This weekend Bloomberg published an article titled “The Bull Market Almost No One Saw Coming.“ While I don’t want to delve into the content of the article, the title triggered me a little bit. I saw this bull market coming from a mile away and you should have seen it too.

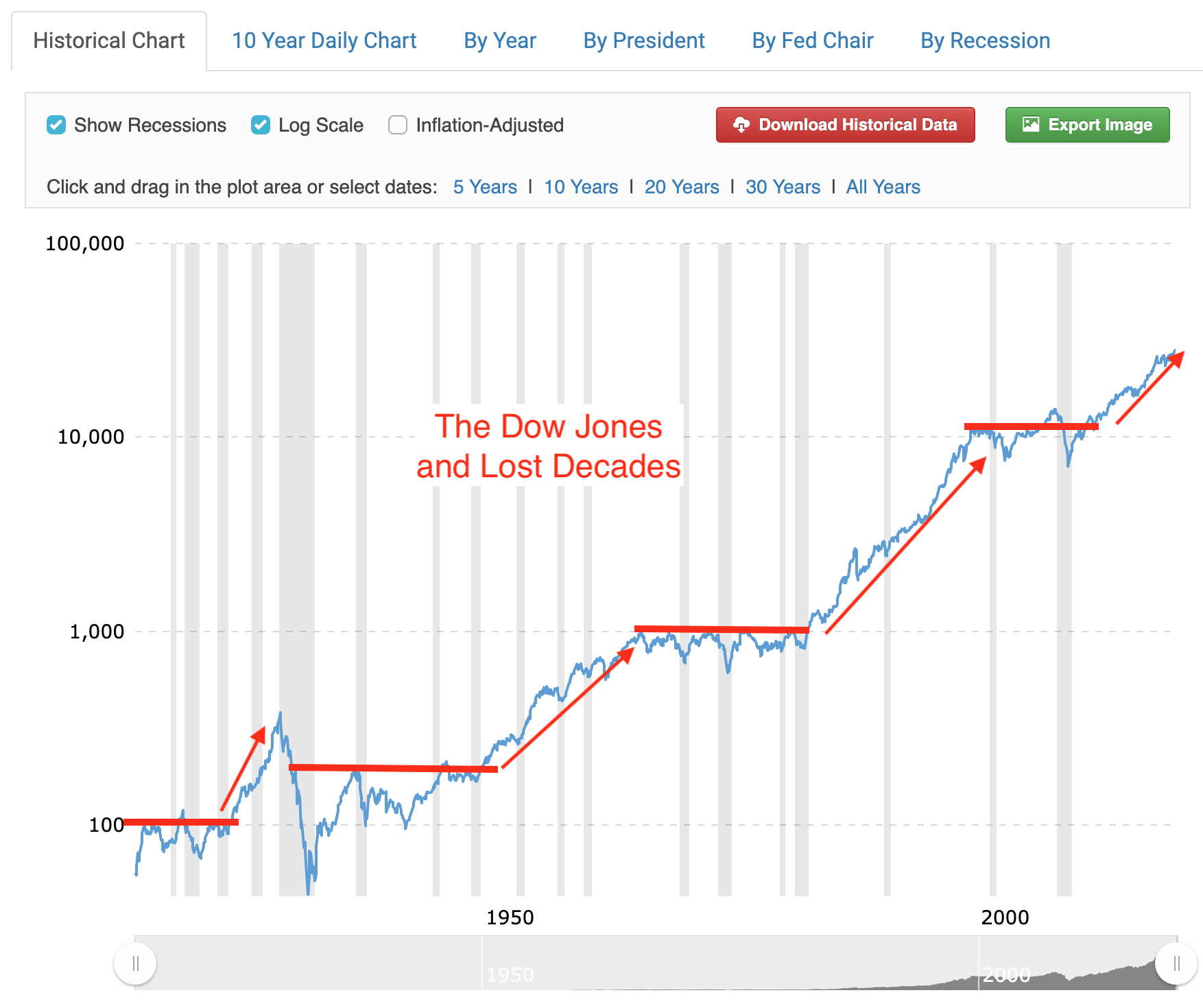

I’m not psychic or anything of the sort, but to me, this decade-long bull market was fairly obvious to anyone who spent time looking at long-term historical charts. Over the last 100 years, there have been multiple “Lost Decades.” These were extremely discouraging periods that triggered stock market crashes and the indexes spent the better part of 10 years trying to get back to the old highs. The most recent “Lost Decade?" From 2000 to 2013.

While everyone was giving up hope 10 years ago after the Financial crisis, I saw tons of opportunity. Sure, stocks obviously got too far ahead of themselves during the dot-com bubble and again during the housing bubble. But after a decade of trading sideways, a lot was happening in the real world that wasn’t being reflected in stock prices. In real terms, stocks were actually getting cheaper as the economy grew and equities failed to keep up.

Looking back in history, similar events transpired in the 1910s, 1930s, 1940s, and 1970s. Huge, brutal bear markets devastated stocks and turned an entire generation into cynics. But just when the masses had given up all hope, the market stunned us with the 1920s, 1950/60s, and the 1990s. Four times the market lost a decade and four times the market came roaring back. Was the 2000’s “Lost Decade” going to be any different? No, of course not.

Some of the best investment opportunities in the history of the stock market came in the 10 years following a “Lost Decade.” This time was no different. The only people who didn’t see this bull market coming were the ones who don’t know their history.

As for what comes next, is this bull market tired? Is a crash long overdue? Not if you look at history. Stocks rallied for nearly 20 years between the early 1980s and the late 1990s. By that measure, we could easily see another decade of strong gains before the next “Big One.” Of course, the worst day in stock market history happened during that 20-year bull market in 1987, so we cannot be complacent. But the prognosis for the next 10 years is still good even if we run into a few 20% corrections along the way.