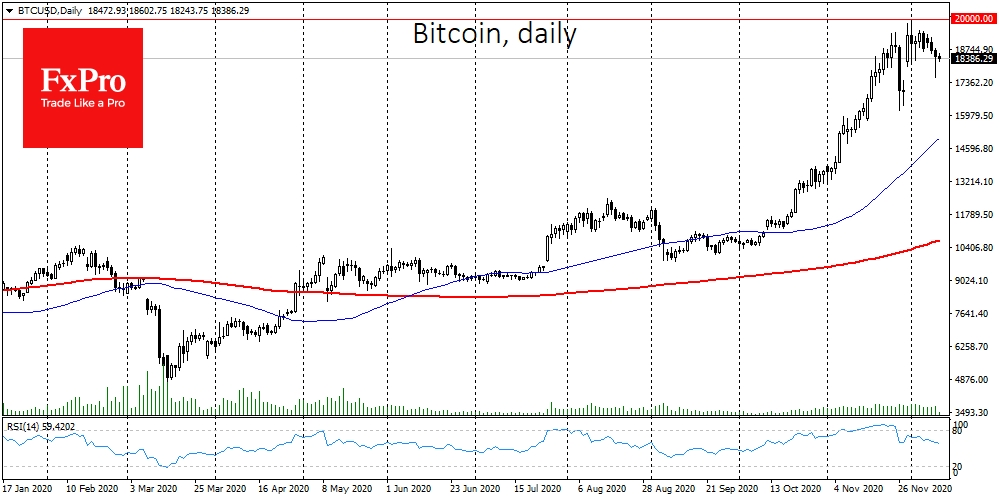

A corrective sentiment continues to prevail in the crypto market. Yesterday afternoon, Bitcoin briefly dipped to almost $17,500 and is trading at $18,400 at the beginning of the day on Thursday. Nevertheless, with the general downward trend continuing, which is clearly visible on the daily charts, buyers are coming to the rescue, stepping up purchasing after sharp declines. However, there were not many who wished to open positions with the current discount.

The pendulum has swung in the direction of the bears, and the increased trading volumes show that Bitcoin is changing hands more actively than before. Amid extreme overbought conditions, many are rushing to take profit after double-digit price gains over the past two months, in anticipation of the end of the calendar year.

The active role of institutions also increases the correlation of cryptocurrencies with gold and stocks mostly included in the Nasdaq. Both assets are under pressure for a second day, which is not encouraging optimism among buyers.

Along with Bitcoin, the correctional pullback has spread to altcoins, which usually react more actively in such situations.

Since August, MicroStrategy has been supporting Bitcoin by reporting large purchases. Now, the company plans to raise another $400 million to buy Bitcoins through a bond offering. MicroStrategy has already invested $475 million in Bitcoin, and the first cryptocurrency was able to show recent highs due to this news. The current news probably does not lead to as strong a reaction right now because of the overbought market. Nevertheless, it will help in the future by bringing in new investors.

Countries with troubled economies, as well as those under sanctions, can also provide background assistance to the crypto market. For example, Venezuelan authorities intend to use cryptocurrency to avoid U.S. sanctions. Anonymous sources from the country's central bank say that they are already paying for imports from Turkey and Iran in Bitcoin.

Demand from a rapidly impoverished part of the world, driven by distrust of local currencies and the inability to settle in dollars, could be a real driving force for Bitcoin and other cryptocurrencies as a means of payment and promote its active use, not just price speculation.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Crypto Market Reluctantly Retreats From Highs

Published 12/10/2020, 10:48 AM

Updated 03/21/2024, 07:45 AM

The Crypto Market Reluctantly Retreats From Highs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.