Traditionally, the tech sector has not been a source of dividend stocks. Many tech companies, particularly those at earlier stages of their development, do not pay dividends at all. Instead, they typically need to reinvest as much cash flow as possible back into growing the business. And even among tech companies that do pay dividends to shareholders, yields are usually low.

However, in rare cases investors can find highly profitable, mature tech companies with enough cash flow to pay high dividend yields to shareholders. For example, Texas Instruments (NASDAQ:TXN) currently has a 3.2% dividend yield, which beats the average yield in the S&P 500 Index by a considerable margin. And, Texas Instruments is a dividend growth stock. It has raised its dividend for 15 consecutive years, including a 24% increase in 2018. Texas Instruments qualifies as a Dividend Achiever, a select group of stocks with 10+ consecutive years of dividend growth.

Texas Instruments is a unique stock. It offers a mix of high yield and dividend growth, which makes the stock attractive for income and growth investors.

Powering The Technological Revolution

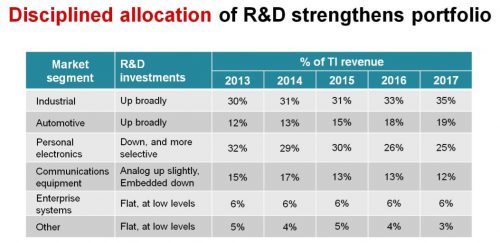

Texas Instruments operates in the semiconductor industry. It manufactures analog and embedded processors, primarily for the automotive and industrial markets. One of the company’s strongest competitive advantages is that it has a focused operational structure. Texas Instruments operates in two segments—analog and embedded processing equipment—and dominates both categories. The company has dedicated greater amounts of research and development investment to these two categories, as they have the strongest growth potential moving forward.

Source: Investor Presentation, page 12

The company has approximately 100,000 customers globally. Its products include semiconductors that measure sound, temperature and other physical data and convert them to digital signals, as well as semiconductors that are designed to handle specific tasks and applications.

Texas Instruments reported its third quarter earnings results on October 23rd. The company grossed revenues of $4.3 billion, an increase of 3.6% year over year. Revenues were primarily driven by higher Analog revenues, which more than offset a 4% sales decline for the Embedded Processing segment. Texas Instruments grew earnings-per-share by 25% year over year, to $1.58.

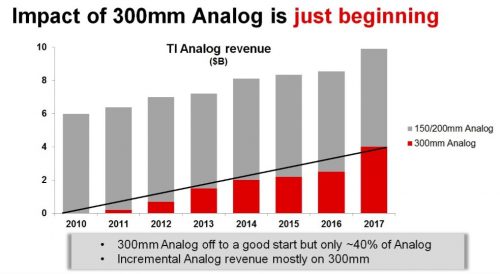

Analog is arguably the company’s strongest growth catalyst moving forward, as the category continues to see rising demand. In response, Texas Instruments is rolling out new products in Analog, such as its 300-millimeter wafers, which have about a 40% cost advantage over the company’s 200-millimeter wafers.

Source: Investor Presentation, page 17

Another competitive advantage for Texas Instruments is its manufacturing efficiency. The company has a policy of purchasing smaller companies and manufacturing assets that have long operational lives but can be purchased at a discount. The company keeps internal production, rather than relying on outsourcing for its manufacturing, which gives it greater quality control that fuels its pricing power and high margins.

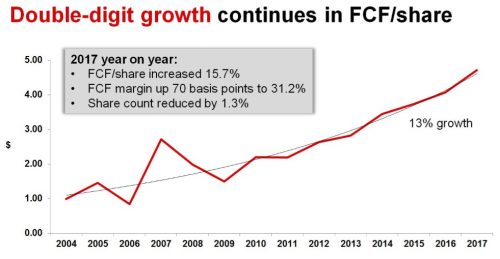

The overall result is that the company has generated excellent growth rates and huge amounts of cash flow over the past several years. Texas Instruments generated free cash flow of $4.7 billion in 2017. From 2004-2017, free cash flow has increased by approximately 13% each year, including 15.7% growth in 2017.

Source: Investor Presentation, page 19

This growth has enabled Texas Instruments to increase investment in future growth, and return lots of cash to shareholders each year, through dividends and share repurchases. Texas Instruments spent $1.51 billion on research and development in 2017, up 11% from the previous year.

Texas Instruments is also a very shareholder-friendly company. Not only does Texas Instruments stock have a hefty 3.2% dividend yield, along with 15 consecutive years of dividend increases, but the company has also reduced its share count by 43% since 2004.

Value, Growth, And Dividends All In One

Texas Instruments stock could provide high returns to shareholders over the next several years, from a combination of valuation changes, earnings growth, and dividends. Each of these three factors is likely to positively contribute to Texas Instruments’ shareholder returns.

Texas Instruments currently pays an annual dividend of $3.08 per share. At a recent share price of $95, the stock has a current dividend yield of 3.2%. Texas Instruments is a premier dividend growth stock. Over the last five years, it has raised its dividend by 21% per year on average. This is a very high dividend growth rate. At 21% per year, an investor would see his or her dividends double every 3.4 years on average.

Texas Instruments’ dividend yield of 3.2% is much higher than usual. In fact, its dividend yield is at the highest level in the last 10 years. One reason for this is the company’s high rate of dividend growth; another reason for the abnormally high dividend yield is that the stock price has declined over 20% from its 52-week high of $120.75. Texas Instruments’ valuation has come down substantially over the last few months, due to a combination of a broad market decline, pressure on semiconductor stocks, and the guidance for Q4 that came in below expectations.

At the same time, the decline in Texas Instruments’ valuation has resulted in an attractive valuation. Using 2018 earnings estimates of $5.52 per share, the stock has a price to earnings ratio of 17.1, which could be too low for a company of Texas Instruments’ quality. The stock has a fair value estimate of 19, which is a more reasonable valuation for a highly profitable and growing company. Using the fair value estimate of 19, Texas Instruments is undervalued, and a return to fair value could add approximately 2.1% to annual returns.

Dividends and valuation changes could result in 5.3% annual returns. The final contributor will be earnings growth. Texas Instruments is a growth company. Over the next five years, the company is expected to grow earnings by 11%-12% per year. As a result, valuation changes, dividends, and earnings growth could cumulatively result in annual returns of nearly 17% over the next five years.

Final Thoughts

A stock with the combination of high earnings growth, a 3%+ dividend yield, and a modest valuation is a rare find. Texas Instruments has a leading industry position, durable competitive advantages, and an outlook for growth over the next several years. The company has always been associated with growth, and due to the recent share price decline, the stock is appealing for value and income investors as well.