SPX Monitoring purposes; Long SPX 12/14/20 at 3647.49.

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX monitor purposes; Long SPX on 10/26/20 at 3400.97.

It’s a bullish longer term sign when the 5 and 10 day TRIN reach bullish levels in the same time. The bottom window is the 5 day average of the TRIN and next window up is the 10 day average. When both are in the bullish level (Circled in blue and with red vertical lines) the rallies last longer. This evidence suggests the rally could last into year end if not longer. Long SPX on 12/14/20 at 3647.49.

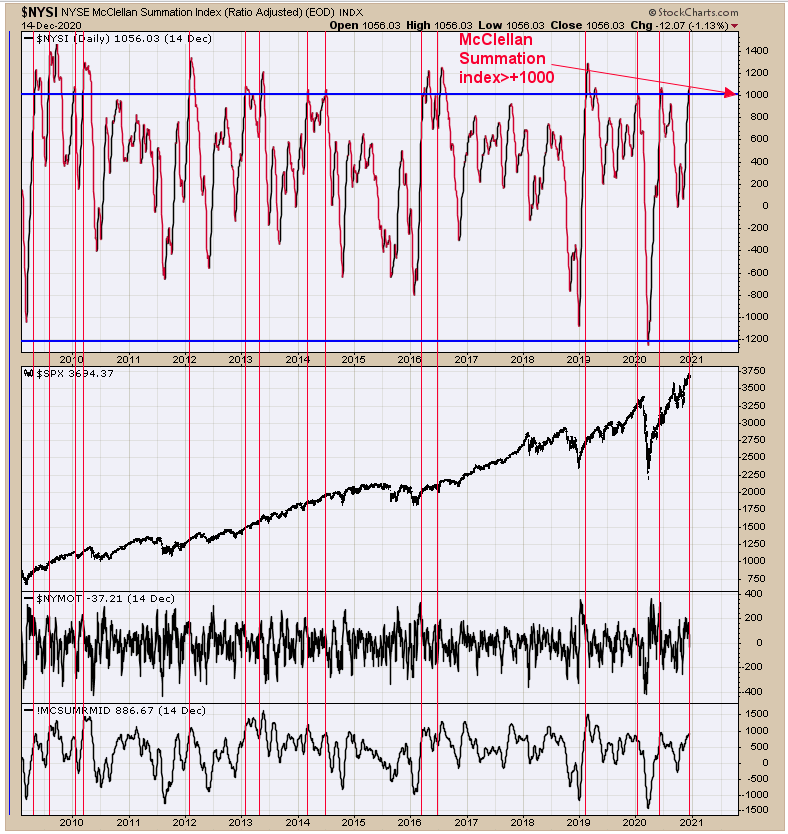

Above is another view of the intermediate term for the market. The current NYSE McClellan Summation index reading is +1056. We went back to 2009 and showed the times when the NYSE McClellan Summation index closed above +1000 (noted with red vertical lines) and in most all cases the market at least marched higher for several weeks (some cases a lot longer). Our point is the next several weeks look good. Markets weaken first before a top is near and so far no weakness is showing up. Sentiment is terrible but momentum rules all and right now the momentum is up.

We have shown this chart is the past which is the daily GLD. A “Selling Climax” occurred on 11/9 and the test came on 11/23; but the test needs to close above the “Selling Climax” low for a bullish signal. A close above the “Selling Climax” low did come on 11/23 but failed to hold above. Today GLD (NYSE:GLD) is back at the low of the “Selling Climax” but not giving a clear signal, at least for today. The pattern forming since November could be a “Head and Shoulders bottom” where the “Head” is the November 30 low; the “Right Shoulder” is being completed now. There is a cycle low due around 12/23 and the gold market could meander around tell then. Our view is that this is a good place to be long Gold stocks including (GDXJ) and GDX. Silver on the next ally phase should outperform Gold. Long GDX on 10/9/20 at 40.78.