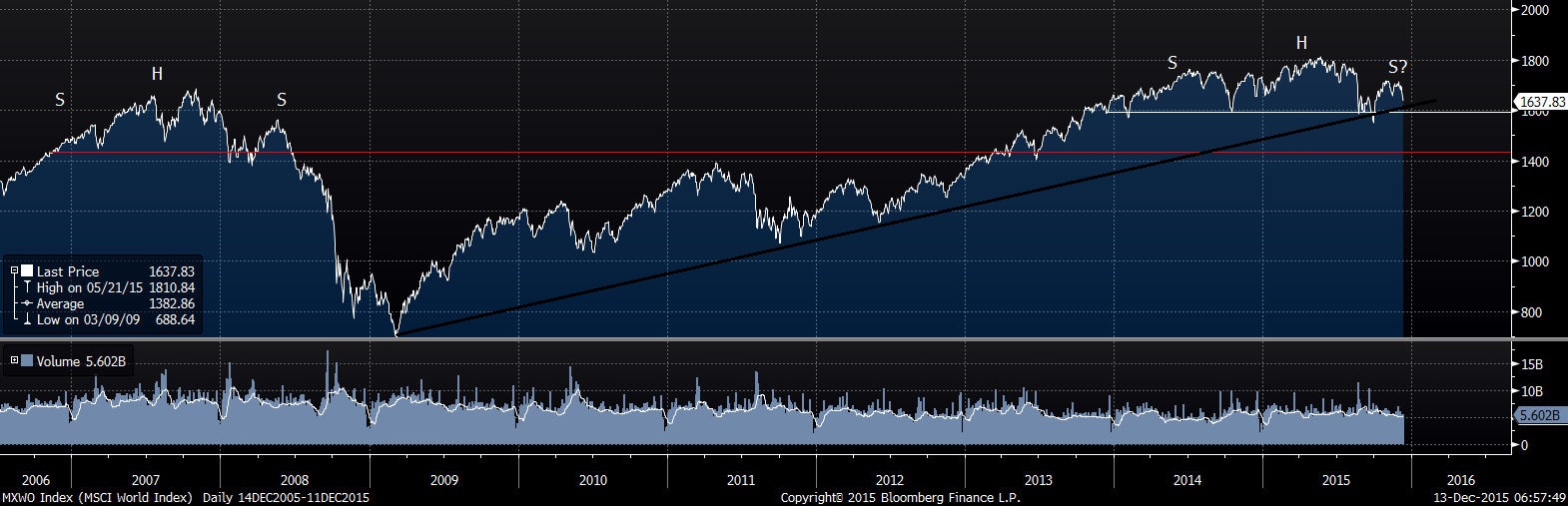

MSCI World Index forming a massive 2-year H&S top

The MSCI World Equity Index appears to be rolling over in a right shoulder of a significant top pattern. One must be blind not to notice the similarities between this potential top and the chart top completed in 2008. Also, notice how the right shoulder held at the 6+ year trendline.

The completion of the H&S top would also violate the trendline. A completion of this top could lead to a decline toward 1400.

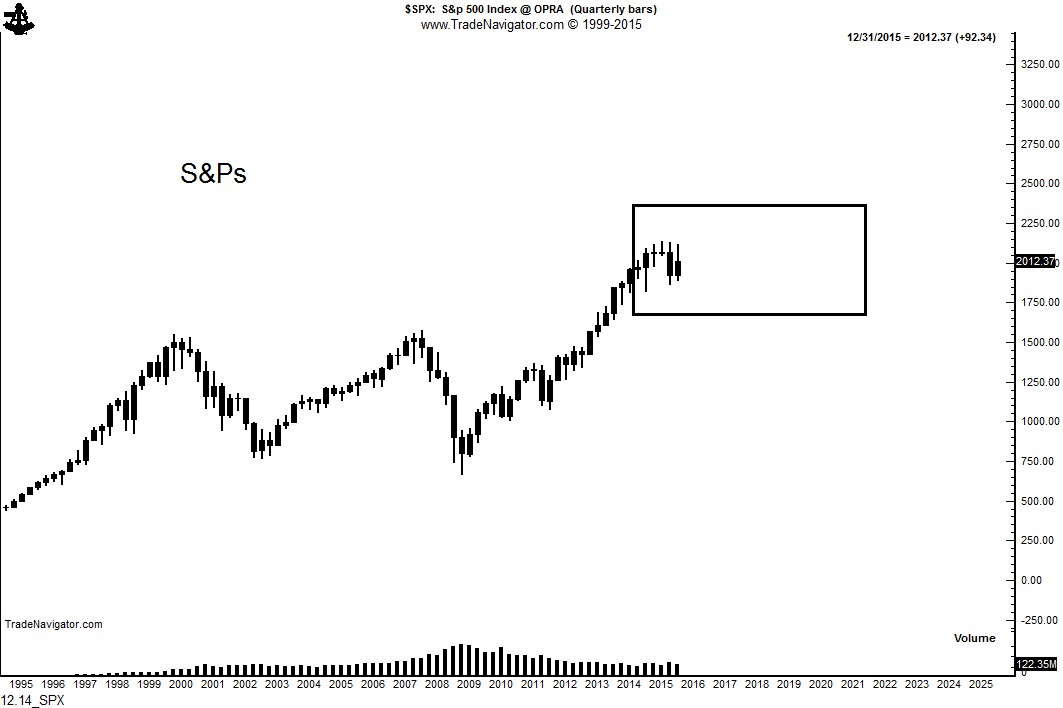

But I am NOT a doomsayer. In U.S. stocks I am NOT a bear and I am NOT a bull. In fact, I believe the S&P will remain in a range of 10% above the recent high to 10% below the recent low for the next five to eight years.

The markets always find a way to surprise expectations. I do not think anyone expects the market to be right where it is now many times during the coming years.

Disclosure: The information in this post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.