Usually, if you call someone lazy, it’s an insult. But in finance, it’s actually a compliment.

That’s because passive investors prefer “set it and forget it” investment strategies that focus on market index funds. And those strategies work really well.

Beating the market is difficult. Betting on it instead is often both easier and more lucrative.

However, many “lazy investors” are missing out on the full potential of a market index-focused strategy. That’s because too many people invest in the same few cookie-cutter index funds.

There’s more to life than S&P 500 ETFs and bond funds. With a little digging, you can find index funds that offer higher returns for equally low effort.

Let’s learn about some of the best market indexes you’ve never heard of...

Dividend Funds

Dividend-paying stocks aren’t usually very exciting. They tend to be big, stable household names like Coca-Cola Company (NYSE:KO) or Kimberly-Clark (NYSE: NYSE:KMB). These stocks don’t move around enough to satisfy active day traders.

But if you hold on to them for many years and reinvest their dividend payments, you’ll gradually buy more and more shares. And that means that the returns can stack up to crazy heights.

That’s the strategy advocated by our Chief Income Strategist Marc Lichtenfeld. He literally wrote the book on dividend investing.

Marc’s system automatically reinvests payments from big, reliable stocks that raise their dividends every year. It’s the perfect fit for a lazy investor.

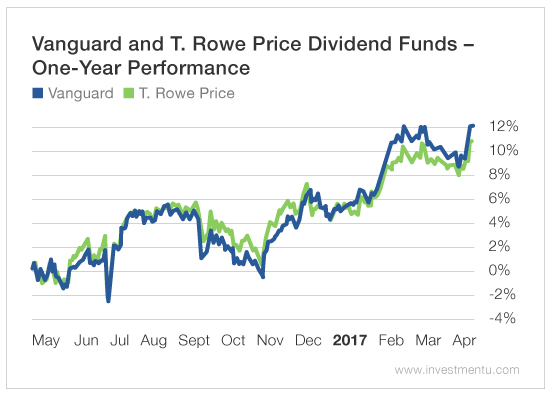

But if that’s still too much work, then you should look into some market indexes that contain good dividend stocks. Two of the most popular ones are the Vanguard Dividend Appreciation (NYSE:VIG) and the T. Rowe Price Dividend Growth. Both have had respectable returns over the last year.

Small Cap Funds

The one problem with the big, stable dividend payers is that they don’t generally grow much. Some lazy investors don’t want to bother with income stocks. Maybe you want to grow your money in value stocks instead.

Small caps are, as the name implies, smaller stocks that are early in their life cycles. You can get incredible returns if you pick the right ones. But they also face considerable risk compared to the more boring blue chips. Many young companies fail. Thus, small cap stock picking is not a good choice for passive investing fans.

However, the right small cap market index can give you exposure to this high-growth sector without too much risk. Two time-tested market index ETFs are the iShares Russell 2000 (NYSE:IWM) and the SPDR S&P 600 Small Cap ETF (NYSE: NYSE:SLY). Once again, both were up by decent margins in 2016.

Emerging Market Funds

A few paragraphs ago, we discussed how big dividend-paying companies are very reliable but don’t grow much. Meanwhile, volatile small caps grow very fast but are more disaster-prone. This logic doesn’t apply to just individual stocks and funds... it also applies to countries.

It may not feel like it from here, but the U.S. economy is very resilient. Even during the worst financial crises, our GDP shrinks by only a couple percentage points. We never have food riots, electricity shortages or hyperinflation.

Conversely, in the best of times, our GDP grows by only 1% to 3%. And a bull market doesn’t instantly make every American richer.

That’s because we’re a proverbial “blue chip” country... stable, low volatility, but not much potential for big gains. To be invested in high-growth “small cap countries,” you have to look to emerging markets.

However, emerging markets are hard to gauge, just like small cap stocks. Underdeveloped countries do grow at rates that the U.S. could never match. But they’re also more economically and politically unstable.

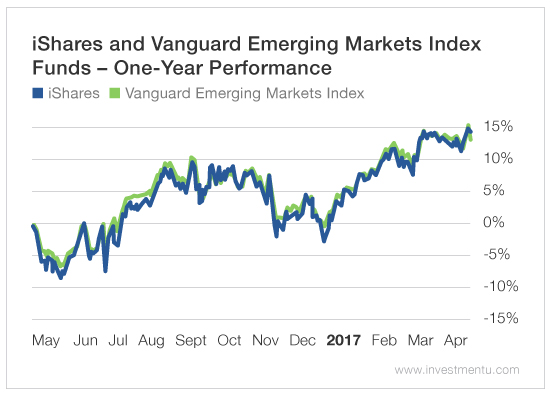

That’s why a widely diversified emerging markets index is a good addition to your portfolio. Two of the most well-liked are the iShares MSCI Emerging Markets Index ETF (NYSE: NYSE:EEM) and the Vanguard Emerging Mkts Stock Idx Inv. Both have been up more than 10% over the last year.

However, maybe you’re a more geopolitically conscious investor who wants to hand-pick your emerging market indexes. In that case, check out Where in the World Should I Invest? from The Oxford Club’s Options Strategist Karim Rahemtulla.

The Mother of All Lazy Portfolios

As you can see, lazy investing doesn’t have to be that lazy. You have more options than the generic stock and bond market indexes. And you can use these other indexes to customize your portfolio for high returns and low maintenance.

But it can be tough to determine what balance of index funds is right for you. Are you willing to accept more risk in order to quickly grow your money in small cap and emerging market indexes? Or would you rather be more conservative by sticking to dividend and bond funds?

If you don’t know, that’s OK... because our Chief Investment Strategist Alexander Green has combined them into the mother of all lazy portfolios.