The Putwrite Index (“PUT”) is an index created by the CBOE (Chicago Board options Exchange) which acts as a benchmark index that measures the performance of a hypothetical portfolio that sells S&P 500 Index (SPX) put options against collateralized cash reserves held in a money market account. It is similar to the “BXM” which tracks the performance of a hypothetical S&P 500 covered call strategy.

Comparison to our traditional strategy of selling cash-secured puts

When we sell cash-secured puts, we place an adequate amount of cash into our brokerage account to pay for a possible future stock transaction (buy the shares) if the put option is exercised. In the PutWrite Index, an added element of buying one- and three-month Treasuries in a specific rotation is added to the strategy. Here’s how it works:

- Every 3rd Friday of the month when the puts expire is known as the “roll date” which is set up in sequences of three roll dates. In roll dates one and two, 1-month Treasuries are purchased and in roll date three, 3-month Treasuries are purchased. The amount purchased would be adequate to finance the maximum possible loss from final settlement of the SPX puts should SPX move to zero. This is known as collateralizing the puts. As portfolios are re-balanced on the roll dates, the portfolio will be long 1- and 3-month Treasuries and short 1-month SPX puts

- On roll dates at-the-money puts are sold that do not exceed the current value of SPX

- The cash proceeds from put sales are invested in 1- or 3- month Treasuries depending on the roll date of the 3-month sequence

- If puts expire in-the-money, the final settlement loss is financed by the Treasury Bills

- The number of puts sold at each roll is determined by the maximum final settlement loss to account for a worst-case scenario (S&P 500 drops to zero)

Long-term results

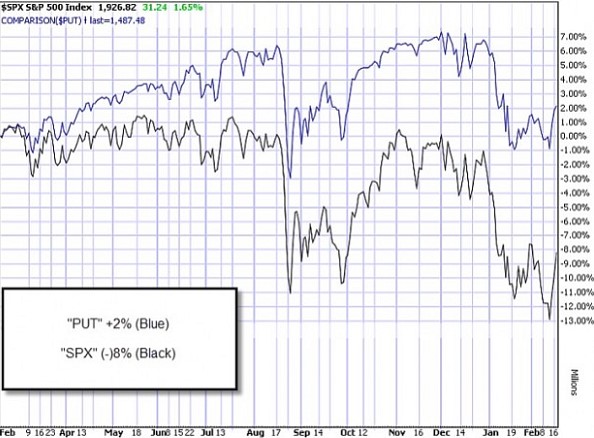

The PutWrite Index generates returns slightly higher than the S&P 500 with less portfolio volatility and higher risk-adjusted returns. The index performs particularly well in bear markets where put premiums are highest as volatility tends to be elevated and puts are being purchased to hedge portfolio risk. Here is a comparison chart of PUT vs. SPX from February, 2015 through February, 2016:

“PUT” vs. SPX: 1-Year Chart

Why retail investors can do so much better

So far, this strategy doesn’t seem so bad but we can absolutely out-perform this index as we can any computer-generated strategy where one size fits all and every situation is handled in a robotic fashion no matter what extenuating circumstances exist at the time. Cases in point:

- When we are leveraging an entire index, we are using every stock in that index, the good, the bad and the ugly…no stock selection

- Only at-the-money strikes are used, discounting overall market assessment where we can take advantage of out-of-the-money (lower than current market value) and in-the-money strikes (higher than current market value)…no strike selection

- The index waits for final results and settlement on the roll or expiration dates. With traditional selling of cash-secured puts we have an array of position management techniques to mitigate losses and enhance gains…no exit strategies

Discussion

The CBOE S&P 500 PutWrite Index (PUT) is an outstanding tool that demonstrates the value of the put-selling strategy. However, like all computer-generated blueprints, it has its limitations. Practical application of the three required skills for option-selling (stock selection, option selection and position management) will allow the retail investor to far exceed the above-average historical returns of this index as well as the covered call writing index (BXM).

Market tone

Stock markets around the world rebounded modestly this week. The Chicago Board Options Exchange Volatility Index (VIX) dipped to 20.53 from 27.5 last week, a positive for conservative investors. This weeks reports and other international news of import:

- Saudi Arabia and Russia proposed crude production caps however Iran rejected the offer. Markets reacted positively and then negatively on the Iran news

- European leaders gathered in Brussels on Thursday to begin final negotiations on a deal to help prevent the United Kingdom from exiting the European Union

- The European Central Bank is ready to “do its part” to spur more growth, Mario Draghi told a committee in the European Parliament on Monday. If inflation weakens further, the ECB will not hesitate to act, the ECB president said.

- Members of the US Federal Reserve’s Federal Open Market Committee said at their January meeting that it would be premature to change their outlook for the US economy but added that they would closely monitor global economic developments, as well as oil and stock prices

- They discussed “altering earlier views of the appropriate path for the target range for the federal funds rate,” given the recent tightening of global financial conditions

- Consumer prices in the US were unchanged in January versus December, but the core Consumer Price Index, which strips out volatile food and energy prices, rose 0.3%, its fastest rate in over four years

- Recent market whipsaws have not led to large-scale layoffs, according to weekly jobless claims data. Initial claims for state unemployment benefits fell to 262,000 from 269,000 the previous week. That is only 6,000 above the low for the cycle and a sign that the US labor market continues to improve

- Claims have been below 300,000 for 50 straight weeks, the longest such streak since the early 1970s, according to Reuters.

For the week, the S&P 500 increased by 2.84% for a year-to-date return of – 6.17%. After three consecutive bullish days (Friday, Tuesday and Wednesday), Thursday and Friday resulted in modest selling on light volume, very encouraging.

Summary

IBD: Market in confirmed uptrend

GMI: 1/6- Sell signal since market close of December 10, 2015

BCI: I have been in 1/3 cash in the stock portion of my portfolio the past several weeks due to the market turmoil. For the March contracts, I am putting that cash back to work…vacation over. However, I will remain focused primarily in defensive positions, selling out-of-the-money puts and in-the-money calls in a ratio of 3-to-1 over more aggressive positions.