Here are seven stocks with exposure to the semiconductor industry, trading at a low P/E multiple, and have yet to report their Q3'17 earnings.

A Semi-Surprising Earnings Season

This earnings season has been a story of semi-surprises thus far with 275 members of the S&P 500 having reported as of Friday, October 27. According to Factset, 76% (209 of 275) of companies that have reported Q3'17 results have beat their EPS estimates. This is above the trailing 4-quarter average EPS beat percentage of 71% and well above the 5-year average of 59%. In addition, these companies have beat their expected earnings on average of 4.7% which is also above the 5-year average of 4.2%.

The reason this earnings season has been semi-surprising is due to the minuscule impact these positive surprises have had on share prices. Companies that have reported upside earnings surprises have seen an average price impact of only +0.1% immediately following the announcement. Investors typically expect a stock to jump much higher when the company beats their estimates. We’re not seeing this impact because the market has already priced in these positive earnings as illustrated by the S&P 500’s premium valuation. The forward P/E ratio for the S&P 500 currently stands at 17.9x. This is well above its 5-year average of 15.6x and its 10-year average of 14.1x.

However, there has been a silver lining among these earnings announcements.

Semiconductor Stocks Outperforming

The Information Technology (IT) sector has been a clear leader this earnings season with 91% of companies reporting earnings above estimates. Furthermore, these companies are beating their expected earnings on average of 11.3%. This sector is on pace to achieve 14.8% year-over-year (YoY) growth.

More specifically, companies in the Semiconductor & Semiconductor Equipment industry have significantly outperformed reporting 42% YoY earnings growth thus far (factset). Other IT industries such as Software, IT Services, and Internet Software & Services have also reported healthy earnings growth of 12%, 11%, and 10%, respectively.

The semiconductor industry is highly cyclical and is constantly facing booms and busts as demand for its products quickly changes. However, it is worth taking a closer look at stocks in this industry when times are good as they currently are; iShares PHLX Semiconductor ETF (NASDAQ:SOXX) is up 40% since the beginning of the year and nearly 10% in the last month.

Therefore I was curious to see if there were still any companies that have (1) exposure to the semiconductor industry, (2) have yet to report earnings, and (3) are still trading at a fairly reasonable valuation implying that there’s still upside potential.

Screening For Semiconductor Stocks With Low Valuations

According to finbox.io, the forward P/E multiple for the entire IT sector currently stands at 21.4x, well above the 17.9x of the S&P 500. This is not surprising as premium growth warrants a premium valuation. Therefore I use the 21.4x multiple as a ceiling in my screen.

The following are all the filters applied in this semiconductor stock screen.

- Company’s Description contains “Semiconductor”,

- Days to next earnings is within 15 days,

- Sector is Information Technology,

- Forward P/E ratio is less than 21.4x, and

- Market capitalization is greater than $2 billion.

There were only 7 stocks that resulted from this stock screen as of October 31st. I then ranked them below by their P/E multiple in ascending order.

#1 Microsemi

Microsemi Corporation (NASDAQ:MSCC) designs and manufactures analog and mixed-signal semiconductor solutions worldwide. The company’s products are used in various applications, such as communications infrastructure systems comprising wireless and wired LAN systems, pacemakers and defibrillators, radar systems, missile systems, and oil field equipment. Microsemi Corporation was founded in 1960 and is headquartered in Aliso Viejo, California.

The company’s Forward P/E multiple of 13.6x is not only well below that of the S&P 500’s 17.9x but below all of its comparable public companies: Teradyne’s (NYSE:TER) 21.2x, Cypress Semiconductor’s (NASDAQ:CY) 18.5x, Analog Devices’ (NASDAQ:ADI) 20.6x and Cadence Design Systems’ (NASDAQ:CDNS) 31.1x.

source: finbox.io

The company is expected to report earnings on Thursday, November 9 after the market closes. Although the stock is up 105% over the last three years, shares down -3% year-to-date as Microsemi has reported earnings in-line with expectations over the last three quarters. Don’t be surprised if that trend changes next week.

#2 ON Semiconductor

ON Semiconductor Corporation (NASDAQ:ON) manufactures and sells semiconductor components for various electronic devices worldwide. It operates through three segments: Power Solutions Group, Analog Solutions Group, and Image Sensor Group. The company serves original equipment manufacturers, distributors, and electronic manufacturing service providers. ON Semiconductor Corporation was founded in 1999 and is headquartered in Phoenix, Arizona.

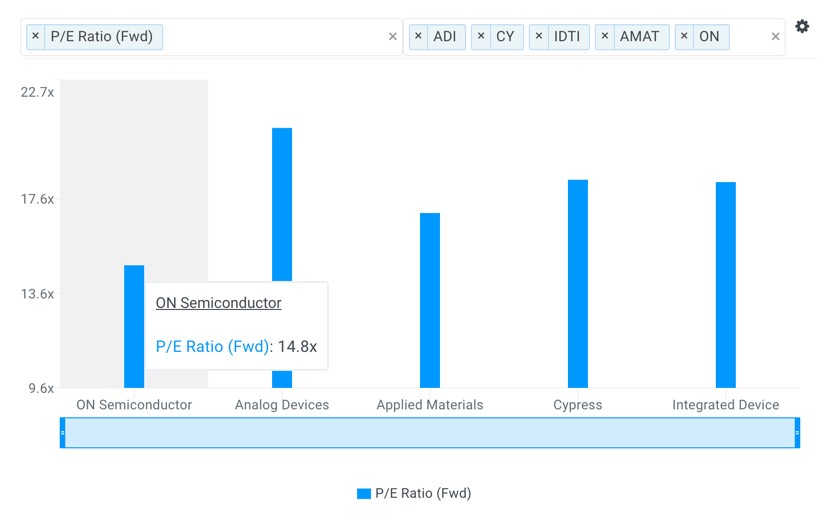

ON Semiconductor’s forward P/E multiple of 14.8x is below selected peers: Analog Devices’ (NASDAQ:ADI) 20.6x, Applied Materials’ (NASDAQ:AMAT) 17.0x, Cypress Semiconductor’s (NASDAQ:CY) 18.5x, and Integrated Device Technology’s (NASDAQ:IDTI) 18.4x.

source: finbox.io

The company’s shares last traded at $21.32 as of Tuesday, October 31, approximately 99.8% of its 52-week high. The stock is up 64% year-to-date and 13% over the last month. Analysts are expecting management to announce $172 million of Net Income on Monday, November 6th.

#3 Vishay Intertechnology

Vishay Intertechnology, Inc. (NYSE:VSH) manufactures and supplies discrete semiconductors and passive components. It serves industrial, computing, automotive, consumer, telecommunications, military, power supplies, aerospace, and medical markets. The company was founded in 1962 and is based in Malvern, Pennsylvania.

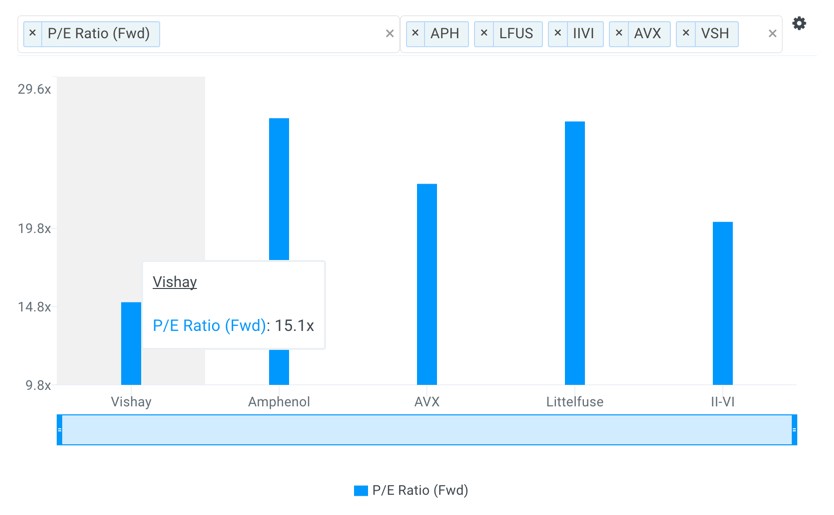

Vishay’s forward P/E multiple of 15.1x is below the S&P 500’s 17.9x and also all of its comparable public companies including Amphenol’s (NYSE:APH) 26.9x, AVX Corp’s (NYSE:AVX) 22.7x, Littelfuse’s (NASDAQ:LFUS) 26.7x, and II-VI’s (NASDAQ:IIVI) 20.2x.

source: finbox.io

Vishay is expected to report earnings on Monday, November 6th and the company has beat earnings expectations nine of the last eleven quarters. Shares are up 36% year-to-date and 16% within the last month.

#4 Microchip Technology

Microchip Technology Incorporated (NASDAQ:MCHP) develops, manufactures, and sells semiconductor products for various embedded control applications. In addition, the company licenses its technologies to foundries as well as provides engineering services. Microchip Technology serves automotive, communications, computing, consumer, aerospace, defense, medical, and industrial markets. The company was founded in 1989 and is headquartered in Chandler, Arizona.

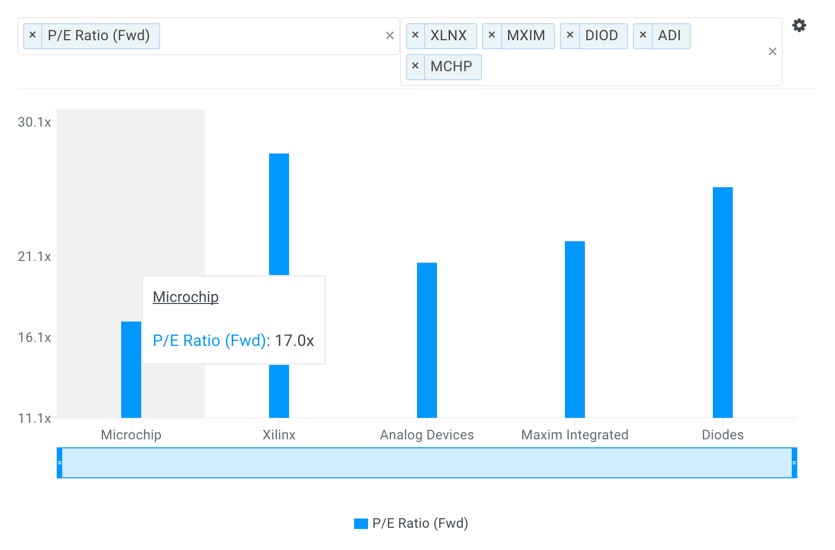

Microchip Technology’s forward P/E multiple of 17.0x is below comparable public companies Xilinx’s (NASDAQ:XLNX) 27.4x, Analog Devices’ (NASDAQ:ADI) 20.6x, Maxim Integrated Products’ (NASDAQ:MXIM) 22.0x, and Diodes’ (NASDAQ:DIOD) 25.3x.

source: finbox.io

Although the stock is up 48% year-to-date, it still trades at a reasonable level. Microchip is expected to report earnings on Monday, November 6 after the markets close. Management has reported an earnings beat for ten of the last eleven quarters.

#5 Skyworks Solutions

Skyworks Solutions, Inc. (NASDAQ:SWKS) designs, develops, and manufactures semiconductor products worldwide. The company provides its products for automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet, and wearable applications. Skyworks was founded in 1962 and is headquartered in Woburn, Massachusetts.

The company’s forward P/E multiple of 17.2x is below all of its peers: Maxim Integrated Products’ (NASDAQ:MXIM) 22.0x, Analog Devices’ (NASDAQ:ADI) 20.6x, Kyocera’s (NYSE:KYO) 25.8x, and Xilinx’s (NASDAQ:XLNX) 27.4x.

source: finbox.io

Skyworks is expected to report earnings on Monday, November 6th after markets close and analysts are expecting the company’s bottom line to grow by 17.4% (CapitalIQ).

This is another stock that trades at a reasonable multiple considering shares are up 50% year-to-date and 11% over the last month.

#6 MACOM Technology

MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) designs and manufactures analog RF, microwave, millimeter wave, and photonic semiconductor solutions. Its semiconductor products are incorporated in electronic systems, such as radios, high-density networks, active antenna arrays, radars, magnetic resonance imaging systems, and unmanned aerial vehicles. MACOM Technology Solutions Holdings, Inc. was incorporated in 2009 and is headquartered in Lowell, Massachusetts.

The company’s forward P/E multiple of 17.5x is below all of its selected comparable public companies: Semtech’s (NASDAQ:SMTC) 20.5x, Cavium’s (NASDAQ:CAVM) 23.0x, Analog Devices’ (NASDAQ:ADI) 20.6x, and Comtech Telecommunications’ (NASDAQ:CMTL) 31.1x.

source: finbox.io

Unlike the other semiconductor names on this list, MACOM’s stock is actually down -13% year-to-date and -10% over the last month. The majority of these losses are a result of the company’s disappointing Q2'17 earnings announcement. Shares fell 25% after management reported net profit that grew 57% but missed analyst estimates by 3.6% according to CapitalIQ.

However, expectations are much lower for Q3'17 with Wall Street projecting earnings growth at only 2.1%. Management is expected to be announced on Tuesday, November 14th.

#7 Versum Materials

Versum Materials, Inc. (NYSE:VSM) develops and manufactures specialty materials to the semiconductor and display industries worldwide. Its Materials segment provides specialty chemicals and materials used in semiconductors as well as specialty gases used in the semiconductor manufacturing process. Versum was previously the Materials Technologies business of Air Products & Chemicals Inc. (NYSE:APD), which was spun-off in October 2016.

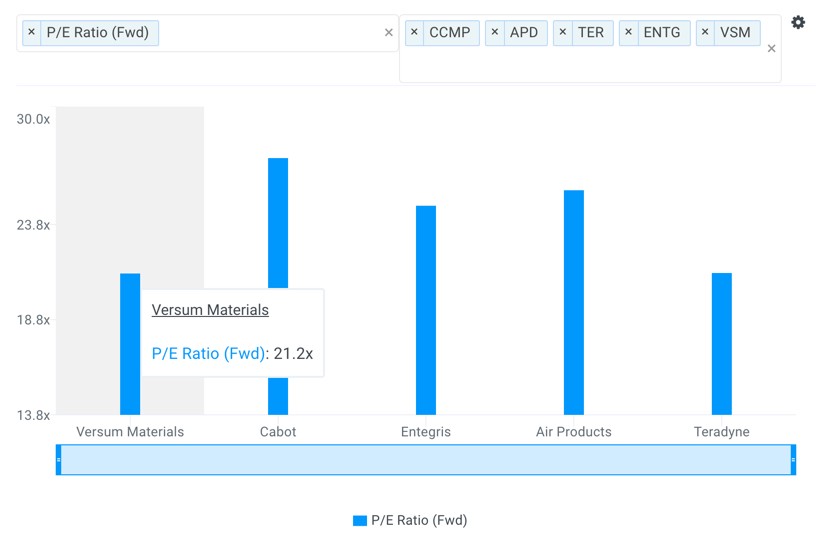

Versum’s forward P/E multiple of 21.2x is slightly below the IT sector average of 21.4x and below peers Teradyne (NYSE:TER), Air Products (NYSE:APD), Entegris (NASDAQ:ENTG) and Cabot Microelectronics (NASDAQ:CCMP).

source: finbox.io

The company is expected to report its Q3'17 earnings on Thursday, November 9th. Versum has beat its earnings estimate every quarter since its spin-off (four quarters of data). Analysts are expecting management to announce $51 million of Net Income implying growth of 8.1% according to CapitalIQ.

It may be worth taking a closer look at these seven semiconductor stocks prior to them reporting earnings.