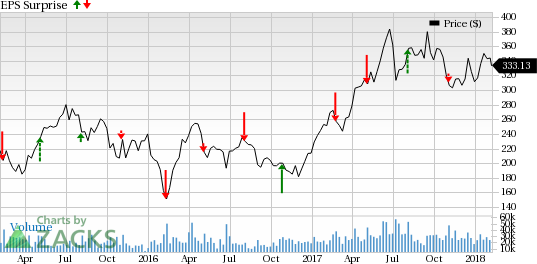

Tesla, Inc. (NASDAQ:TSLA) is expected to report fourth-quarter and full-year results on Feb 7, 2018, after market close. Last quarter, the electric carmaker delivered an earnings miss of 19.2%.

In the trailing four quarters, the company missed estimates thrice and beat once, with an average negative surprise of 140.1%.

Let us see, how things are shaping up for this announcement.

Factors Influencing the Quarter

Lately, Tesla has been facing serious issues in the production of Model 3. However, in fourth-quarter 2017, the company made good progress in addressing Model 3 production bottleneck (read: Will Progress in Model 3 Production Aid Tesla's Q4 Earnings?). Also, with respect to actual vehicle deliveries, in fourth-quarter fiscal 2017, the company witnessed a 27% year-over-year rise in deliveries to 29,870 vehicles (read: Will Rise in Deliveries Drive Tesla's Q4 Earnings?).

Not only Tesla but also other leading automakers are investing a large amount of money in the electric vehicles (EV) space. In October, 2017, General Motors Company (NYSE:GM) announced its intention of launching 20 new all-electric models by 2023. Ford Motor Company (NYSE:F) announced its intention of investing $11 billion in EVs by 2022, targeting 40 hybrid and all-electric vehicles. Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) and Toyota Motor Corporation (NYSE:TM) are also aggressively expanding their EV line up.

One key ingredient in order to get an edge over others in the EV race is to have a better hold on lithium. In fact, the demand for lithium-powered batteries is expected to rise with their increasing adoption in consumer electronic products as well as efforts toward promoting the use of electric cars by several governments to curb pollution.

Per a Reuters report, Tesla has completed installing the world's largest lithium-ion battery in South Australia. The construction was completed within 55 days from Sep 29, 2017 when the grid connection deal was signed. Tesla is also opting for partnership to produce key battery components in order to ease Model 3 production bottlenecks.

Earnings Whispers

Our proven model does not conclusively show that Tesla will beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below.

Zacks ESP: Tesla has an Earnings ESP of +3.92% as the Most Accurate estimate of a loss of $3.06 is narrower than the Zacks Consensus Estimate of a loss of $3.19. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Tesla carries a Zacks Rank #4 (Sell).

We caution against the Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Other Stocks to Consider

Here are a couple of stocks worth considering from the same space with the right combination of elements to outpace earnings estimates this time around.

Allison Transmission Holdings, Inc. (NYSE:ALSN) has an Earnings ESP of +10.40% and a Zacks Rank of 2. The company is expected to report fourth-quarter 2017 results on Feb 14. You can see the complete list of today’s Zacks #1 Rank stocks here.

American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) has an Earnings ESP of +2.81% and a Zacks Rank #3. Its fourth-quarter 2017 results are expected to be released on Feb 16.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Ford Motor Company (F): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Tesla Inc. (TSLA): Free Stock Analysis Report

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

American Axle & Manufacturing Holdings, Inc. (AXL): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Original post

Zacks Investment Research