As the global highly-leveraged debt-based financial system comes under serious stress, investors are going to finally realize that the silver market is very tiny and extremely undervalued. This is when we will likely see the exponential silver price movement. And, it’s not a matter of “IF,” but rather a case of “WHEN.”

While most precious metals analysts focus on the systemic risks in the financial system to own Silver, I believe the real problem has to do with the HUGE ISSUES we are now facing with ENERGY. In my newest video, I discuss the two reasons why I believe we are going to BIG MOVE in the silver price.

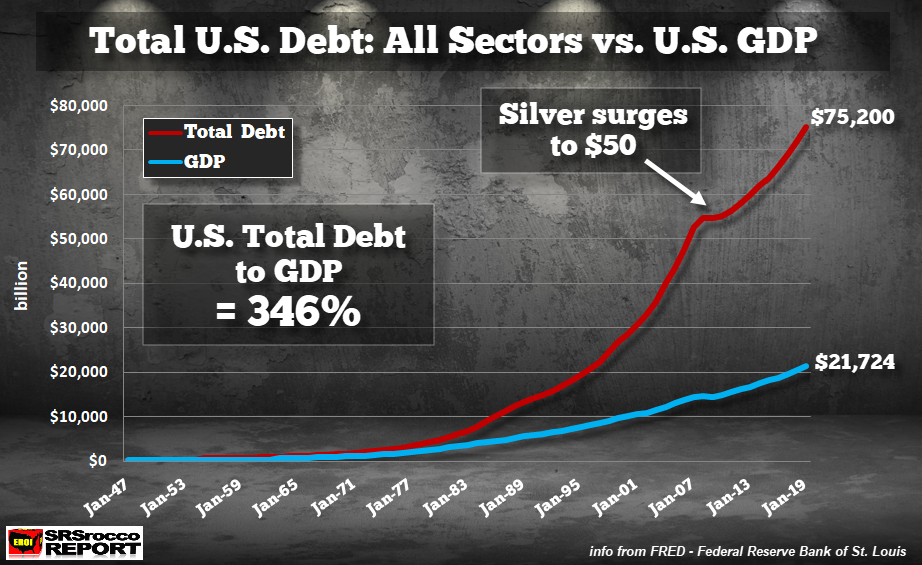

In the video, I show why the huge U.S. Total Debt to GDP of 346% is unsustainable due to the coming collapse of the U.S. Shale Oil Industry. Without oil production growth, there is no GDP growth. And, when there is no GDP growth, then the entire highly-leveraged debt-based financial system starts to disintegrate.

When Americans are faced with the task of “Protecting Wealth,” they will find out that “PAPER” or “DIGITS” will not make the CUT. Why? Paper money and Digits are based on future energy production. Thus, they are ENERGY IOU’s. However, Silver is money or wealth because it is a store of Energy Equivalent Value.

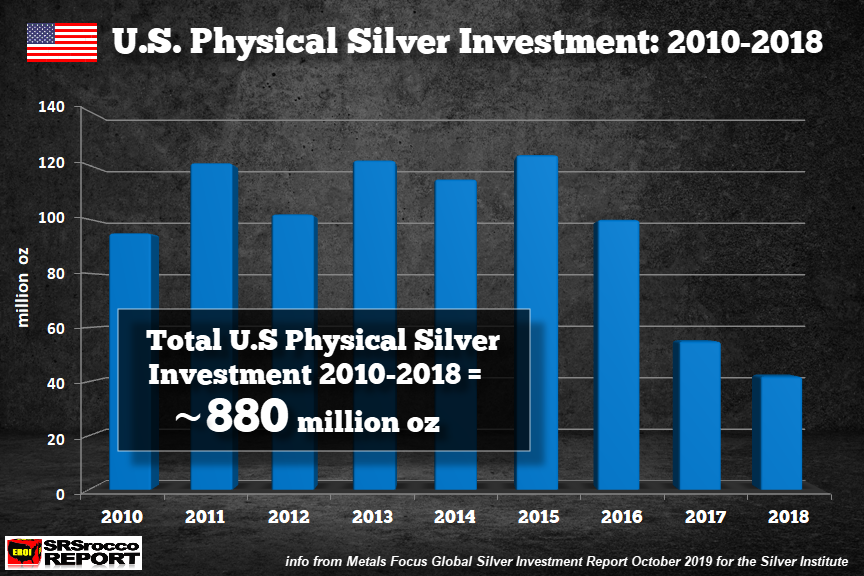

Also, in the video, I discuss some updated charts on U.S. Physical Silver Investment from 2010-2018 (Source: Metals Focus Silver Investment Report for the Silver Institute– OCT 2019):

Lastly, those Americans who have purchased approximately 880 million oz of physical silver bars and coins (2010-2018), have no idea that they are holding onto an asset that is likely the most undervalued in history.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI