Fastenal Company’s (NASDAQ:FAST) shares dropped 5.1% following second-quarter 2019 earnings release, wherein the top and bottom lines missed the respective Zacks Consensus Estimate, thanks to slower activity levels in the quarter.

Earnings & Sales Detail

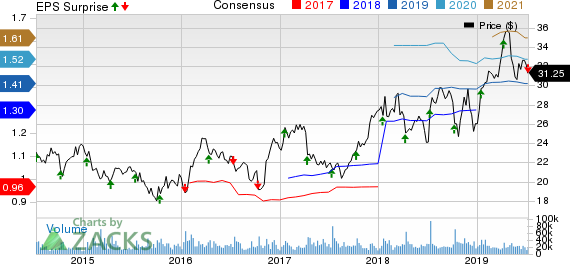

Fastenal reported earnings of 36 cents per share in the quarter, missing the consensus mark by a penny. The reported figure also compares unfavorably with the year-ago profit level of 37 cents.

Net sales of $1.37 billion lagged the consensus mark of $1.38 billion. Sales growth slowed to 7.9% year over year, marking the first sub-10% reading in nine quarters. The increase was driven by higher unit sales, primarily related to growth drivers, with notable contributions from industrial vending, Onsite locations and construction. Higher underlying market demand than second-quarter 2018 also contributed to the growth.

The company’s daily sales growth was recorded at 7.9%, lower than 12.2% and 13.1% increase in first-quarter 2019 and the prior-year quarter, respectively, as end-market activity slowed down in the quarter.

On a monthly basis, daily sales improved 7% in June, 9.5% in May and 12.5% in April compared with 13.5%, 12.5% and 13.4%, respectively, in the prior-year months.

Daily sales of Fastener products (mainly used for industrial production and accounting for approximately 34.5% of first-quarter sales) rose 5.5% year over year.

Non-fastener products’ daily sales (mainly used for maintenance and representing 65.5% of the quarterly sales) increased 9.5% year over year.

Vending Trends and Other Growth Drivers

As of Jun 30, 2019, Fastenal operated 85,871 vending machines, up 12.9% year over year. During the quarter, the company signed 5,439 machine contracts, down from 5,537 a year ago.

Fastenal signed 94 new Onsite locations during the quarter, up from 81 signings in the prior-year period. As of Jun 30, 2019, the company had 1,026 active sites, up 34.8% from the comparable year-ago period. It signed 51 new national account contracts in the second quarter (representing 53.3% of the total revenues). Daily sales to national account customers increased 12.5% on a year-over-year basis during the quarter.

Higher Costs Hurting Gross Margin

Gross margin of 46.9% in the quarter contracted 180 basis points (bps) year over year due to changes in product and customer mix, and inflation.

Also, operating margin contracted 110 bps year over year to 20.1% in the quarter, owing to lower gross margin.

Financials

Cash and cash equivalents were $175 million as of Jun 30, 2019, up from $167.2 million on Dec 31, 2018. Long-term debt at the end of the quarter was $497 million, flat with 2018-end figure.

Company Views

Fastenal, which currently carries a Zacks Rank #3 (Hold), shares spaces with Builders FirstSource, Inc. (NASDAQ:BLDR) , Tecnoglass Inc. (NASDAQ:TGLS) and BMC Stock Holdings, Inc. (NASDAQ:BMCH) in the Zacks Building Products – Retail industry. The company acknowledged the fact that overall activity in end markets served slowed down in the quarter. This offset the continued double-digit growth of vending and onsite locations, as well as sales to National Account customers. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

To offset tariffs placed on products sourced from China to date, Fastenal has successfully raised prices. However, those increases were not sufficient to counter general inflation in the marketplace. The company has been undertaking additional steps in the third quarter of 2019 to counter cost pressure and the incremental tariffs that were levied on China-sourced products in May 2019.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Builders FirstSource, Inc. (BLDR): Free Stock Analysis Report

Fastenal Company (FAST): Free Stock Analysis Report

BMC Stock Holdings, Inc. (BMCH): Free Stock Analysis Report

Tecnoglass Inc. (TGLS): Free Stock Analysis Report

Original post

Zacks Investment Research