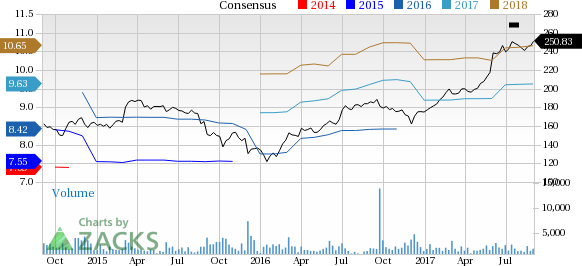

The Cooper Companies Inc. (NYSE:COO) reported adjusted earnings of $2.64 in third-quarter fiscal 2017, surpassing the Zacks Consensus Estimate by 6 cents and improving from $2.30 in the year-ago quarter. We believe that the upside was driven by robust revenue growth. The stock carries a Zacks Rank #2 (Buy).

Revenues increased to $556 million from $515 million recorded in the prior-year quarter. The figure also beat the Zacks Consensus Estimate of $552 million. Solid top-line performance was driven by innovative products like Biofinity and daily silicone hydrogel lenses.

Revenue Segments

The Cooper Companies has two business segments – CooperVision (CVI) and CooperSurgical (CSI).

CooperVision Segment: CVI revenues increased 8% at constant currency (cc) to $437.3 million on a year-over-year basis. Revenues continue to gain from the company’s silicone hydrogel lenses led by solid prospects in the MyDay, Clariti and Biofinity platforms. Coming to the major catalysts within the CVI segment, robust performance by Toric (31.6% of CVI revenues), Multifocal (10.7% of CVI revenues), Single-use sphere lenses (26.5% of CVI revenues) and Non single-use sphere lenses (31.2%) propelled solid growth.

Multifocal revenues rose 7% at cc to $46.8 million, while Toric revenues increased 11% at cc to $138.3 million on a year-over-year basis. Single-use sphere lenses sales climbed 14% at cc to $115.8 million, while sales of non single-use sphere lenses inched up 2% at cc to $136.4 million year over year.

Geographically, CVI revenues increased 2% in the Americas, while revenues from the Asia Pacific and EMEA rose 13% year over year at cc.

CooperSurgical Segment: CSI revenues jumped 4% at cc to $118.7 million on a year-over-year basis.

Coming to the CSI segment, the fertility category witnessed a 6% rise (at cc) in sales in the reported quarter on a year-over-year basis, totaling $65.5 million. However, the office and surgical products category at the CSI segment inched up 1% at cc to $53.2 million.

Margin Details

Adjusted gross margin in the reported quarter was 65% of revenues as compared with 64% registered in the year-ago quarter. The gross margin improvement was fueled by favorable product mix within the CooperVision segment, improved margins at CooperSurgical segment, and favorable foreign exchange.

Adjusted operating margin, as a percentage of revenues, was 26% in the fiscal third quarter flat on a year-over-year basis.

Guidance

Fiscal 2017: For fiscal 2017, total revenue is expected in the band of $2,129–$2,142 million, up from the previously issued range of 2,110–$2,135 million.

Revenues at the CVI segment are estimated between $1,670 and $1,680 million, up from the previously guided range of $1,645 million and $1,665 million, while CSI revenues are projected in the range of $459 - $462 million, a little lower from the previously guided range of $465–$470 million.

Meanwhile, adjusted earnings are anticipated in the band of $9.66–$9.76, up from the previously provided range of $9.50–$9.65 per share.

Fourth Quarter: The Cooper Companies expects revenues in the range of $552 million to $565 million. CVI revenues are expected between $435 million and $445 million, while CSI revenues are anticipated between $117 million and $120 million. The company expects adjusted earnings per share between $2.60 and $2.70.

Our Take

The Cooper Companies ended third-quarter fiscal 2017 on a solid note, beating the Zacks Consensus Estimate on both lines. The company has always seen impressive results at its CooperVision business segment. The CooperSurgical segment also delivered strong sales in the third quarter, buoyed by robust Toric performance. The company provided strong guidance for fiscal 2017. However, the dampening outlook for the CooperSurgical segment indicates looming concerns. Furthermore, intensifying competition in the contact lens space will continue to increase pricing pressure for the company.

We also note that The Cooper Companies has completed the acquisition of a small specialty contact lens company named Procornea earlier this month. This added a leading ortho-k technology to the company’s lens portfolio. The acquisition marked the company’s foray in the emerging myopia controlled markets.

Considering the outstanding performance of the stock, we expect The Cooper Companies to scale higher in the coming quarters. In this regard, positive long-term growth of 10.8% holds promise.

Key Picks

A few better-ranked stocks in the broader medical sector are Edwards Lifesciences Corp. (NYSE:EW) , IDEXX Laboratories, Inc. (NASDAQ:IDXX) and Cogentix Medical, Inc. (NASDAQ:CGNT) . Notably, Edwards Lifesciences sports a Zacks Rank #1 (Strong Buy), while IDEXX Laboratories and Cogentix Medical have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences delivered an average earnings beat of 10.8% over the trailing four quarters. The company has a long-term expected earnings growth rate of 15.2%.

Cogentix Medical registered a positive earnings surprise of 200% in the last reported quarter. The stock represented a stellar return of 100.9% over the last one year.

IDEXX Laboratories delivered an average earnings beat of 9.3% over the trailing four quarters. It has a long-term expected earnings growth rate of 19.8%

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Cogentix Medical, Inc. (CGNT): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Cooper Companies, Inc. (The) (COO): Free Stock Analysis Report

Original post