This week, we are doing something different.

We are analyzing two charts - one that exposes a huge threat to your retirement and another that shows how you can protect yourself.

First, the bad news...

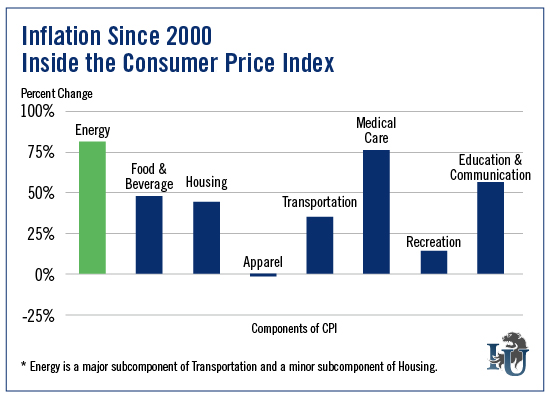

Since 2000, inflation has significantly increased prices in nearly every component of the consumer price index (CPI). The only exception is Apparel.

This hits people who rely on fixed income the hardest. As prices go up, there is no cost of living raise to offset them. And with retirees consuming 36% of total U.S. medical expenses, the 75.7% rise in Medical Care costs is especially concerning.

Breaking Information on Stock Exchange Bylaw "Section 703"

Thanks in part to a little-known stock exchange rule, some pre-retirees and retirees are now collecting six to 21 times more income, over time, than the average investor. It's called Regulation "Section 703," and we estimate not one in 1,000 Americans has heard of it. \\

Of course, retirement age or not, inflation can also wreak havoc on your portfolio. The higher the inflation rate, the higher return you’ll need to maintain your standard of living. (For example, if you held an energy stock that returned 4% and inflation was 5%, your return on investment would be -1%.) That bring us to our second chart...

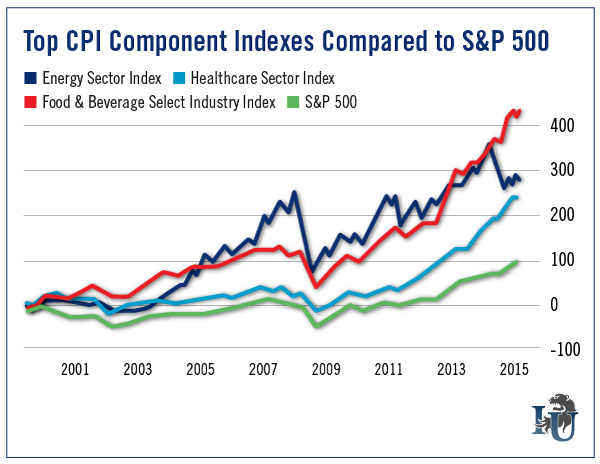

In it, we compare indexes for the three fastest-rising CPI components - Energy, Healthcare and Food & Beverage - to the broader market.

While food, healthcare and energy costs have risen more dramatically than other CPI components, these sectors have historically outperformed the S&P 500.

Since 2001, the Food & Beverage Select Industry Index (SPSIFB) has shot up more than 427 points. That’s more than four times the S&P.

Why?

It’s actually quite simple. A growing population... shortage of water... and rising demand for meat in emerging markets have steadily driven up food costs.

This is partly why The Oxford Club’s Emerging Trends Strategist Matthew Carr has recently advocated investing in the Food & Beverage industry. He’s particularly bullish on fast-casual restaurants like Chipotle Mexican Grill (NYSE: NYSE:CMG).

While it may feel a bit backward, the charts speak for themselves. Investing in the sectors that are most susceptible to price increases is a great way to hedge against rising inflation.