Australian dollarThe Australian dollar can’t find a way out of the darkness. The AUD has been falling since January 2019 and it seems that the situation only worsens. Let’s see what factors will affect the currency in the middle term.

Chart powered by TradingView

On May 20, the AUD firmed on the unexpected results of parliamentary elections. However, the rally was limited and the currency continued its downward movement. RBA meeting minutes (May 21) just worsened the situation. Comments by the central bank that the low cash rate is positive for the national economy were not new but this time they were more than just words. And although markets had already expected the rate cut on the June meeting, confirmation from the central bank pulled the currency further down. The meeting is on June 4, risks of the cut are high, what would prevent the plunge?

Before June 4, we don’t anticipate releases of any important economic data that can change the decision of the central bank. As a result, it’s more likely that the RBA will not change its decision and will cut the rate. However, as the rate cut is already priced-in there are high odds that a great fall will not occur.

Any chances that the RBA will not cut the rate? Yes, the decision is not taken. That’s why chances still exist.

Technical Picture

On the daily chart of AUD/USD, the pair has been moving towards the lows of January 2016 at 0.6832. The level is crucial for the aussie. If the pair slumps below it, the next support will lie only at 0.6287 – lows of the first quarter of 2009.

The recovery of the pair will be likely if only the pair is able to stick above 0.6952. Until then, any rise below this level will be considered as only a consolidation.

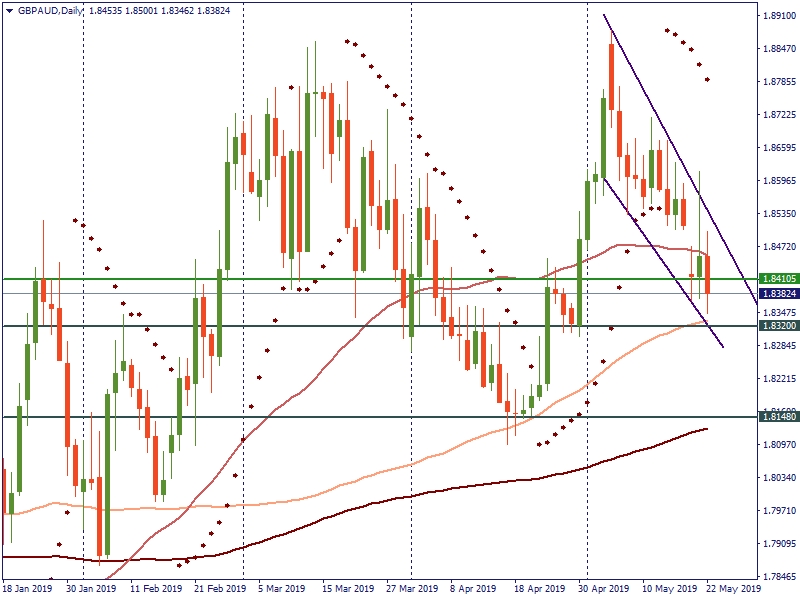

Nevertheless, the Australian dollar depreciates against most of the currencies; it has chances against the GBP/AUD, which began its movement down on May 6. Negative meeting minutes pushed the pair up. The pound/Australian dollar rate showed the volatility of 243 pips but it didn’t turn the downtrend. The pair tested the upper boundary of the trend but rebounded and continued sliding. And although the aussie is weak, the GBP seems to be on worse levels because of the Brexit deal.

The first support is located at 1.8320. A breakthrough will strengthen the downtrend. After the level is broken, bears will lead the pair to the support at 1.8148. The downward trend will be ended as soon as bulls manage to keep the pair above 1.8410.

Making a conclusion, we can say that we can anticipate a further weakness of the Australian dollar in the middle term because of the lack of the economic data and threats of the rate cut. Moreover, the US-China trade war puts additional pressure on the risky asset. However, the AUD will be stronger than such currencies as the British pound.