Markets have displayed some bipolar behavior after Moderna (NASDAQ:MRNA) and Pfizer/BioNTech announced encouraging late-stage trial results for their COVID-19 vaccines over the last few weeks. Both ventures reported their experimental vaccines were more than 90% effective at stopping the coronavirus in third stage trials and both indicated their plans to submit for Emergency Use Authorization from the U.S. Food and Drug Administration.

As one would expect, investors greeted the news with much fanfare, pushing the U.S. broad-based indices to new highs during the Refinitiv Lipper fund-flows week ended Wednesday, November 18, 2020, with the Dow, the S&P 500, and the Russell 2000 each setting new closing highs on Monday, November 16, as the rotation out of growth-oriented tech stocks and into out-of-favor issues continued from the prior week. However, the rally was short lived, with the broad-based U.S. indices suffering declines on Tuesday and Wednesday after investors learned of a slowdown in retail sales, a dramatic rise in COVID-19 cases and hospitalizations, and New York City officials closing their public-school system in an effort to contain the virus spread.

Investors’ emotions have bounced between COVID-19 vaccine-news elation and despair caused by the record rise of positive cases and announcements of new lockdowns in the last two weeks, but estimated net flows have continued to show a slight rotation to value and cyclical issues.

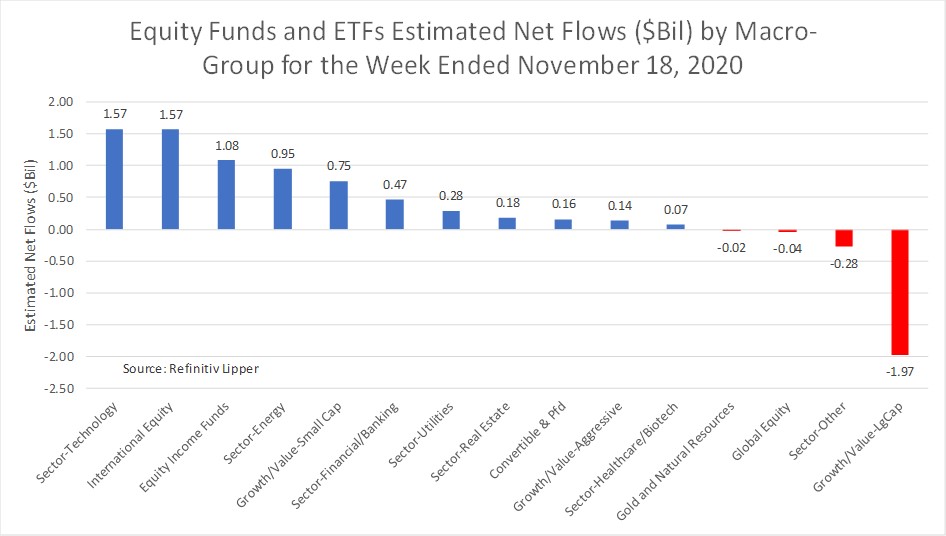

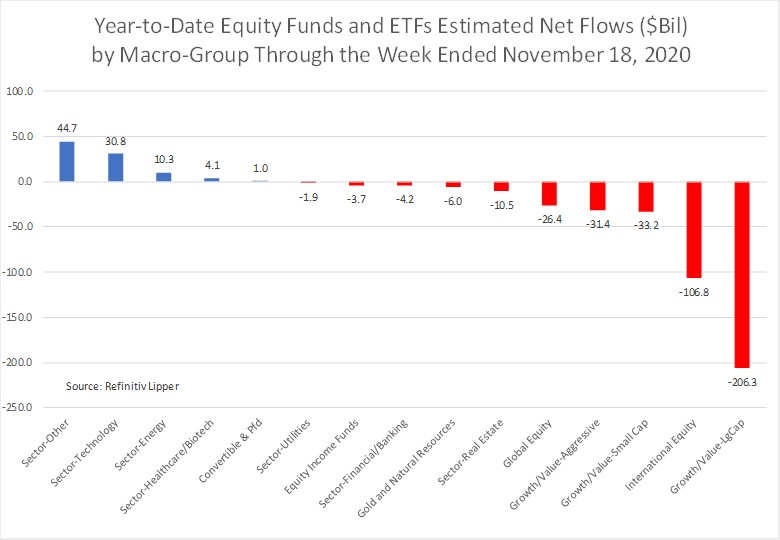

Zooming in on equity funds and ETFs for the most recent fund-flows week, investors continued to pad the coffers of technology funds—which took in the largest net flows for the week—but year-to-date laggards started to get a little TLC. International equity funds (+$1.6 billion), equity income funds (+$1.1 billion), and small-cap funds (+$752 million) moved to the top of leaderboard this week, while large-cap funds and sector-other funds—dominated by commodities funds and ETFs—handed back the largest amounts this past week.

Except for sector-technology funds (one of the top attractors of investor’s assets year to date) and large-cap funds (the biggest losers), we have seen some recent rotation when comparing the year-to-date estimated net flows total to those above. International income funds and small-cap funds have gone from suffering some of the largest net outflows year to date, to recently being the primary attractors of investors assets. It’s obviously too soon to say, but the recent change in flows may be telling.

For the most recent flows week, lopsided flows into equity funds and ETFs continued, with conventional equity funds suffering $2.1 billion in net redemptions. Meanwhile, their ETF counterparts attracted a net $7.0 billion. On the conventional equity mutual funds side of the ledger, the primary attractor of net new money were equity income funds (+$462 million) and small-cap value funds (+$131 million), while large-cap funds (-$2.5 billion) suffered the largest net redemptions. T. Rowe Price Blue Chip Growth Fund (TBCIX, +$522 million) and T. Rowe Price International Stock Fund (PRIUX, +$375 million) witnessed the largest individual draw of net new money of all the weekly reporting conventional equity funds.

Estimated net flows into equity ETFs for the flows week was somewhat evenly distributed across the macro-groups, with international equity ETFs (+$1.8 billion) taking in the largest draw, followed by sector-technology ETFs (+$1.5 billion) and sector-energy ETFs (+$940 million), while the sector-other ETF (-$304 million) group suffered the only significant outflows for the week. iShares Core S&P Small-Cap ETF (IJR, +$671 million), iShares Core S&P 500 ETF (IVV, +$514 million), and Energy Select Sector SPDR ETF (XLE, +$462 million) attracted the largest amounts of net new money of all individual equity ETFs for the most recent flows week.