Once upon a time, there was a zombie corporation named GameStop (NYSE:GME). For the last few years, it has been circling the bankruptcy drain. Similar to Blockbuster, its business model—renting and trading video games and equipment—is going the way of digital streaming. GME’s brick and mortar operations held a competitive advantage versus most competitors. Unfortunately, in today’s digital streaming world, they are minnows, prone to attack by the likes of Amazon (NASDAQ:AMZN).

We tell the story of GME because it’s fascinating. More importantly, however, it holds an important lesson about the level of speculation the Fed is fostering.

Preamble: Know Who You Are Squeezing

As we wrote this article, the short squeeze phenomena were shifting toward the silver sector. There are two essential differences between shorting iShares Silver Trust (NYSE:SLV), an ETF, and GME. First, because SLV is an ETF, dealers can create shares. Such makes it more difficult to squeeze. To create shares, the dealer must deliver silver in exchange for the new shares.

Second, while squeezes in GME primarily only affect GME shareholders, SLV affects the price of silver itself. If SLV continues to rise, it brightens the outlook for silver miners but raises input costs for manufacturers that use silver in their production process.

Silver is widely required to produce many high tech goods; therefore, a rising price has economic implications. As such, it is a more critical squeeze to follow, and no doubt the Fed is closely watching.

In our article, What The Hunt Brothers Can Teach Us About Gamma Squeezes we wrote:

“As the Hunt brothers can attest, do not bet against the establishment, the banks, and those who sponsor them (Fed, Treasury, etc.)”

GME: Dead Man Walking

A hedge fund quant doesn’t need a supercomputer to realize that GME is a company with a dim future. Like other companies that did not adapt to technology, GME will likely follow them into bankruptcy or become an inconsequential player.

GME’s stock opened in 2019 at $15 a share, and by January 2020, it was only $6. The writing on the wall was becoming fate. COVID-related economic shutdowns made matters worse, and the stock flirted with $3 in March 2020.

Some hedge funds likely value GME near zero. Surely a few of them were accumulating shorts in large quantities, hoping to repurchase them when GME was a penny stock. It appeared to be easy money, and the market was proving them right. Even with a low price, shorting GME offered good returns. Accordingly, the shorts stuck with the trade.

GME Resurrected

By late August 2020, the stock doubled to trade near $6 a share. Despite doubling, the trend of the last few years’ was firmly intact. More importantly, for the short investors, the fundamental story hadn’t changed. It’s likely some thought the price gains were a gift and added to their shorts.

As the calendar progressed, the stock moved higher. GME closed September at $10, October at $12, November at $18, and for the year at $20. Hedge funds that liked shorting it in the single digits must have loved shorting it at $20.

Unbeknownst to the hedge funds, retail investors were accumulating the stock of GME and other companies with large amounts of short interest. Trading forums like Reddit promote such squeezable stocks. The new highly speculative investor base, fed by zero commission platforms like Robin Hood, and recent large gains, were emboldened. They made a lot of money taking significant risks in the extremely speculative environment and were willing to escalate. They smelled blood in the water.

These new investors likely have little idea of what GME’s balance sheet or income statement looks like. Nor do they care. They saw an opportunity to join forces and make a lot of money. They saw a way to stick it to Wall Street, and they did.

As the stock price recovered in the fourth quarter, short interest rose. In fact, there were more shares shorted at the end of December than shares outstanding. Retail traders could sense the squeeze, while hedge funds thought they were adding shorts with massive potential.

Squeezing the “Best and the Brightest”

The rogue retail traders, including some large investors like Elon Musk, David Portnoy, and Chamath Palihapitiya, understood they could buy and push GME ever higher. Their logic was that the shorts would get squeezed and have to buy back their shares to limit losses. As this occurs, the short-sellers buying back shares help their cause.

Squeezing a stock is not new. Banks, brokers, and hedge funds have perpetrated squeezes since they first started trading under Wall Street’s buttonwood tree.

Adding Gamma To The Squeeze

In this case, the rogue traders have another weapon up their sleeve. Over the prior months, Gamma Squeezes have become a popular trading weapon. The following comes from our Hunt Brothers article, linked above:

“A Gamma squeeze relies on the hedging actions of options dealers. The banks and brokers who are the largest sellers of options must hedge their trades. Most dynamically hedge, meaning they frequently adjust the hedge amount according to the Delta of the option.”

“If the Whale buys enough calls, they can trigger a Gamma squeeze. The option purchases force the dealers to buy the stock, which pushes the share price higher. As this happens, the dealers’ buying activity increases the Delta at a non-linear rate (gamma). In circular fashion dealers then must buy more of the stock, and on and on.”

Simply, dealers are forced to buy stock to hedge call options as prices rise. Relatively low costing options trades can result in large share purchases by the dealers.

With the power of the traditional short squeeze amplified by the gamma squeeze, the game was on. GME shares went through the roof, hitting a high of $500.

Melvin Capital, a large hedge fund, was on the wrong side of the trade. The $13 billion hedge fund required a $2.75 billion bailout from fellow hedge funds Citadel and Point 72. There are many other victims as well.

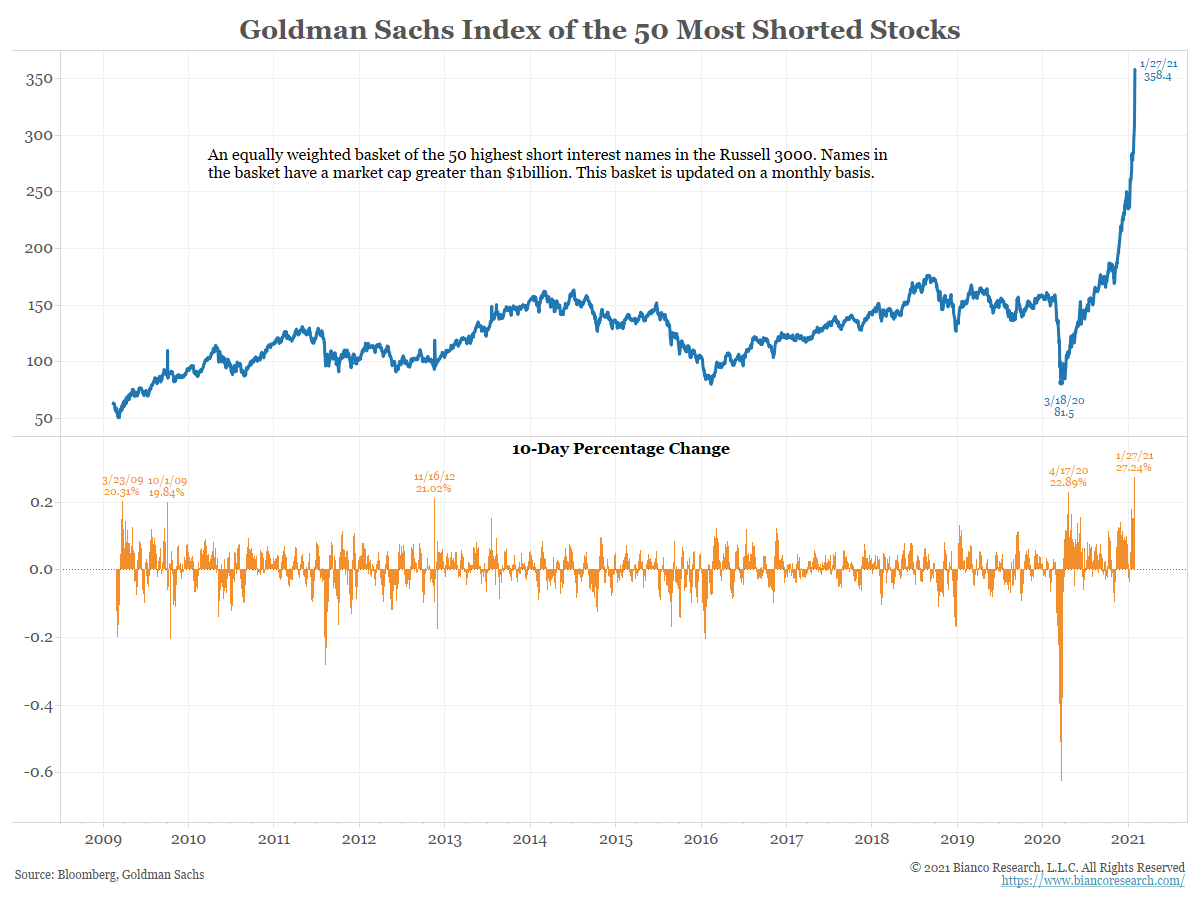

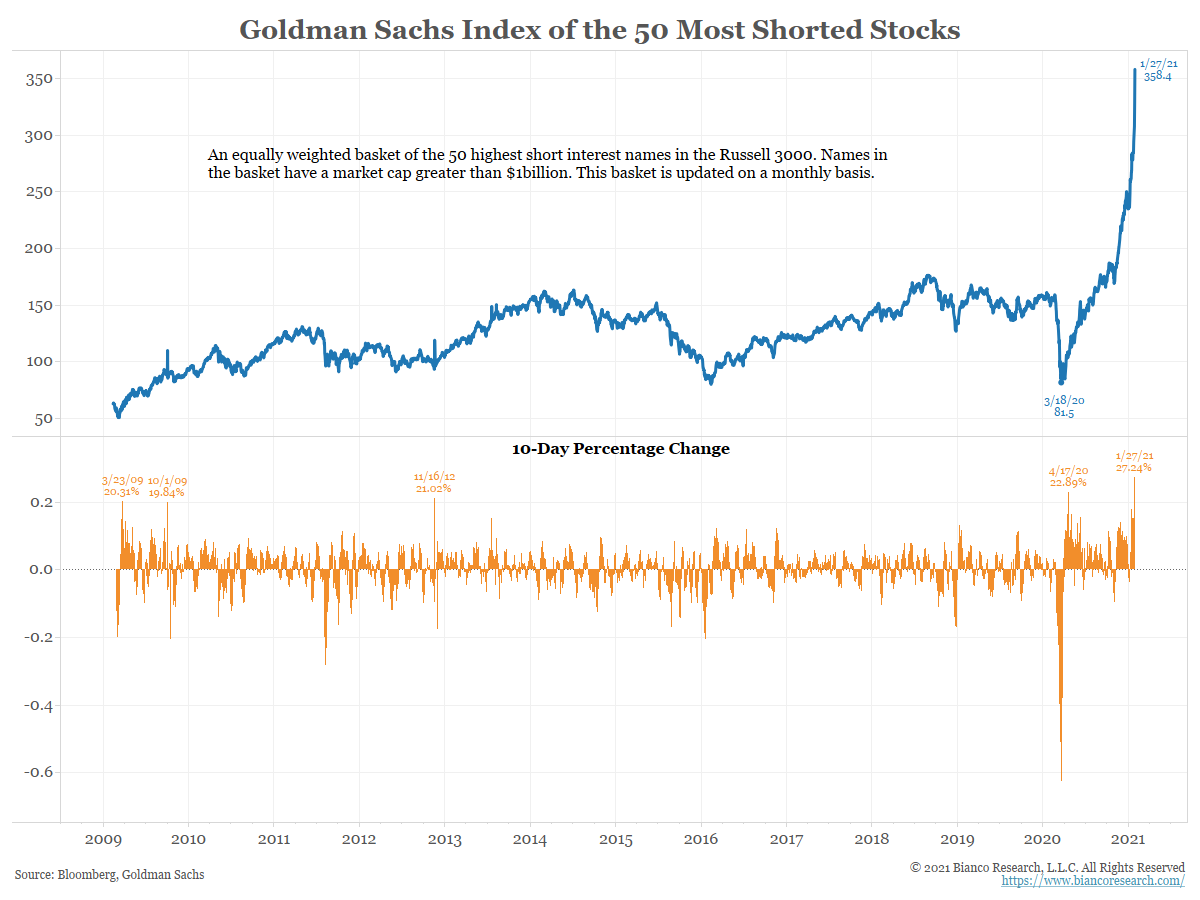

The fun and games do not end with GME. Short squeezes are occurring in many smaller to mid-size companies with considerable short interest. The blueprint is working, and investors are following it.

The Fed’s Casino

While we hope you enjoy the tale, the underlying lesson is of greater importance.

“Gotta admit it’s really something to see Wall Streeters with a long history of treating our economy as a casino complain about a message board of posters also treating the market as a casino” – Alexandria Ocasio-Cortez.

She is right, markets have become a casino.

The takeaway from our tale is not the winners and losers of an age-old trading game. What matters is the unprecedented level of speculation present in just about all asset markets.

Why is this? Significant consideration must be excessive monetary policy and how it reduces the level of perceived risk. Investors are blinded as the Fed has more than doubled the money supply in less than a year. The result is massive amounts of liquidity infiltrating the asset markets. Further, investors, rightly or wrongly, firmly believe the Fed will do whatever it takes to prop up ailing markets.

Essentially, by manipulating the perception of risk, the Fed hides its true cost, spurring reckless behavior.

In January 2021, we wrote The Fed is Juicing Stocks. In the article, we lay out four ways in which the Fed drives stock prices higher and reduces risk perception.

Powell’s Take On GME et al

Jerome Powell’s first question at the FOMC meeting on January 27, 2021 was about GME. He responded:

“If you look at what’s really been driving asset prices, really in the last couple of months, it isn’t monetary policy. The connection between low interest rates and asset values is probably something that’s not as tight as people think.”

Mr. Powell is smart enough to see the casino environment he has fostered. While he may tell bold lies and deny culpability, he must concern himself with consequences. Powell knows, as well as his advisors at the Fed and Wall Street, periods like today, with excessive speculation, never end well.

“The harder they come, the harder they fall.” – Reggae Legend Jimmy Cliff

Summary

The Fed has charged the investment atmosphere. Today’s investors view markets as get rich quick schemes. Stories of investors turning thousands into hundreds of thousands litter social media. The problem is that such behavior is not natural nor sustainable. It relies on ever-growing amounts of monetary and fiscal stimulus, which are not sustainable.

There is another vital aspect. Capitalism provides better living standards for more people when it is most efficiently run. A core component of capitalism is how productively capital is used. Ask yourself, is capital being deployed most productively?

The casino may stay open for a while longer, so enjoy it while it lasts. Make no mistake, the doors will close, and gamblers will be trapped.

This time is not different!