You probably have a toolbox at home stuffed with useful items. A hammer, wrenches, pliers, all sorts of fasteners, a tape measure and several screw drivers. All serve a purpose but perhaps the most useful is the screwdriver. You can use it to take things apart and put them back together as it was designed. But it can also be used to pry things open, or punch a hole. You probably have found other uses as well. An all purpose tool. Technical analysis is like that toolbox. It is chock full of tool to analyse the market, but it too has one tool that is a basic necessity.

One of the simplest tools in technical analysis is the 200 Simple Moving Average (SMA). This mathematical construct is simply adding the prices of the last 200 trading days and dividing by 200. When it is looked at through time it is a smoothing mechanism that can clearly identify if the price trend is rising, flat or falling. If the price is above it then the trend is more bullish, and if the price is below it, bearish.

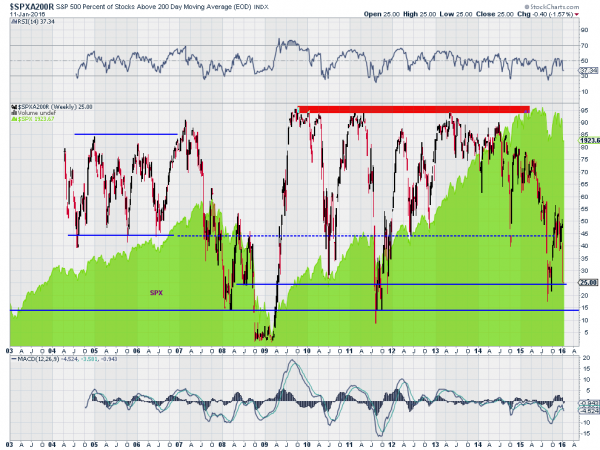

For the S&P 500 this can be used as a barometer of the entire market. And it is widely used. Even fundamental investors know that if the S&P 500 is over the 200 day SMA they have a tailwind. But you take this one step further by looking at the dispersion of the stocks within the S&P 500. Relax, there will be no math involved. Simply look at how each stock stands relative to its 200 day SMA. When you view the number over time you get some interesting data points. The chart below does just this.

The choppy red and black line is the percentage of stocks in the S&P 500 that are over their 200 day SMA. Behind it in green is the chart of the S&P 500 itself. There are several interesting pieces of information that can be seen in this chart. First, The percent of stocks over their 200 day SMA spends a lot of time between 45 and 85.

This makes sense as the market is generally rising over time. The typical number should be over 50 if the S&P never corrected, and average over 60 to rise over time despite corrections in the index. Notice the long periods from 2004 to 2007 and 2012 to 2014 when this was the case. The S&P 500 marched steadily higher.

But what may be more interesting is when the number moves outside of that range. First look at when it broke the range to the upside. It did this in 2007, 2009, 2011 and 2012. Every time except for 2012 that it moved above 85 the S&P 500 started a downturn or correction shortly afterwards. In 2007 it was followed by the Financial Crisis crash. In 2009 and 2011 short term pullbacks. The pullback following the 2012 range break was very delayed, not occurring until August 2015.

The downside range break is the current focus. The times the number of stocks over their 200 day SMA goes below 45 is quite small. If you make a further cut at 25 it is even smaller. Only 4 times in the last 12 years have the number of stocks over their 200 day SMA fallen below 25. Each one marked a major bottom in the S&P 500. In 2009 it marked the bottom of the Financial Crisis. In 2011 the 20% correction, and in August 2015, the 10% pullback.

Going into Tuesday the number of stocks in the S&P 500 above their 200 day SMA stands right at 25%. Will this mark the start of yet another major bottom?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.