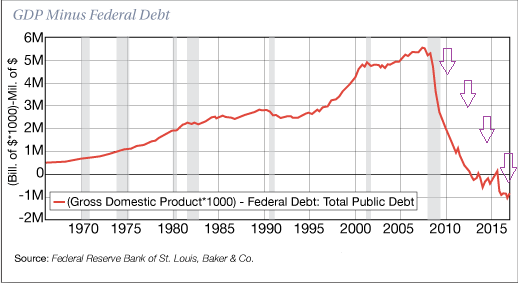

Can the U.S. economy grow without the federal government overspending? Apparently not. Since the financial crisis in 2008, GDP has only grown alongside massive Treasury debt issuance.

Some might argue that it does not matter how the economy expands as long as it is expanding. After all, the U.S. is still capable of paying the interest on its mushrooming obligations.

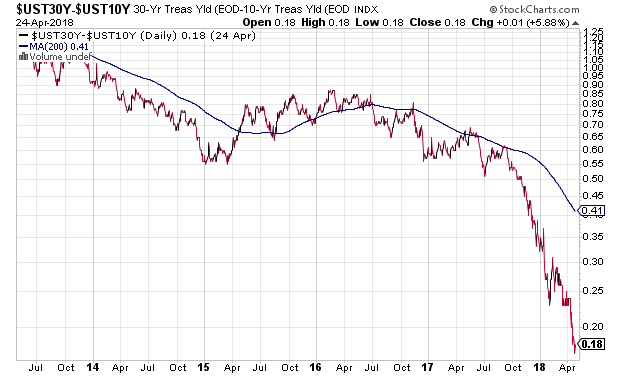

On the flip side, the bond market does not believe that the near-term economic picture will be quite so rosy. The paltry 0.18% additional yield for investing in a 30-year Treasury bond over a 10-year Treasury bond speaks volumes.

The fact that the stock market is grappling with the 10-year Treasury piercing the 3.0% level is telling as well. Stock investors are likely coming to grips with the reality that when home price growth doubles the pace of wage growth, and mortgage costs tied to the 10-year continue climbing, consumers may not be able to spend freely.

Indeed, the S&P 500 has been stuck in a range since February. And that’s the good news. The not-so-good news? We are sitting in the midst of the longest unresolved correction since May of 2008.

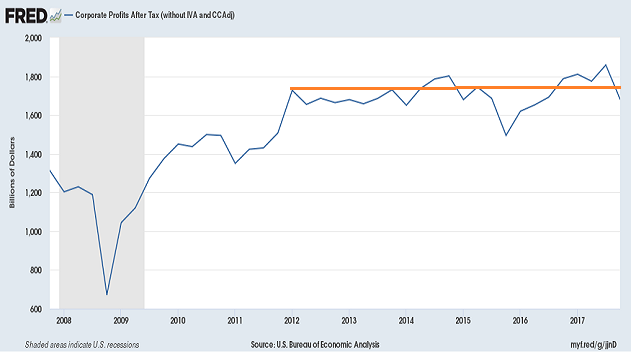

The mainstream financial media insist that investors will eventually turn their collective attention back to remarkably robust earnings-per-share (EPS) growth. The problem? The investment community already bought the tax cut rumors for 2018 in 2017. Meanwhile, year-over-year profitability comparisons will return in Q1 2019.

There’s more. The upbeat perception for corporate profitability primarily relates to companies buying back shares of stock. Reducing the shares in existence successfully inflates profits per share, but has meant little with regard to actual profit gains over time.

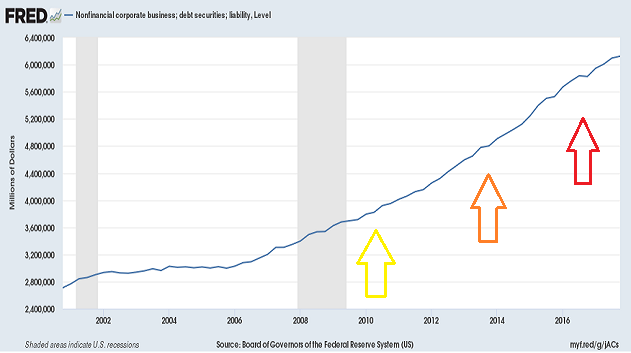

In the same way that economic growth is still economic growth regardless of Treasury debt issuance, earnings-per-share (EPS) gains are still EPS gains. Perhaps one need not be concerned with corporations ratcheting up their debt profiles to acquire shares of their own stock to improve profitability perceptions.

However, junk-rated corporations are vulnerable to higher borrowing costs in the future. Unlike Apple (NASDAQ:AAPL) or Microsoft (NASDAQ:MSFT), cash-starved companies will be refinancing corporate debt at inopportune times down the road.

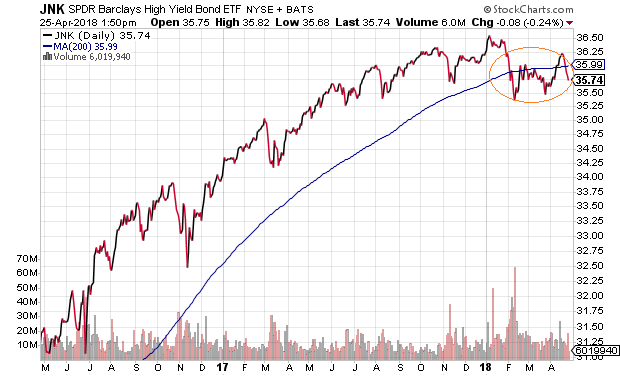

It follows that owners of corporate credit appear vulnerable. Indeed, the SPDR Barclays High Yield Bond Fund (MX:JNK) has been flashing warning signs since January.

Far too many folks have persuaded themselves that the Powell-led Federal Reserve will act quickly to prop up assets if they stumble. Maybe those folks are not paying attention to the inflation indicators that committee members at the Fed look at.

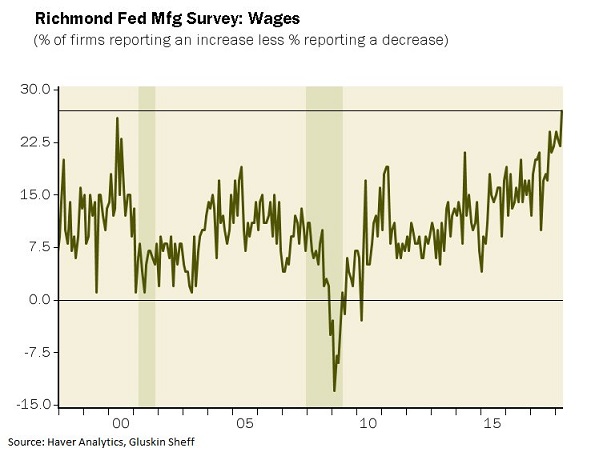

For example, the core consumer price index hit 2.1% in March. Crude oil and a variety of input costs have been hitting 4- and 5-year highs. Meanwhile, the percentage of firms reporting wage increases minus those reporting decreases are the highest that they’ve been since 1999.

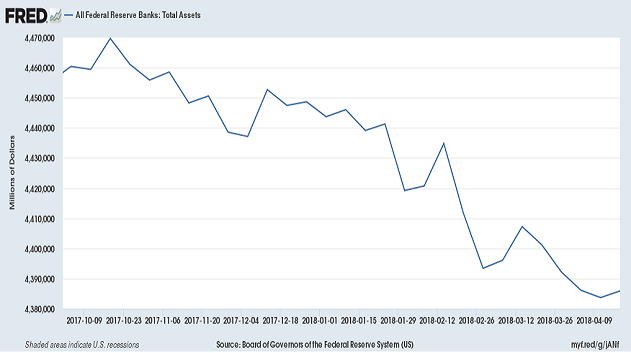

If the Fed’s dual mandate is to promote maximum employment while securing price stability, Chairman Powell may feel compelled to continue raising overnight lending rates as well as reducing the central bank’s balance sheet. What about the “third mandate?” Maintaining a wealth effect through ever-appreciating assets? This goal may become the proverbial third wheel.

Bear in mind, balance sheet reduction means that additional bond supply will keep coming. That will push rates in the 2-10 year range upward, likely dragging on stocks.

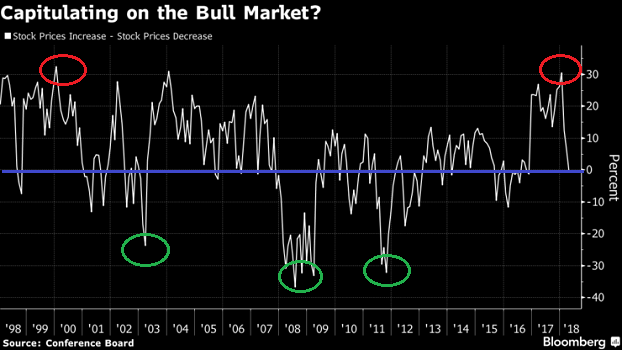

The effects are already taking a toll on the retail investing public. According to the Conference Board, record-level optimism peaked in January in the same fashion that it did before the dot-com stock bust at the start of 2000. Now, however, there are as many survey participants expecting stocks to be lower in 12 months as there are those who expected stocks to be higher over the next year.

Perhaps ironically, those who had been insisting that we had not been seeing irrational euphoria earlier this year (we had been) now insist we are witnessing irrational despair. We’re not. Fear has a long way to go before it reaches the level of anguish associated with the tech wreck, the financial collapse and/or the euro-zone sovereign debt crisis.

Stocks may hang in there and even push higher due to share buybacks. They’ve averaged nearly $5 billion per day in 2018 — a pace that is twice the rate of the same period in 2017. What’s more, the Federal Reserve’s path for gradual rate increases and for balance sheet reduction is slower than molasses dripping from a spoon.

Nevertheless, there’s no economic boom around the corner. Only tighter monetary policy alongside political and geopolitical angst.

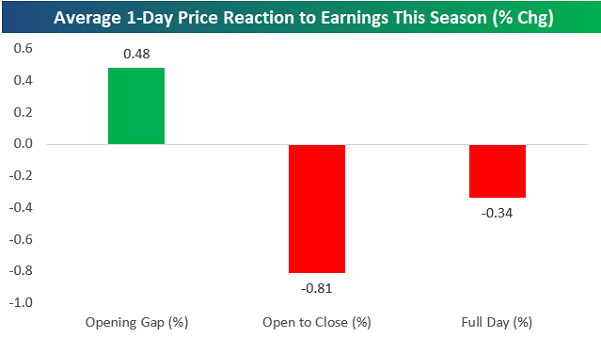

If you’re an investor who became a bit too aggressive with your large-cap U.S. stock exposure, use inevitable earnings report “beats” to rebalance back to a more modest allocation. If you’re more of a trader, take note of the shifting tides. “Buy the freaking dip” has been morphing into “sell the freaking rip.”

Disclosure Statement: ETF Expert is a web log (“blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert website. ETF Expert content is created independently of any advertising relationship.