Teva Pharmaceutical Industries Ltd. (NYSE:TEVA) announced that the FDA has accepted the supplemental New Drug Application (sNDA) for Trisenox on a priority review basis.

The company is looking to expand the label of Trisenox to include its use in combination with all-trans retinoic acid for the treatment of newly diagnosed patients with low-to-intermediate risk of acute promyelocytic leukemia (APL)

The eligible APL patients should have t(15;17) translocation or PML/RAR-alpha gene expression.

With the FDA granting priority review, a decision is expected in the first quarter of 2018.

We remind investors that Trisenox is currently approved for induction of remission and consolidation in refractory/relapsed APL patients with t(15;17) translocation or PML/RAR-alpha gene expression. The patients should have received prior treatment with retinoid and anthracycline chemotherapy.

The drug is approved in the EU as both first-line and second-line treatment for this indication.

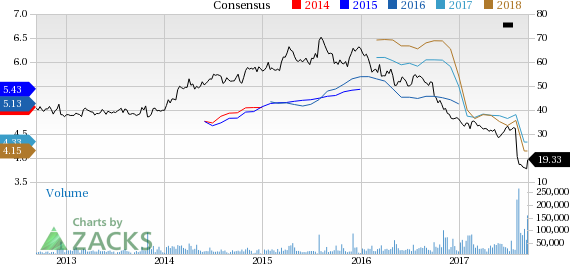

Shares of the company were up almost 4.5% on Tuesday, riding on the momentum following the appointment of H. Lundbeck’s (OTC:HLUYY) chief Kare Schultz as its new CEO and sale of Paragard devices to Cooper Companies, Inc. (NYSE:COO) for $1.1 billion. However, shares of Teva have underperformed the industry so far this year due to challenges in the U.S. generic industry. The company’s shares have plunged 46.7% while the industry has lost 14.5% in that period.

According to the company, Trisenox, in combination with retinoic acid, can increase survival rates, dramatically reduce the risk of relapse, and help avoid chemotherapy-related side effects in low-to-intermediate risk APL patients. It has been seen in clinical studies that Trisenox, in combination with retinoic acid, can lead to a 99% overall survival rate with almost no relapse after more than four years (50 months) of median follow-up.

Zacks Rank & Stocks to Consider

Teva currently has a Zacks Rank #5 (Strong Sell). Aduro Biotech, Inc. (NASDAQ:ADRO) is a better-ranked stock in the healthcare sector, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aduro’s loss estimates have narrowed 9.6% to $1.32 for 2017 and 20% to $1.24 for 2018 over the last 60 days. The company delivered an average earnings beat of 2.53% for the four trailing quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

H Lundbeck A/S (HLUYY): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Teva Pharmaceutical Industries Limited (TEVA): Free Stock Analysis Report

Cooper Companies, Inc. (The) (COO): Free Stock Analysis Report

Original post

Zacks Investment Research