On June 6, 2016 (U.S. time), the Reserve Bank of Australia released its latest statement on monetary policy. The pronouncement was as pedestrian as ever, including leaving rates untouched.

The most notable difference from the current and the previous statement appears to be the RBA’s reflections on inflation. In the current statement, the RBA made clear (or confirmed) it thinks low inflation will persist for some time to come:

“Inflation has been quite low. Given very subdued growth in labour costs and very low cost pressures elsewhere in the world, this is expected to remain the case for some time.”

Compare this commentary to May’s observation on inflation:

“Inflation has been quite low for some time and recent data were unexpectedly low. While the quarterly data contain some temporary factors, these results, together with ongoing very subdued growth in labour costs and very low cost pressures elsewhere in the world, point to a lower outlook for inflation than previously forecast.”

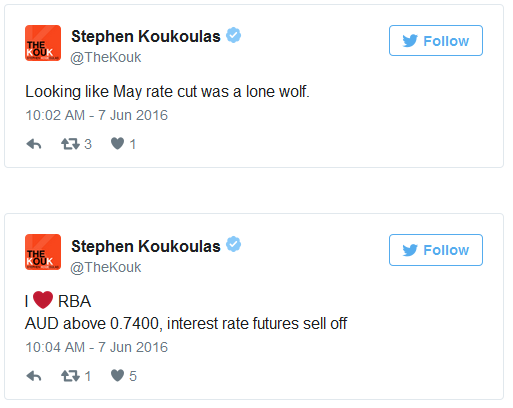

Recall in May that the RBA cut interest rates by 25 basis points primarily because inflation was “unexpectedly low.” Now, the RBA says the lower inflation rate will be the new norm for the foreseeable future.

This expectation implies that the RBA will also keep rates exceptionally low for the foreseeable future. Yet, this assessment was enough to bring out the buyers in the Australian dollar. Perhaps traders were (incorrectly) hoping for even more dovishness from the RBA, and the RBA “surprised expectations.”

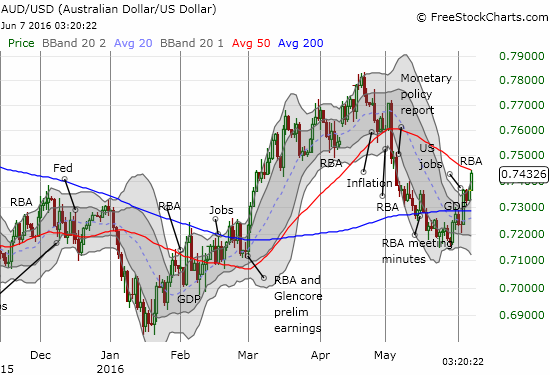

Just like the trigger buying that occurred in the wake of a strong GDP report, I think this latest spurt of buying will reverse. The next reversal could take more time since traders are still adjusting to the potential for the Federal Reserve to hike rates much later in the year than earlier as expected. This adjustment includes making high-yielding currencies look relatively more attractive in the near-term.

\

\

The Australian dollar runs right into presumed resistance at its 50-day moving average (DMA).

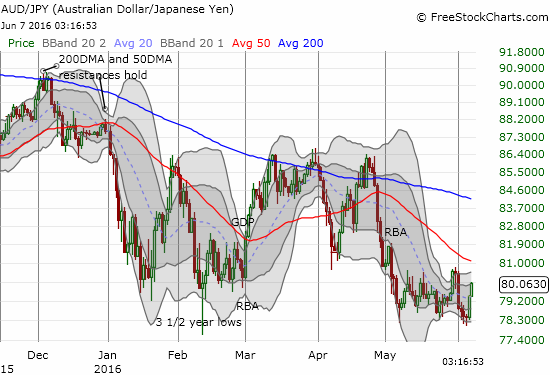

The Australian dollar is bouncing off recent lows against the Japanese yen. AUD/JPY may be ready to at least hold onto a trading range.

Under these circumstances, I would typically start fading AUD/USD, given it is right at a declining 50DMA.

However, I do not trust the U.S. dollar at this juncture where traders are adjusting to a more bearish thesis on the greenback. So, I instead started my latest fade using the Japanese yen and the euro. This choice carries the additional benefit of providing a hedge on my pro-dollar positions against these currencies.

Be careful out there!

Full disclosure: Net short the Australian dollar, net long the U.S. dollar.