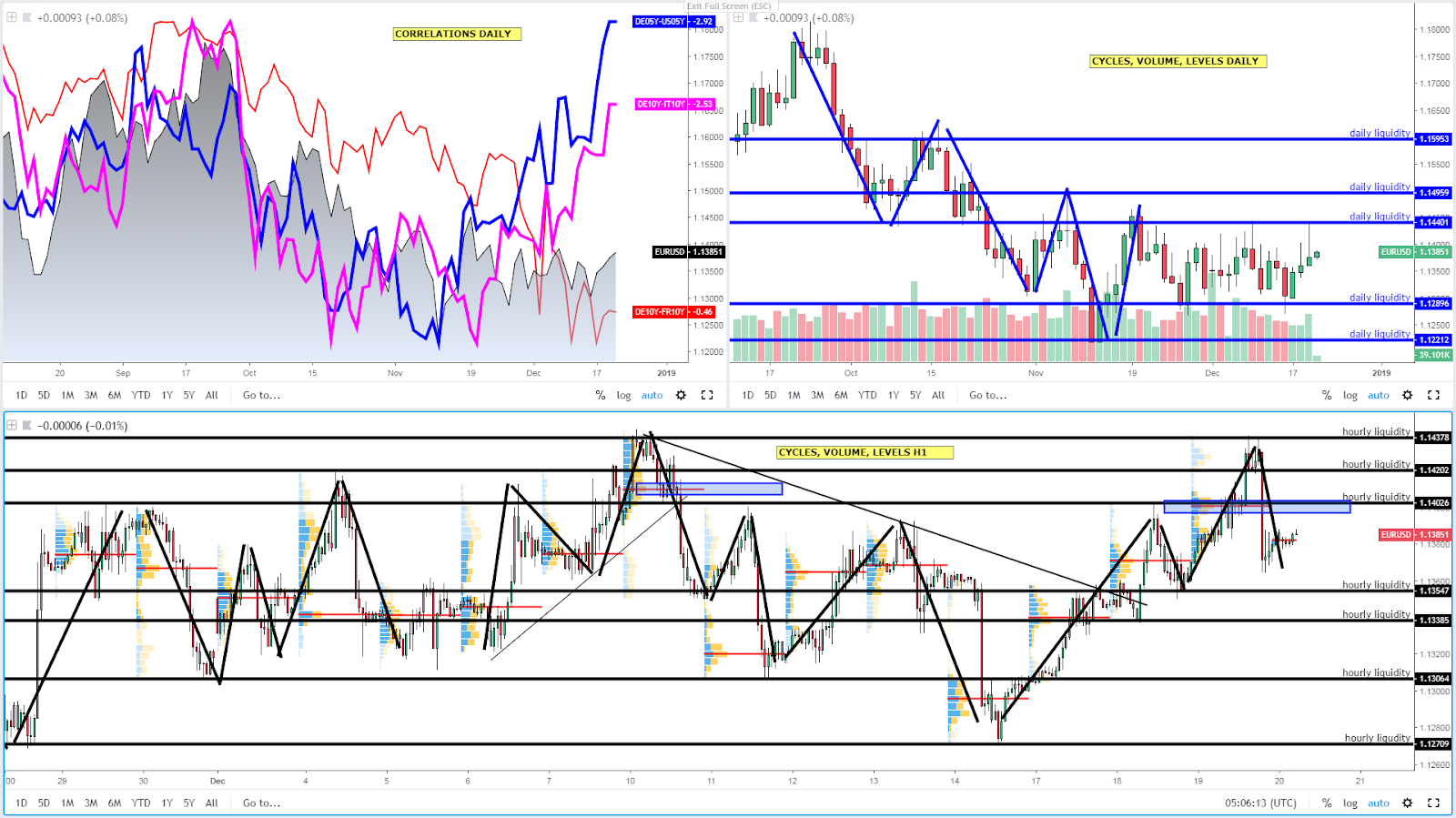

Forex Majors EUR/USD — Supply Imbalances Topside Still Dominant

Access the chart via Tradingview

The bullish tendencies in the pricing of the pair came to an abrupt halt at the key 1.1435–40 resistance after the Federal Reserve delivered a less dovish rate hike, leading to a major removal of downside liquidity immediately after the event. The daily chart still provides an unambiguous bullish macro backdrop, even if the back-to-back daily topside rejections, accompanied by the intraday impulsive move down clouds the outlook for the pair short-term.

I must say that we are experiencing an unprecedented and very prolonged compression in this pair. Be prepared for volatility to pick up substantially on a breakout. For now, imp vols via options do suggest gamma scalping at the edges of the broad range should continue to ensure familiar levels.

Let’s be clear. Sellers have gained ground, but structurally wise, the battle is not yet lost by buyers, as the cycle of higher highs and higher lows is still intact. The sell-side flows managed to absorb Tuesday’s POC, but residual demand at 1.1350–55 still needs to be cleared before the structure turns bearish on the hourly time frame. On the upside, the clustering of offers around 1.14 (POC Wed) must contain further appreciations or else 1.1420 (origin supply imbalance post-Fed) is next up, in which case, the risk of an upside breakout would be a realistic outcome to expect.

GBP/USD — At A Key Juncture, Buyers Must Show Up

Access the chart via Tradingview

We continue to see the contrast of opposing forces. On one hand, the yield spread valuation does scream to buy this market as the widening continues. However, the moment we stare at the daily price action, it’s almost the dreamed setups to engage in further selling following two pin bar rejections off 1.2680–1.27, an area that I’ve consistently highlighted as a major cluster of offers where trend traders may be looking to engage with impetus on the back of the weekly close sub 1.27.

On the hourly, the bullish structure is the Pound has been semi-compromised by the transition into ranging conditions. If the cluster of bids fails to absorb the increasing sell-side pressure post the FOMC, the Sterling risks a renewed directional bias to the downside. The exchange rate is resting at a critical intersection, represented by a horizontal line + 3rd touch of an ascending trendline. Failure to break lower sees room for a recovery until 1.2670 ahead of 1.27, while the clearance of 1.26–2610 bids triggers the initiation of a new cycle low towards 1.2580 as the next horizontal target.

USD/JPY — Selling On Strength Favored As Risk Deteriorates

Access the chart via Tradingview

Once again, the pair saw a vigorous rejection away from a key area of support circa 112.20–30. The correlations continue to provide clear selling signals as both the risk profile and the US vs JP yield spread keep deteriorating dramatically, suggesting a fair value of sub 110.00 in USD/JPY.

The absorption out of the daily chart is notable, but with sellers still drawing the line in the sand at the topside of the hourly range around 112.60, they remain the clear side in control. Selling on strength at key liquidity areas continues to be a strategy that should keep sellers ‘on the money’ as long as the divergence in valuations remain as clear as they are. If the follow-through doesn’t abate, 112.00 and 111.80 are the next objectives to aim for by sellers. Overall, the market still remains in gamma scalping mode judging by the impl vs hist vols, so be aware of fading moves at the edges.

AUD/USD — Aiming To Retest Yearly Lows

Access the chart via Tradingview

We were well tipped way in advance, via the increase in Put premiums ahead of the FOMC, that interest to engage in topside sell-side action on the Aussie was on the rise. The daily shows a sizeable bearish price action, with the breakout of the key 7160 now a reality. The spurs of risk-off have dramatically compromised the outlook for the Aussie, as equities sell-off with earnest.

Drilling down into the hourly chart, the 100% fib projection target comes at 0.7192, a level that also aligns with the POC from the October balance area. If the momentum extends, the next key area to be targeted would be the year lows at 0.7150–0.7130, where support should be found, as it also aligns with the 100% projection target from the 7380–7220 breakout measure.

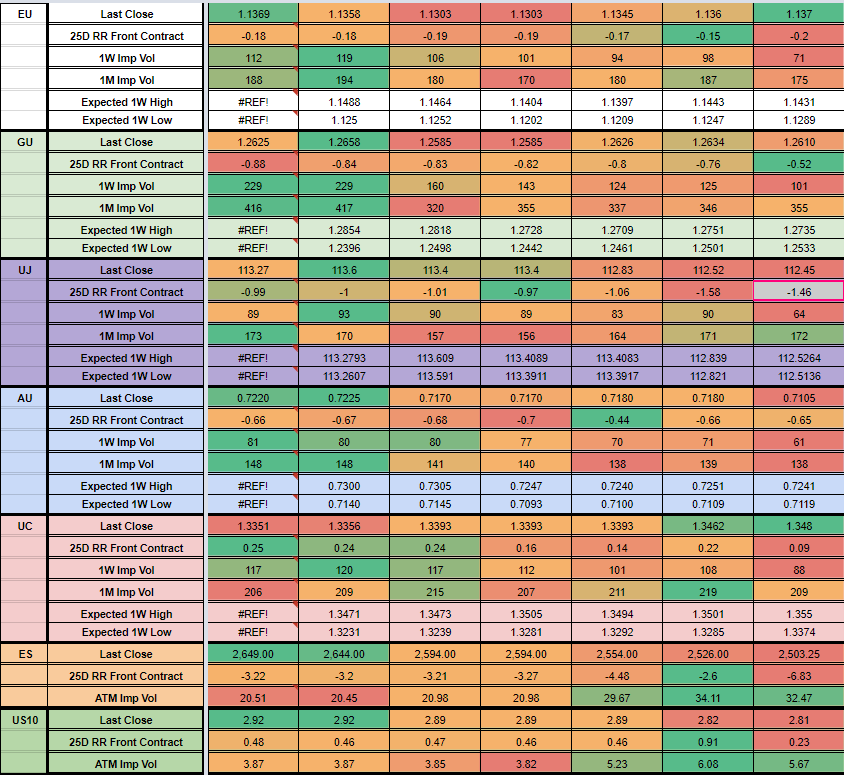

Options — 25 Delta RR & Vols

From today’s 25 delta risk reversals, we can observe the gradual reversion towards pricing Puts in the E6 contract more expensive than on the lead up to the FOMC, suggesting that the options perceive higher risks of the pair being offered after the supply imbalance see post the FOMC. Interestingly, the Sterling is not as bearish heading into the BoE, with the Puts premium reduced. The pricing of Puts in the Canadian Dollar has also come lower, in expectations of a potential pullback after the overextension in the charts. Not the case of the Aussie, with Puts priced at the same levels, which is never a positive sign. The most notable change in option premiums can be found in the ES contract, with the pricing of Puts going through the roof vs Calls, indicating the high degree of fear that exists. Lastly, we’ve seen a surprising reduction in the Call premium in the ZN contract (10-yr US bond).

* The 25-delta risk reversal is the result of calculating the vol of the 25 delta call and discount the vol of the 25 delta put. … A positive risk reversal (calls vol greater than puts) implies a ‘positively’ skewed distribution, in other words, an underperformance of longs via spot. The analysis of the 25-delta risk reversals, when combined with different time measures of implied volatility, allows us to factor in more clues about a potential direction. If the day to day pricing of calls — puts increases while there is an anticipation of greater vol, it tends to be a bullish signal to expect higher spot prices.

Source: http://cmegroup.quikstrike.net (The RR settles are ready ~1am UK).

Important Footnotes

- Risk model: The fact that financial markets have become so intertwined and dynamic makes it essential to stay constantly in tune with market conditions and adapt to new environments. This prop model will assist you to gauge the context that you are trading so that you can significantly reduce the downside risks. To understand the principles applied in the assessment of this model, refer to the tutorial How to Unpack Risk Sentiment Profiles

- Cycles: Markets evolve in cycles followed by a period of distribution and/or accumulation. The weekly cycles are highlighted in red, blue refers to the daily, while the black lines represent the hourly cycles. To understand the principles applied in the assessment of cycles, refer to the tutorial How To Read Market Structures In Forex

- POC: It refers to the point of control. It represents the areas of most interest by trading volume and should act as walls of bids/offers that may result in price reversals. The volume profile analysis tracks trading activity over a specified time period at specified price levels. The study reveals the constant evolution of the market auction process. If you wish to find out more about the importance of the POC, refer to the tutorial How to Read Volume Profile Structures

- Tick Volume: Price updates activity provides great insights into the actual buy or sell-side commitment to be engaged into a specific directional movement. Studies validate that price updates (tick volume) are highly correlated to actual traded volume, with the correlation being very high, when looking at hourly data. If you wish to find out more about the importance tick volume, refer to the tutorial on Why Is Tick Volume Important To Monitor?

- Horizontal Support/Resistance: Unlike levels of dynamic support or resistance or more subjective measurements such as fibonacci retracements, pivot points, trendlines, or other forms of reactive areas, the horizontal lines of support and resistance are universal concepts used by the majority of market participants. It, therefore, makes the areas the most widely followed and relevant to monitor.

- Trendlines: Besides the horizontal lines, trendlines are helpful as a visual representation of the trend. The trendlines are drawn respecting a series of rules that determine the validation of a new cycle being created. Therefore, these trendline drawn in the chart hinge to a certain interpretation of market structures.

- Correlations: Each forex pair has a series of highly correlated assets to assess valuations. This type of study is called inter-market analysis and it involves scoping out anomalies in the ever-evolving global interconnectivity between equities, bonds, currencies, and commodities. If you would like to understand more about this concept, refer to the tutorial How Divergence In Correlated Assets Can Help You Add An Edge.

- Fundamentals: It’s important to highlight that the daily market outlook provided in this report is subject to the impact of the fundamental news. Any unexpected news may cause the price to behave erratically in the short term.

- Projection Targets: The usefulness of the 100% projection resides in the symmetry and harmonic relationships of market cycles. By drawing a 100% projection, you can anticipate the area in the chart where some type of pause and potential reversals in price is likely to occur, due to 1. The side in control of the cycle takes profits 2. Counter-trend positions are added by contrarian players 3. These are price points where limit orders are set by market-makers. You can find out more by reading the tutorial on The Magical 100% Fibonacci Projection