Over the last couple of weeks I have been laying out the technical case for a breakout above the downtrend. Such a breakout would demand a subsequent increase in equity risk in portfolios. To wit:

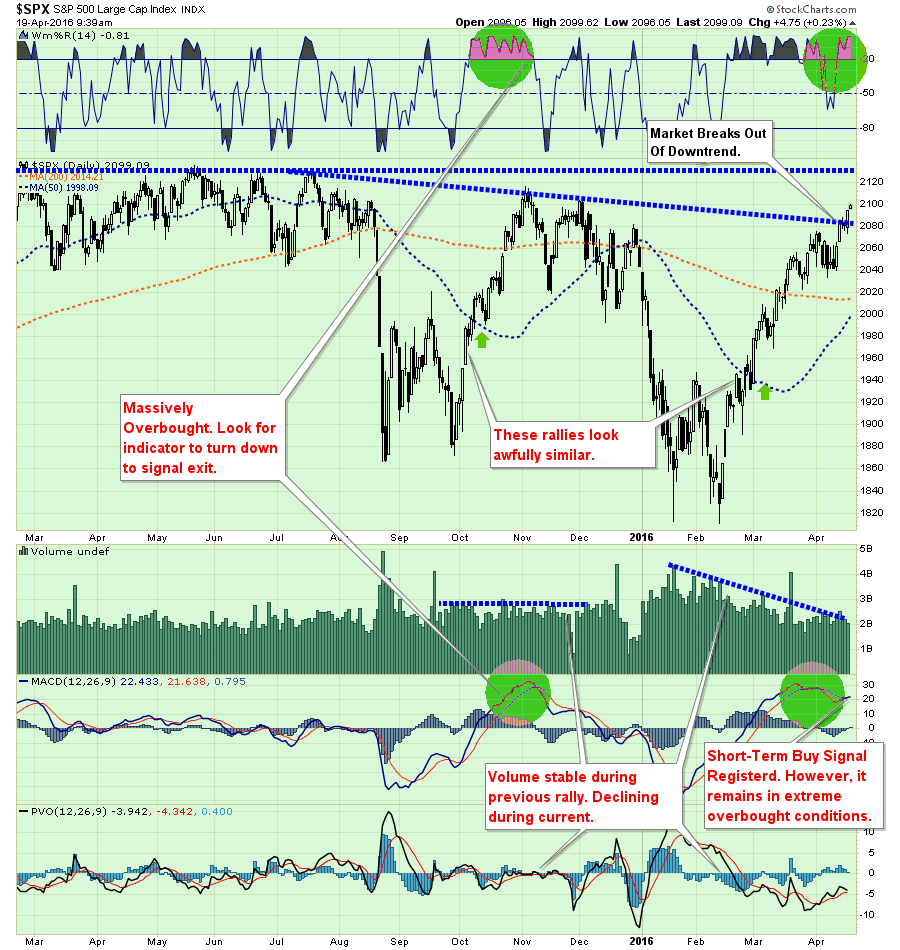

“As I stated last week, the markets have currently registered a very short-term buy signal which dictates that we must consider increasing equity risk in portfolios. I would be remiss in not paying attention that signal, but such signals can be a “false flag” during a larger market topping process.

The markets must break above the current downtrend line in order to increase allocations in portfolios. I have already positioned model portfolios to increase exposure back to 50% should such an event occur.”

I have updated the S&P 500 chart below through Tuesday’s open.

The breakout above the downtrend resistance suggests that a moderate increase in equity exposure is warranted. The breakout also suggests that markets will try to advance back to old highs from last year. However, let me repeat the warning from last week:

“WARNING:

Let me be VERY CLEAR – this is VERY SHORT-TERM analysis. From a TRADING perspective, there is a tradable opportunity being developed. This DOES NOT mean the markets are about to begin the next great secular bull market. Caution is highly advised if you are the type of person who doesn’t pay close attention to your portfolio or have an inherent disposition to “hoping things will get back to even” if things go wrong rather than selling.”

Holding My Nose

With the breakout of the market yesterday, and given that “short-term buy signals” are in place I began adding exposure back into portfolios. This is probably the most difficult “buy” I can ever remember making.

First, as a recap, it is worth remembering that I have been at 50% or less exposure in portfolios since May of last year. This has allowed my clients to bypass the market turmoil that occurred last summer and at the beginning of this year. As I discuss in the following video (skip to 11:45) being underweight has cost me very little.

However, now, as we move back into a “seemingly” more bullish set-up, I can begin to increase equity allocations modestly.

Notice, I said modestly. I didn’t say go buy every high-beta thing you can get your hands on.

As I stated, buying this breakout goes against virtually everything in my bones as the fundamental underpinnings certainly doesn’t support taking on equity risk here.

- We are moving into the seasonally weak time of year.

- Economic data continues to remain weak

- Earnings are only positive by not sucking as bad as estimates

- Volume is weak

- Longer-term technical underpinnings remain bearish.

- It is the summer of a Presidential election year which tends to be weak.

- The yield curve is flattening

- Bonds aren’t “buying” the rally

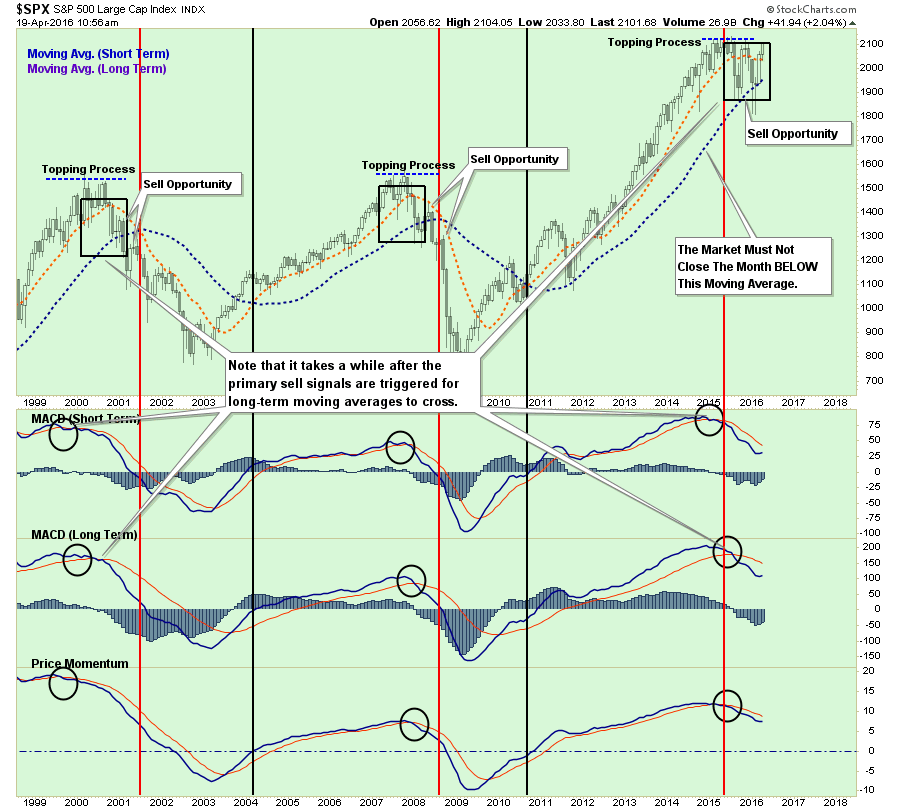

The chart below is a monthly, long-term, chart of the market. Currently, every major sell-signal, with the exception of the monthly moving-average crossover, is in place. Such would suggest that a more “bearish market” remains in place.

While I am increasing exposure here, I do suspect that price volatility has not been eliminated entirely, which is why I remain cautious.

Furthermore, the “bullish case” is currently built primarily on “hope.”

- Hope the economy will improve in the second half of the year.

- Hope that earnings will improve in the second half of the year.

- Hope that oil prices will trade higher even as supply remains elevated.

- Hope the Fed will not raise interest rates this year.

- Hope that global Central Banks will “keep on keepin’ on.”

- Hope that the US Dollar doesn’t rise

- Hope that interest rates remain low.

- Hope that high-yield credit markets remain stable

I am sure I forgot a few things, but you get the point. With valuations expensive, markets overbought, volatility low and sentiment pushing back into more extreme territory, there are a lot of things that can go wrong.

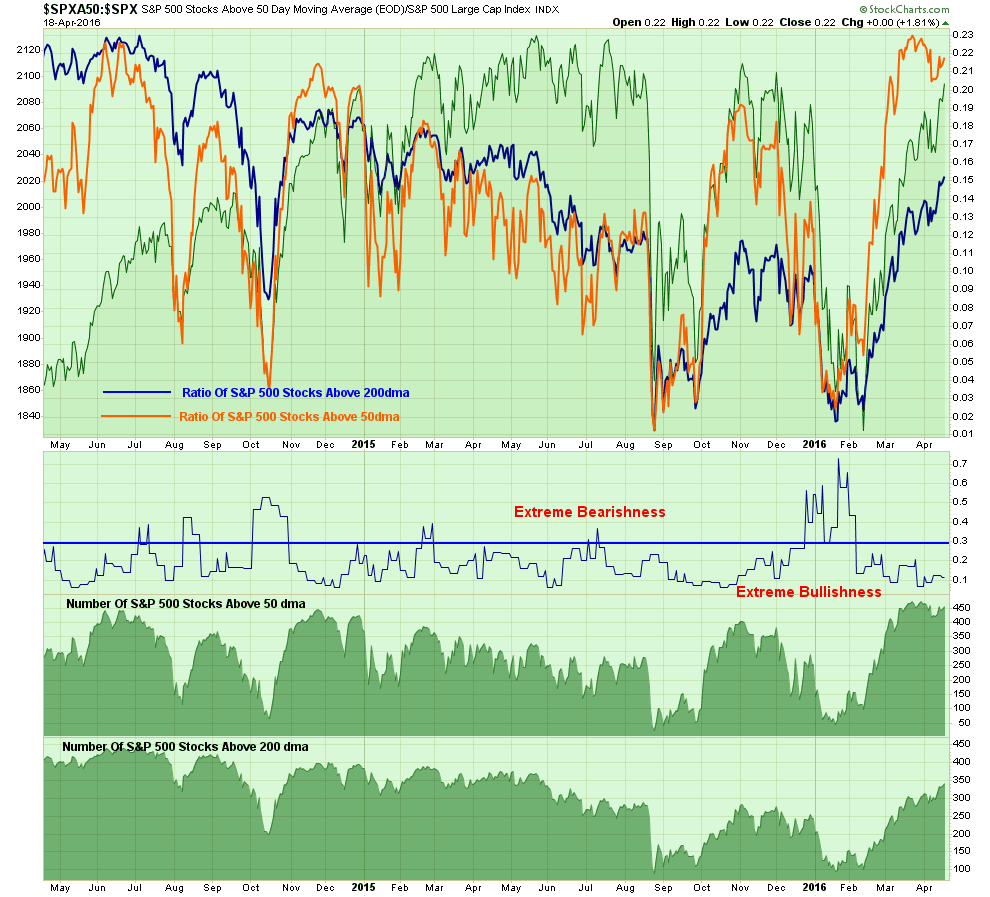

The chart below shows the 10-day moving average of the bull-bear ratio hitting extremely low levels of “bearishness” as the number of stocks above their 50-dma are hitting extremes.

Hedging My Bets

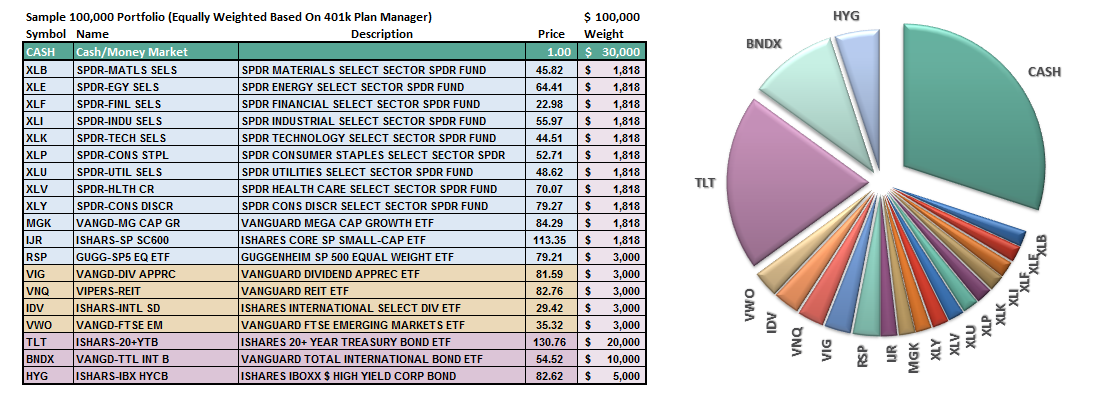

As I laid out in this past weekend’s newsletter, I have already adjusted the model portfolio to reflect the increase in equity risk this week.

“However, if the market does allow for an increase in equity exposure through a consolidation process, an increase in the model allocation to 50% of target weights will take model allocations to the following:”

Again, even with this increase, I am still holding a significant weight in cash, to hedge my risk, until further confirmations of a resumption of a rather old “bull market” are visible. Such would entail a breakout to all-time highs and a subsequent pullback that reduces the overbought condition without reversing the underlying “buy signals.”

Such a feat will likely not be easily accomplished, and I highly suspect that I will be “stopped out” of recent additions first.

I Have To…You Don’t

I am buying this breakout because I have to. If I don’t, I suffer career risk, plain and simple.

But you don’t have to. If you are truly a long-term investor, this rally is just a rally. There is no confirmation fundamentally or technically that the bull market has yet resumed. Such leaves investors with a tremendous amount of downside risk relative to the reward that is currently being offered.

However, investor patience to remain conservatively invested while what seems like a “bull market” is in force is an extremely difficult thing for most to do.

So, if you buy the breakout, do so carefully. Keep stop losses in place and be prepared to sell if things go wrong.

It is important to remember that the majority of those touting the bull market are simply just getting back to even after an almost year-long sludge. For now, things are certainly weighted towards the bullish camp.

However, such will not always be the case.