The Shanghai Composite ran higher through the first half of 2015 to a peak in June. From there, the freefall began, and has now lasted 4 months. The Chinese economy is weakening. So time to sell. The problem with that line of thinking is that even a slow down to a 5 or 6% growth rate is pretty darn strong. But maybe more important to the analysis is the fact that all of those vomiting out their opinions do not live in a planned economy, and so really have no idea as to whether their views hold up in that environment.

But there is more. The government is managing the stock market now too. This created added verbal diarrhea about how markets need to be free and be able to go up and DOWN, but isn’t the point of investing to make money? So if the Government is manipulating the market to keep it from falling, isn’t that a good time to own stocks?

Let me ask another way. Is it wrong to make money owning stocks if the government is supporting them and encouraging the market to go higher? When you answer the question, please also list which countries this applies to.

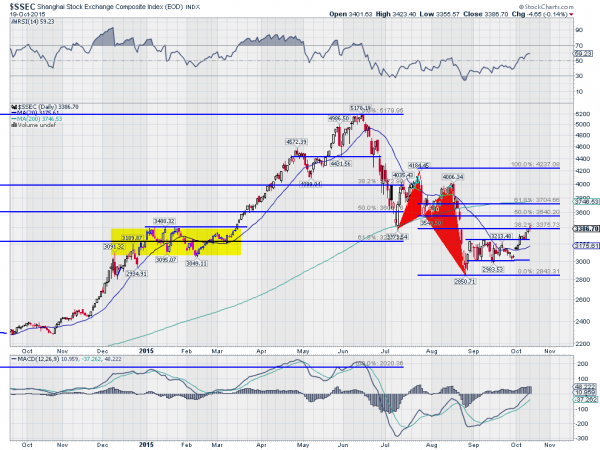

While you are all debating this the stock market looks ready to pull a Bruce Lee move on the shorts and bust out to the upside. The chart above shows the pullback, exceeding the 61.8% retracement of the move higher. The last bit in a bullish Crab harmonic. The bounce that ensued struggled in a range from 3000 to 3200 for 2 months. But then it broke to the upside.

It has retraced 38.2% of the Crab and is now at an important level. This is one target for the harmonic reversal, but the 3400 level nearby also has historical significance from the beginning of the year. A push over 3400 is big.

There are several other pieces of information on the chart that support prices going up. The RSI is bullish and rising and back at levels not seen since the Composite started lower. The MACD had been diverging higher since the August bottom, but has just recently moved positive. The Composite is also over the 20 day SMA. This has been an important indicator of whether price action would be bullish or bearish.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.