The Biotech Growth Trust (LON:BIOGW) was launched in 1997, aiming to generate long-term capital growth from a global portfolio of biotech stocks.

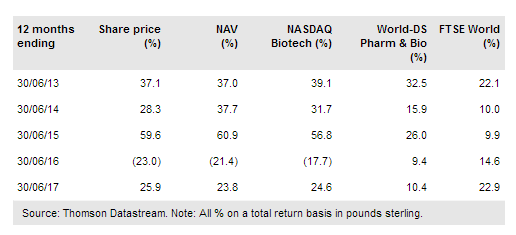

Since 2005, the trust has been managed by OrbiMed Capital, the largest global specialist healthcare investor; over this period, BIOG has significantly outperformed its benchmark NASDAQ Biotechnology Index, despite less compelling short-term performance. The trust’s managers are bullish on the outlook for the biotech industry due to continued innovation, and suggest that investor concerns about drug price controls are overdone and have led to attractive biotech company valuations, especially for the larger-cap stocks. They believe that greater clarity surrounding US tax policy, including the potential repatriation of overseas cash, could lead to more industry mergers and acquisitions (M&A), which should be an important driver for the sector and could lead to a positive revaluation of the industry.

Investment strategy: Proprietary research

Managers Richard Klemm and Geoff Hsu are part of the investment team at OrbiMed, which comprises more than 100 professionals, many of whom have scientific or medical backgrounds. Stocks are selected on a bottom-up basis following rigorous fundamental analysis, which includes financial modelling, an assessment of research pipelines and identification of likely catalysts. BIOG invests across the capitalisation spectrum, although the majority (c 60%) is invested in major US biotech stocks. Gearing of up to 20% of NAV is permitted; at end-June 2017 net gearing was 10.6%, which is towards the high end of its historical range.

To read the entire report Please click on the pdf File Below: