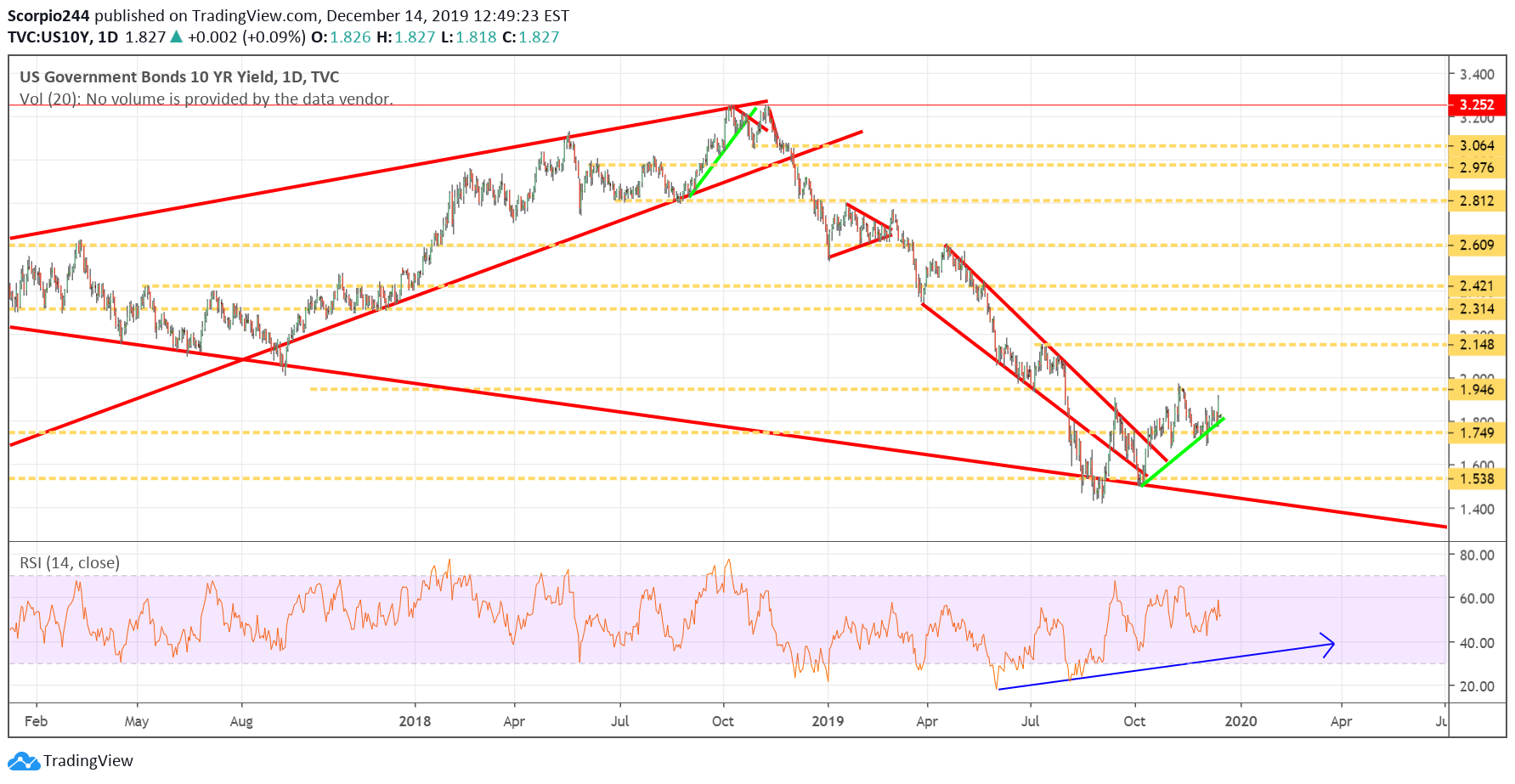

With global growth returning and the U.S. economy surging to a 3% growth rate in 2020, interest rates in the U.S. will begin to rise. It will result in the long-end of the yield curve increasing, sending the 10-Year rate to 2.3%, up from its current rate of 1.83% on December 14.

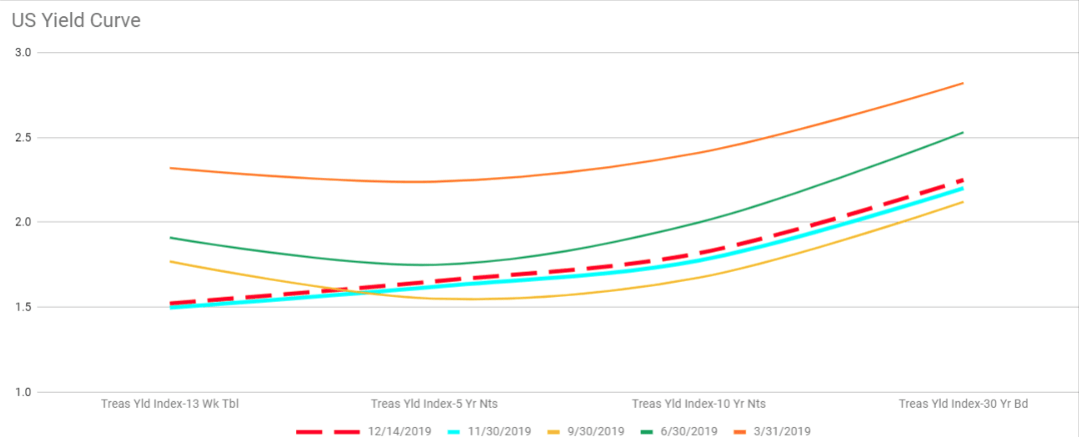

Inverted in 2019

The yield curve was inverted for much of 2019 as investors feared a U.S. recession. However, that recession never came.

But the slowdown was enough to get the Fed to move from a tightening stance to neutral, to cutting. As a result, the Fed lowered rates three times between July and October. It forced the short-end of the curve lower and helped to re-steepen the yield curve.

Yields Rise in 2020

Now with growth returning in 2020, rates on the long end will rise further. The chart shows that the 10-year is currently below a level of resistance at 1.95% The trend for the 10-year rate is higher at this point, forming a technical pattern known as a rising triangle. It will result in the 10-year breaking out and climbing to its next level of resistance at 2.15%. However, it will not stop climbing there. Instead, it will retrace 50% of the decline that started in late 2018, rising to resistance at 2.31%.

Additionally, the RSI has formed a bullish divergence. The pattern formed when the RSI fell to 18.5 in late May, creating a series of higher-lows, while yield continued to plunge. The bullish divergence suggests that momentum has shifted to favor yields rising over the longer-term.

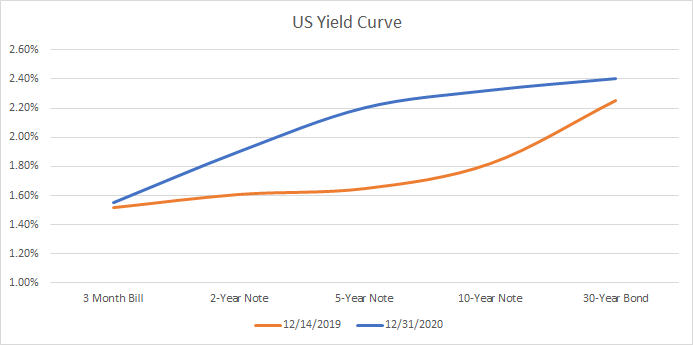

Yield Curve Normalizes

Rising long-term rates will normalize the yield curve and widen spreads between short and long-dated maturities.

Making 10-year rates rising to 2.3%, prediction number 8 for 2020.