Teva Pharmaceutical Industries Ltd. (NYSE:TEVA) announced that the FDA has approved a label expansion for its drug, Austedo. With the latest FDA approval, Austedo’s label has been expanded to include treatment of tardive dyskinesia, a debilitating and often irreversible movement disorder.

We remind investors that Austedo was approved for treating chorea associated with Huntington’s disease in April 2017. Both TD and chorea are characterized by involuntary or diminished voluntary movement of muscles.

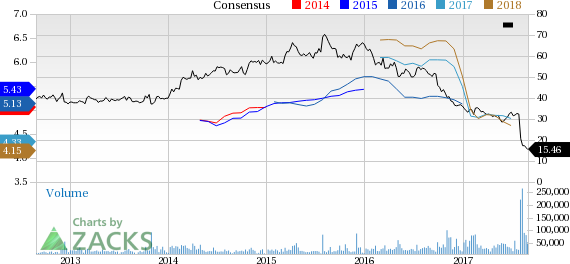

Shares of the company are up almost 2.4% in pre-market trading. However, shares of Teva have underperformed the industry so far this year as it is facing challenges in the U.S. generic industry. The company’s shares have plunged 57.1% while the industry has lost 20.1% in that period.

Coming back to the news, the FDA approval for TD was based on data from two pivotal studies - AIM-TD and ARM-TD - demonstrating statistically significant reduction in severity of abnormal involuntary movements associated with tardive dyskinesia.

Teva's chief scientific officer said that Austedo has a flexible dosing regimen and it also doesn’t affect the ongoing treatment for the underlying condition, which caused the TD disorder.

Teva is also evaluating Austedo in a phase I study for another involuntary movement disease, Tourette syndrome.

Per the company’s press release, TD affects approximately 500,000 people in the U.S. In April 2017, the FDA had approved Neurocrine Biosciences’ Ingrezza as a treatment for adults with TD, which is expected to give competition to Austedo in this indication.

Teva is offering free service to provide support to new patients as well as those already on Austedo therapy.

Zacks Rank & Stocks to Consider

Teva Pharma has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the health care sector include Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) , Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Aduro BioTech, Inc. (NASDAQ:ADRO) . While Alexion and Regeneron sport a Zacks Rank #1 (Strong Buy), Aduro carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alexion Pharmaceuticals’ earnings per share estimates have moved up from $5.32 to $5.61 for 2017 and from $6.53 to $6.92 for 2018 over the last 60 days. The company delivered positive earnings surprises in the trailing four quarters, with an average beat of 11.12%. The share price of the company has increased 13.1% year to date.

Regeneron’s earnings per share estimates have increased 16% to $14.91 for 2017 and 7.7% to $16.45 for 2018 over the last 30 days. The company pulled off positive earnings surprise in two of the trailing four quarters, with an average beat of 10.11%. The share price of the company has increased 32.7% year to date.

Aduro’s loss estimates per share have narrowed 9.6% to $1.32 for 2017 and 12.1% to $1.24 for 2018 over last 30 days. The company came up with positive earnings surprise in two of the trailing four quarters, with an average beat of 2.53%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Teva Pharmaceutical Industries Limited (TEVA): Free Stock Analysis Report

Original post

Zacks Investment Research