-

Apple was the latest Magnificent 7 name to report impressive results for last quarter, yet tempered guidance for next quarter and beyond

-

This week 3,299 companies are expected to report for Q3, 61 from the S&P 500

-

Potential Surprises this week: Sleep Number, Vertex Pharmaceuticals

-

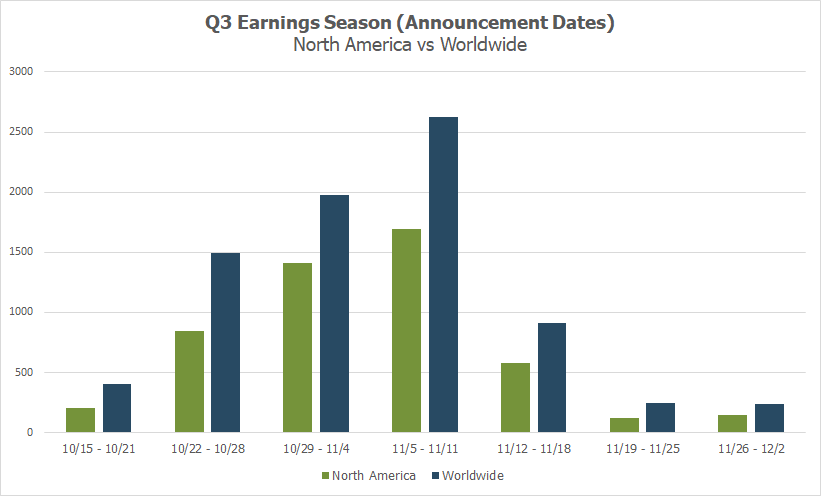

Peak weeks for Q3 season run from October 23 - November 10

During the second peak week of the Q3 earnings season, the dichotomy between robust Q3 results and cautious Q4 and 2024 outlooks continued to be on display.

Highly anticipated results from Apple Inc (NASDAQ:AAPL) came in better-than-expected for the most recent quarter, with record iPhone sales, but it was remarks from CFO Luca Maestri that caught investors off-guard.

Revenue for the company's fiscal first quarter is expected to be "similar" to FQ1 2023, said Maestri.

Investors would likely prefer to see growth, especially in the holiday season. He also warned that revenue for the iPad and Wearables categories would "decelerate significantly."

Investors continued to punish stocks of companies that miss estimates by more than usual, and reward those that surpass estimates by less than usual. According to Factset, S&P 500 companies that have surpassed EPS expectations are up 0.8% in the 2 days following the report (vs. the 5-year average of 0.9%), while those missing Wall Street estimates see their stocks plunge by -5.2% on average (vs. the 5-year average of -2.3%).

And while good news on certain Q3 earnings reports has sometimes been bad news for the stock market, on Friday it was bad economic news that translated to good news for stocks as investors digested lower-than-expected Non-farm Payrolls (NFP). The US Labor Department reported NFP rose by 150,000 in October. While that was 20,000 fewer than expected, that difference is mostly due to the auto strikes which have since been resolved. Tempered job creation along with flat wage growth makes it less likely that the Federal Reserve will raise rates in the near future.

With nearly 81% of S&P 500 constituents reporting at this point, the blended EPS growth rate for Q3 has grown to 3.7% vs. last week's 2.7%.

Earnings on Deck - Week of November 6, 2023

This is the third and final peak week of the Q3 earnings season, with expected earnings releases from 3,325 publicly traded companies (out of our universe of 10,000), with 61 of those coming from S&P 500 companies. Investors will be looking out for results from big names such as Disney (NYSE:DIS), Uber Technologies (NYSE:NYSE:UBER), eBay (NASDAQ:EBAY), automobile makers Rivian Automotive (NASDAQ:RIVN) and Nio Inc. (NYSE: NYSE:NIO) and enterprise tech names: Twilio (NYSE:NYSE:TWLO) and Hubspot (NYSE:HUBS).

Currently, November 9 is predicted to be the most active day with 1,121 companies anticipated to report. Thus far 82% of companies have confirmed their earnings date with 45% reporting.

Source: Wall Street Horizon

Potential Surprises This Week: Sleep Number (NASDAQ:SNBR) Corp, Vertex Pharmaceuticals

This week we get results from a number of large companies on major indexes that have pushed their Q3 2023 earnings dates outside of their historical norms. Nine companies within the S&P 500 confirmed outlier earnings dates for this week, all of which are later than usual and therefore have negative DateBreaks Factors*. Those companies are Celanese Corporation (NYSE:NYSE:CE), Vertex Pharmaceuticals Inc. (NASDAQ:VRTX), Extra Space Storage (NYSE:NYSE:EXR), Waters Corporation (NYSE:NYSE:WAT), eBay Inc. (NASDAQ:EBAY), Gilead Sciences (NASDAQ:GILD), Under Armour (NYSE:NYSE:UA), Corteva Inc. (NYSE:NYSE:CTVA) and Illumina, Inc. (NASDAQ: NASDAQ:ILMN) According to academic research, the later than usual earnings dates suggest these companies will report "bad news" on their upcoming calls.

Also of note, of the nine S&P 500 names with later than usual earnings dates this week, four are from the healthcare sector.

Sleep Number Corporation

Company Confirmed Report Date: Tuesday, November 7, AMC

Projected Report Date (based on historical data): Thursday, November 2, AMC

DateBreaks Factor: -3*

Sleep Number is set to report Q3 2023 results on Tuesday, November 7, five days later than expected. This would be the latest they've ever reported (since we began collecting data for this company in 2018).

Academic research shows when a corporation reports earnings later than they have historically, it typically signals bad news to come on the conference call. As consumers become more cost-conscious after a year of battling higher inflation, large-ticket home items such as mattresses and furniture have been struggling to hit the numbers they did during the post-COVID home improvement boom. According to FactSet data, SNBR's YoY EPS is expected to decline by 18%, while sales are anticipated to fall by 5%.

Vertex Pharmaceuticals

Company Confirmed Report Date: Monday, November 6, AMC

Projected Report Date (based on historical data): Thursday, October 26, AMC

DateBreaks Factor: -3*

Vertex Pharmaceuticals is set to report Q3 2023 results on Monday, November 6, eleven days later than expected. This will be the latest they've ever reported third-quarter results in our 18 years of history on this name. This will also be their first Monday report.

VRTX is known for its four Cystic Fibrosis drugs, with its newest CF drug Trikafta/Kaftrio (in Europe) gaining rapidly in popularity this year. While that will help revenues for Trikafta, analysts worry it will be at the expense of the other drugs in Vertex's CF portfolio, possibly causing overall revenues to dip.